Weekly BullsEye | This Stock Has Crushed NVIDIA On Gains Since 2023, And You Can Still Buy It Before It's Too Late

Nvidia has been a top pick for investors since last year due to its crazy upward motion, but Nvidia actually is not the top performer over the past year. That title goes to a tech company called Super Micro Computer ( SMCI ).

This year, Super Micro Computer has been crushing Nvidia in terms of stock price appreciation as well - up to now, Nvidia's stock price has risen by less than 30%, but SMCI's stock price has spiked more than 85%, more than tripling that of Nvidia.

However, if you look at its business structure and valuation, you can see that there is still a lot of potential left in SMCI's stock.

Nvidia's Alter Ego

It's no coincidence that Super Micro achieved similar if not better results than Nvidia last year on the stock market since the two companies have a lot in common.

Super Micro Computer mainly manufactures high-performance and efficient servers and storage systems, which, like chips, are vital components of AI applications.

As explained by SMCI, AI workloads typically require fast access to storage, driving demand for GPU-based servers. Additionally, SMCI's server systems run on Nvidia's GPUs, helping to maximize throughput, eliminate bottlenecks and reduce latency.

Hence, part of SMCI's growth logic coincides with Nvidia's prospects - if Nvidia has a bright future, then SMCI's growth prospects will not be any less promising.

Full Commitment to AI

In fact, AI for SMCI is not just a concept, but has become an important part of the company's survival - now, SMCI's revenue from AI-related sales already accounts for 50%. While this percentage might be too high in the eyes of analysts, it is this deep connection to the rapidly expanding AI sector that has allowed Super Micro to achieve nearly 600% growth in market capitalization over the past year.

Furthermore, SMCI's main competitors in the server solutions space - IBM, Dell, and Hewlett Packard - do not share the same level of specialization and dominance in the AI sector as SMCI, since they invest more in software and personal computing.

Therefore, with the proliferation of AI and the increasing demand for seamless servers in the future, SMCI's deep connection with AI will provide them with a more competitive advantage.

Meanwhile, when looking from an investor's perspective, if I want to tap into the rapidly growing AI hardware market, I want the company I invest in to prioritize this, and SMCI makes themselves become the choice since its targeted approach in this niche sets itself apart and allows for adaptability to AI's technological advancements and market demands faster than its competitors.

Reasonable Valuation, Outstanding Indicators

According to the company's financial metrics, Super Micro seems to be underrated by the market - Super Micro's Forward P/E ratio is 24.58, which is lower than the median of its industry peers (25.09), signaling that the market seems to have underestimated Super Micro's future earnings potential. At the same time, the company's Forward P/B ratio is 8.39, remarkably higher than the industry's median of 4.27.

These data demonstrate that even after a bullish run, SMCI still has outstanding potential to create high returns, and any future earnings that exceed expectations could potentially bring rich returns to investors who buy SMCI's stock.

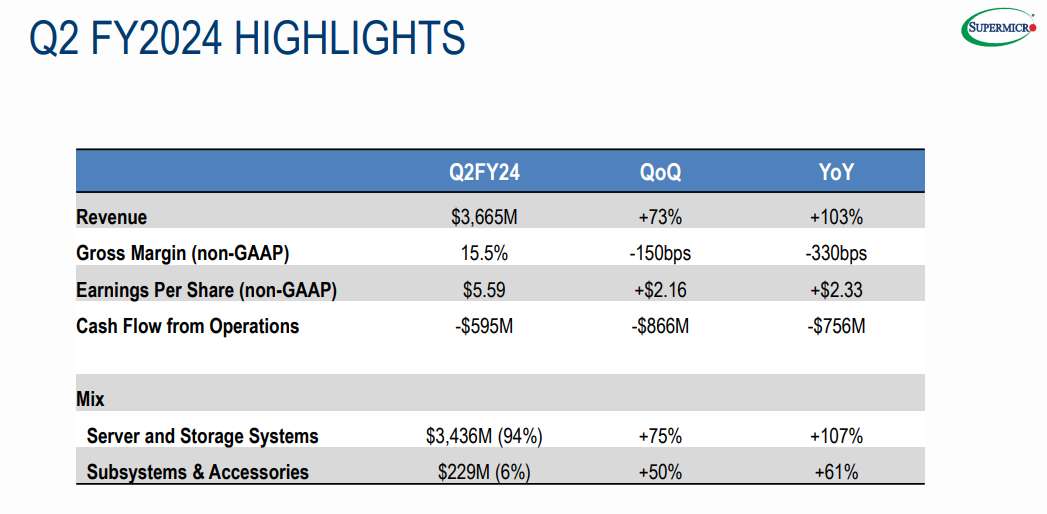

Impressive Q2 performance, strong Q3 guidance

This Monday, Super Micro just released its Q2 financial report for FY 2024, which turned out to be far better than its prediction in November. In the past quarter, SMCI reported revenue of $3.6 billion to $3.66 billion, as compared to its previous estimates of $2.7 billion to $2.9 billion. In terms of EPS, it posted adjusted earnings per share of $5.40 to $5.55, which is way higher than its previous forecast of $4.4 to $4.88.

Nonetheless, the company did not elaborate on the cause of this growth, only mentioning strong market and end-customer demand. For next quarter's performance, SMCI expressed extreme confidence.

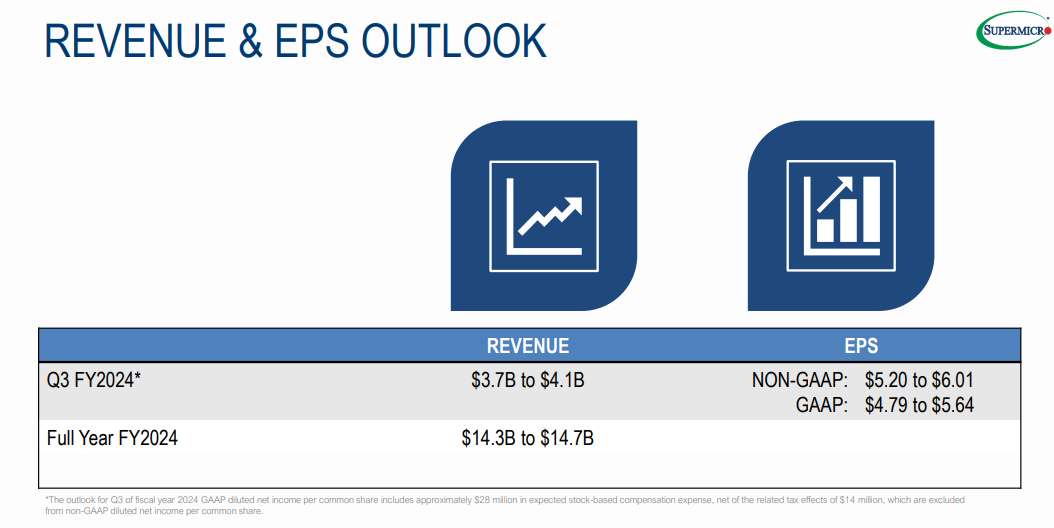

Supermicro's guidance for its 2024 fiscal third quarter ending in March calls for revenue ranging from $3.7 billion to $4.1 billion, a growth of about 204% at the midpoint. For the 2024 fiscal year, Supermicro raised its revenue guidance to a range of $14.3 billion to $14.7 billion, up 103% at the midpoint.

All in all, with the AI boom seemingly just beginning, there are many uncertainties in the ever-evolving AI market, which also carries risks for SMCI's stock. However, considering the future development prospects of the industry, SMCI's business structure, and financial indicators, this could be the last opportunity for investors who haven't jumped on board yet.

Fantastic stocks and where to find them

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet