What's Behind NVIDIA's Most Recent Skyrocketing Surge In Its Stock Price?

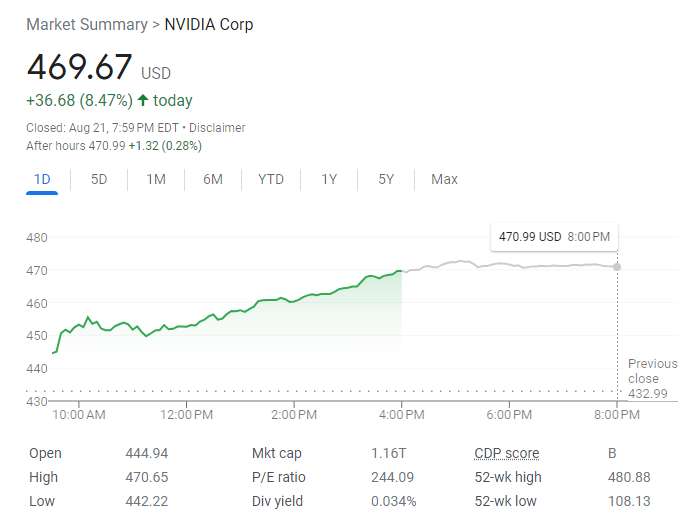

On Monday, NVIDIA's stock price surged approximately 8.5% and marked its most significant daily gain since May 25th. This surge not only offset all declines for the month but also reached a new closing high since July 19th, nearing its record high set on July 18th.

This Wednesday, August 23rd, NVIDIA is set to release its second-quarter results after the US stock market closes. Over the past weekend, many analysts pointed out that NVIDIA's Q2 financial results would be a major test in the current AI boom.

Analysts currently hold exceptionally high expectations for NVIDIA's report. However, should NVIDIA fail to meet these targets, it could potentially hamper the AI surge and impact tech giants ranging from Microsoft, Google, and Meta to long-time rival AMD.

Therefore, this surge in stock price before the release of its financial results reflects the market's optimistic expectations for the company. In fact, many analysts have recently revised their target prices for NVIDIA shares.

Morgan Stanley, UBS, and Rosenblatt Securities have recently raised their target prices for NVIDIA. HSBC, KeyBanc Capital Markets, and BMO Capital Markets all revised their target prices upward before the Q2 report release. Statistics revealed that the average target price for NVIDIA set by Wall Street firms has been on the rise, currently surpassing $520, about 3% higher than the $505 a week ago.

This target price of $520 suggests that analysts and investors from Wall Street anticipate NVIDIA's stock price to surge another 20% from its close last Friday, and over 10% from its intraday level of around $460 on Monday, majorly due to the current AI boom and the company's upcoming financial report.

HSBC analysts, who rate NVIDIA as a 'buy,' stated that expectations for NVIDIA and the overall AI supply chain have noticeably risen, but they anticipate that bullish trends for AI servers will continue to outpace market forecasts.

KeyBanc Capital Markets predicts that, given strong demand trends, NVIDIA's performance and outlook will be significantly above consensus expectations.

UBS even labeled NVIDIA as the undisputed king with a flurry of capital and new financing tools chasing after new AI software and specialized cloud infrastructure.

However, amidst the optimism, there are concerns about supply shortages and intense industry competition.

Due to primary supplier TSMC struggling to meet order demands, NVIDIA faces supply shortages. UBS analysts noted that the surge in demand has delayed the delivery cycle of NVIDIA's crucial AI chip, H100, by six to nine months.

Deutsche Bank analyst Ross Seymore, who maintains a 'hold' rating on NVIDIA, admitted that NVIDIA's results would be astonishing, and AI brings more upside potential. Still, he highlighted that cyclical risks could make the company's future growth trajectory unpredictable and also pointed out that with such high expectations from buy-side analysts, the threshold for financial performance might be even harder to surpass.

Since the beginning of the year, NVIDIA's stock has surged by over 210%, outperforming the semiconductor sector as a whole. The Philadelphia Semiconductor Index has risen by less than 40%. As a dominant player in the AI chip market, NVIDIA's rally is widely seen as a major beneficiary of the AI boom, making the company a benchmark for AI stocks.

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet