Week Ahead: A Comprehensive Outlook on U.S. Labor Market Trends

As we near the end of March 2025, attention turns to the critical economic data release scheduled for April 4, 2025, which includes the March Nonfarm Payrolls, Unemployment Rate, and Average Hourly Earnings Year-over-Year (YoY). These labor market indicators will shed light on the U.S. economy's trajectory amidst evolving policy landscapes.

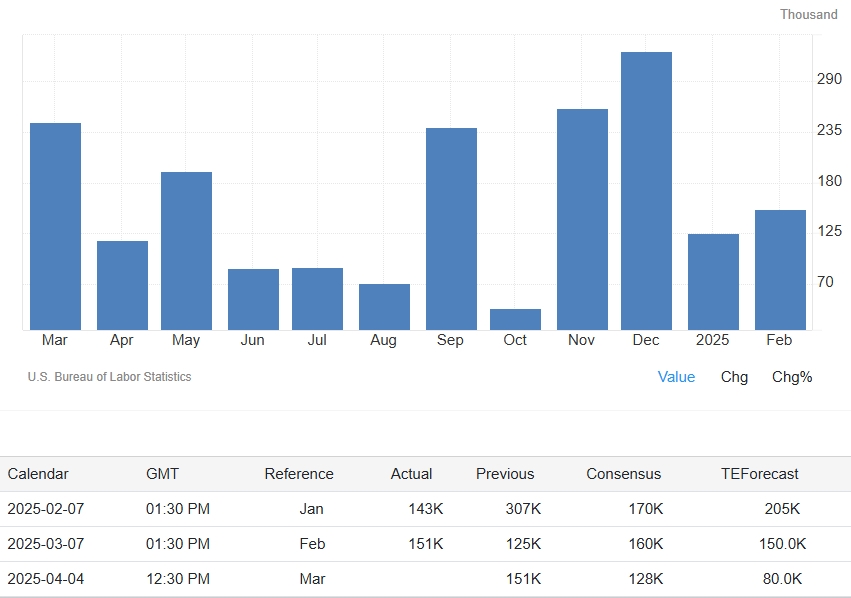

Nonfarm Payrolls

Last Reported Number (February 2025): 151,000 jobs added

Forecasted Number for March 2025: 128,000 jobs added

The Nonfarm Payrolls report measures monthly job creation, excluding agricultural workers. February 2025 saw 151,000 jobs added, slightly below the expected 160,000. For March 2025, analysts forecast a modest increase to 128,000 jobs, a light dip from February's number.

This lower forecast of 128,000 jobs for March stems from a combination of recent economic pressures. One key factor is the slowdown already hinted at in February, where job growth fell short of predictions. Beyond that, early March data points to weaker hiring in industries like manufacturing and retail, likely due to uncertainty from new trade policies. Specifically, the announcement of 25% tariffs on imports from Canada and Mexico, set to start in April 2025, has businesses hitting pause on hiring as they prepare for higher costs. Additionally, a new government initiative to cut federal jobs began ramping up in March, trimming public-sector payrolls and dragging down overall job creation.

If the actual number comes in even lower, it could raise red flags about a broader economic slowdown. On the flip side, if job growth beats this forecast, it might calm nerves about the economy's direction. Either way, this dip reflects real challenges—like trade uncertainty and shrinking government employment—that are starting to weigh on job creation as we head into spring 2025.

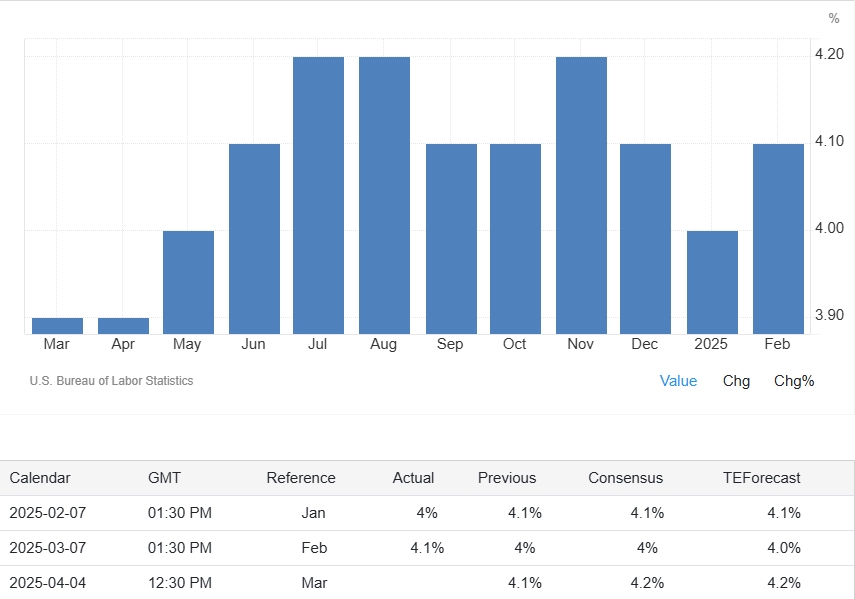

March Unemployment Rate

Last Reported Number (February 2025): 4.1%

Forecasted Number for March 2025: 4.2%

The unemployment rate reflects the percentage of the labor force without jobs but seeking work. It ticked up to 4.1% in February 2025 from 4.0%, missing expectations of stability. For March, analysts expect it to tick slightly to 4.2%, indicating a labor market in equilibrium despite underlying pressures.

The steady forecast hinges on February's slight rise, linked to a shrinking labor force, and a still-tight market with a 0.9 unemployed-people-per-job-opening ratio. This suggests job creation is matching labor force dynamics, preventing a significant shift in either direction.

A climb above 4.2% could indicate accelerating job losses or labor force contraction, possibly spurring Fed intervention. A drop below might reflect a tighter market, raising wage and inflation concerns that could influence monetary policy.

The forecasted 4.2% unemployment rate in March 2025 is shaped by the Department of Government Efficiency initiative's federal layoffs, which ramped up in March after starting in February. These layoffs are swelling the ranks of the unemployed, as many displaced federal workers, especially in administrative and clerical roles, are actively job-hunting in the private sector. This surge in job seekers is exerting upward pressure on the unemployment rate. Meanwhile, the January 2025 immigration crackdown is reducing the flow of new workers into the labor force. With fewer immigrants entering the job market, labor force participation is declining, which tempers the unemployment rate's rise by shrinking the denominator (the labor force). Together, these factors, the DOGE layoffs pushing unemployment up and the immigration policy capping labor force growth, balance out to maintain the rate at 4.2%.

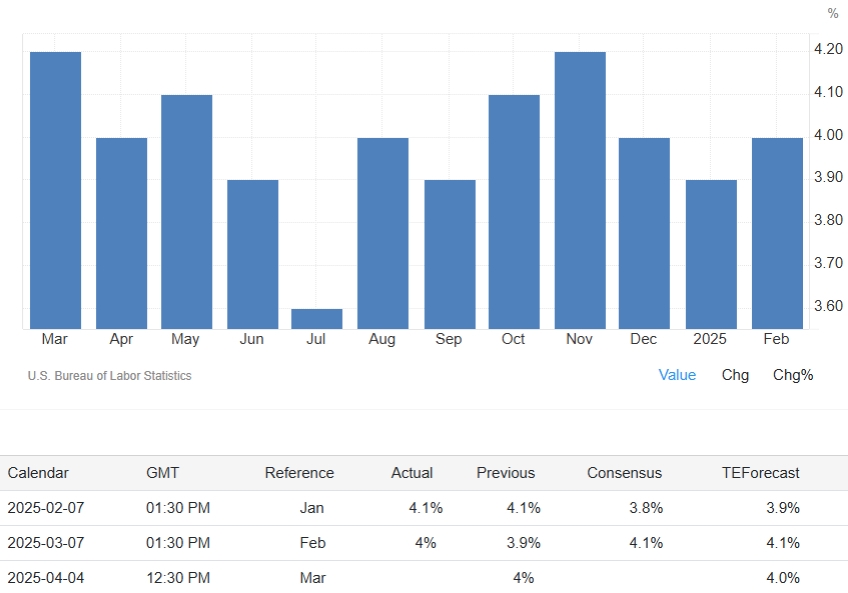

Average Hourly Earnings YoY

Last Reported Number (February 2025): 4.0%

Forecasted Number for March 2025: 4.0%

Average Hourly Earnings YoY tracks annual wage growth, a key inflation indicator. February 2025 reported a 4.0% increase, below the anticipated 4.1%. For March, economists predict it will hold at 4.0%, signaling a plateau in wage pressures.

The 4.0% forecast reflects February's slowdown, driven by easing labor market tightness and employer caution amid rising costs. With inflation in check, this stability aligns with the Fed's watchful stance on wage-driven price pressures.

A dip below 4.0% might ease inflation fears, supporting arguments for rate cuts, but could also suggest weakening demand. A rise above could heighten inflation concerns, diminishing prospects for monetary easing.

The forecasted 4.0% wage growth in March 2025 is influenced by distinct policy-driven dynamics. The looming Trump tariffs policy, slated for April, are already impacting businesses in March. Companies in manufacturing and retail, anticipating higher input costs, are reluctant to raise wages, opting to preserve profit margins instead. Additionally, similar to the DOGE federal layoffs pressure upon Unemployment Rate numbers, federal layoffs are flooding the private sector with skilled workers—such as those in IT, engineering, and administration—heightening competition for jobs . This influx depresses wage growth, as employersEIG-- benefit from a larger talent pool. In contrast, the immigration crackdown is tightening labor supply in low-wage sectors like construction and hospitality, nudging wages up there. However, this upward pressure is offset by the tariff-related cost constraints and the competitive labor market fueled by federal worker displacement, keeping overall wage growth steady at 4.0%.

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet