Trump's Trade War Escalates Before "Liberation Day": Here's the Timeline of How We Got Here

As the fateful April 2nd draws nearer, the air is thick with speculation. President Donald Trump has repeatedly heralded this day as liberation day, touting the wide - ranging reciprocal tariffs as the key to rebalancing U.S. trade relationships. However, sources have recently informed ABC News that the plan for these reciprocal tariffs might be narrower than initially promised, with the details still being ironed out.

Trump himself added an element of ambiguity during a Tuesday interview with Newsmax. He stated, "I'll probably be more lenient than reciprocal, because if I was reciprocal, that would be very tough for people." This signals a potential softening of the tariff stance. The White House further clarified that the Trump administration will no longer consider non - tariff barriers such as value - added tax (VAT), wage suppression, and currency manipulation when determining the reciprocal tariff rate.

The news of a potentially more lenient approach to the forthcoming tariffs provided a glimmer of hope for the markets. Earlier this week, U.S. stocks rallied, recouping some of the losses incurred in March. But the relief may be short - lived. Just recently, on March 26th, Trump took a significant step that signals an escalation of the trade war. He signed an executive order to impose a permanent 25% tariff on all imported cars, with the measure set to take effect on April 2nd. This move is expected to have far - reaching implications for the global automotive industry and trade relations.

Despite the possible softening in some aspects of the tariff plan, this new car tariff clearly indicates that the trade war is far from over. It adds another layer of complexity to the already tense global trade situation as the world watches and waits for April 2nd.

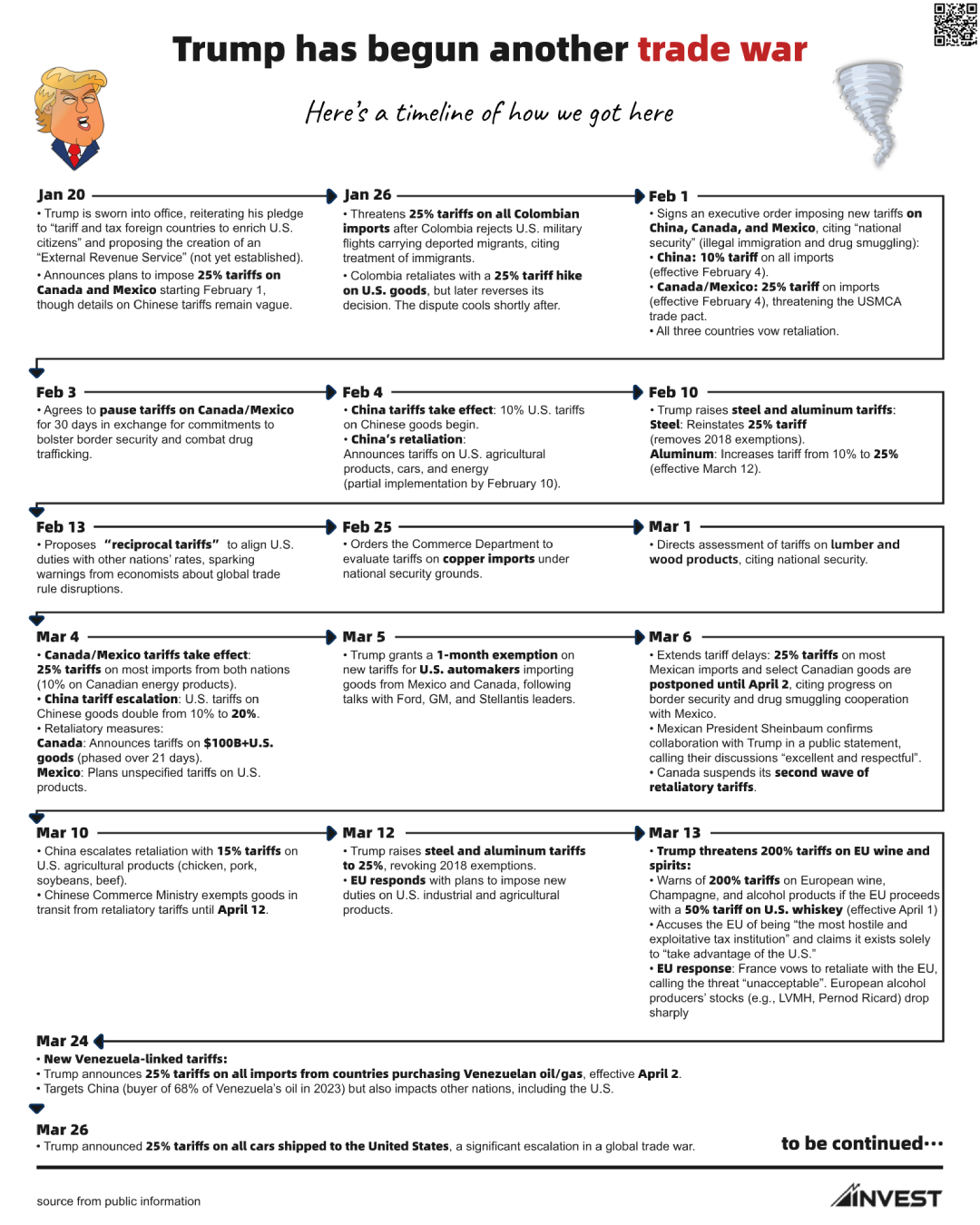

Here's a timeline of how we got here:

Turning market noise into visual signal.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet