Trump Tariffs Trigger Catastrophic Market Bloodbath: Trillions Wiped Out, Billionaires Slammed

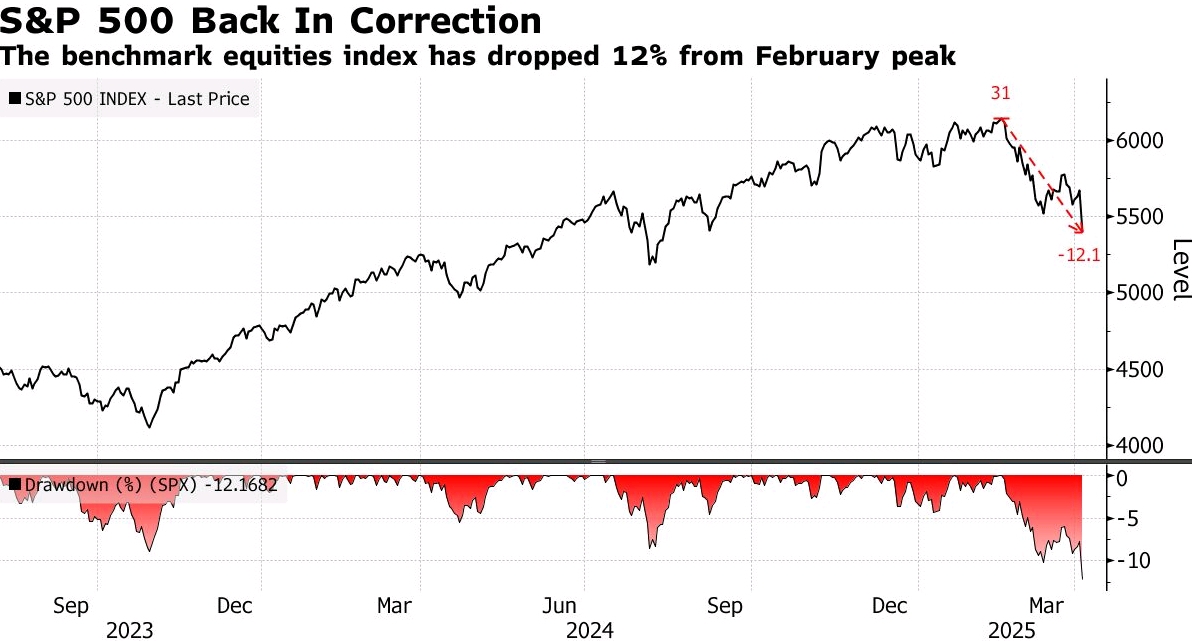

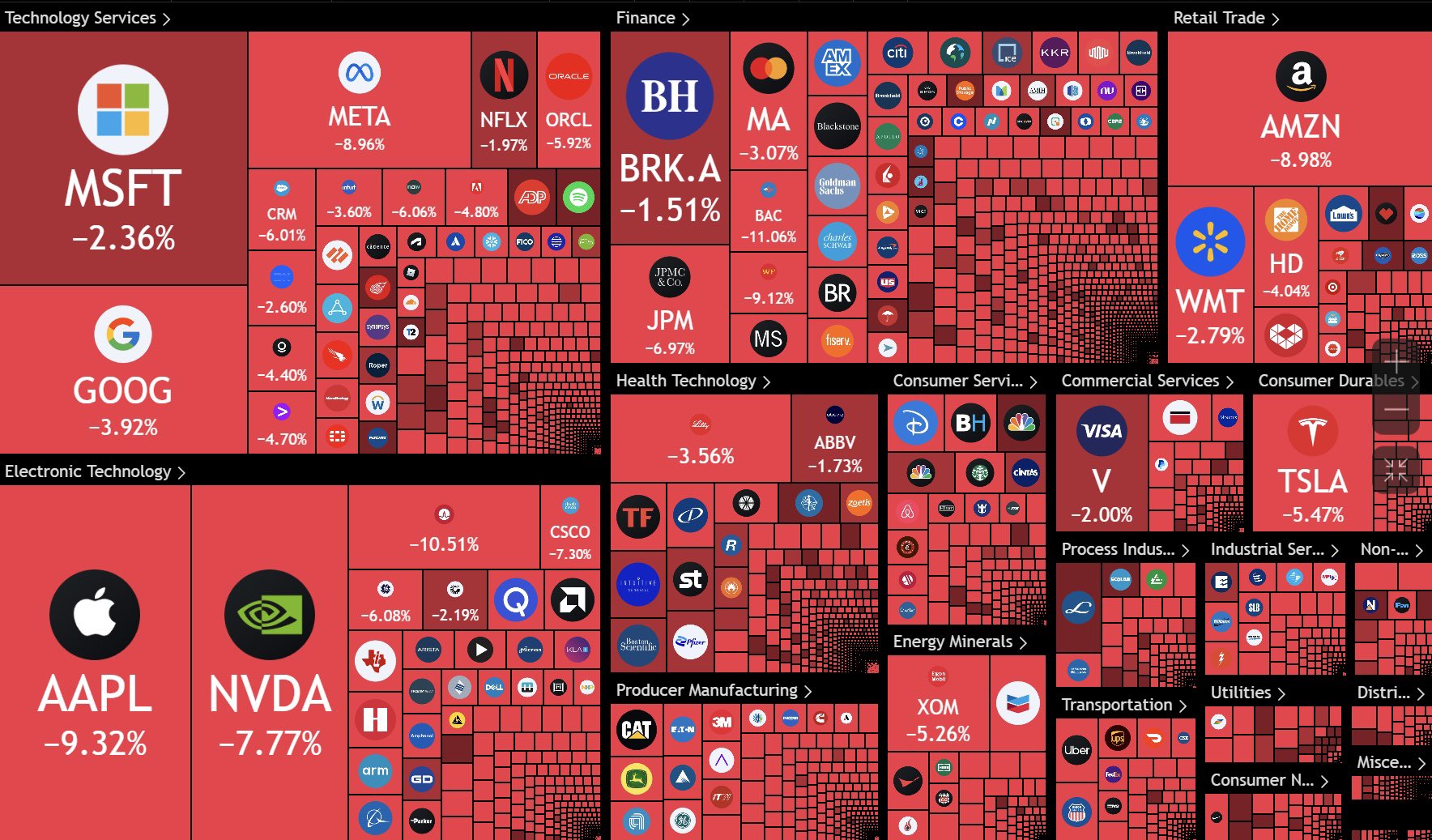

US stocks experienced a catastrophic plunge, with the S&P 500 Index plummeting 4.8% - its most significant drop since June 2020. This decline thrust the index back into a technical correction, following a savage global market rout that spanned from Tokyo to London. The Nasdaq 100 Index wasn't spared either, losing 5.4% - marking its worst day since September 2022.

Apple Inc. led the tech - heavy index down with a staggering 9% loss, while NvidiaNVDA-- Corp. and TeslaTSLA-- Inc. also tumbled. The Russell 2000 Index of small - cap stocks fared even worse, dropping 6.6% and entering a technical bear market as it slumped more than 20% from its late - 2021 record. In total, a staggering $2.5 trillion in value was erased from US stocks.

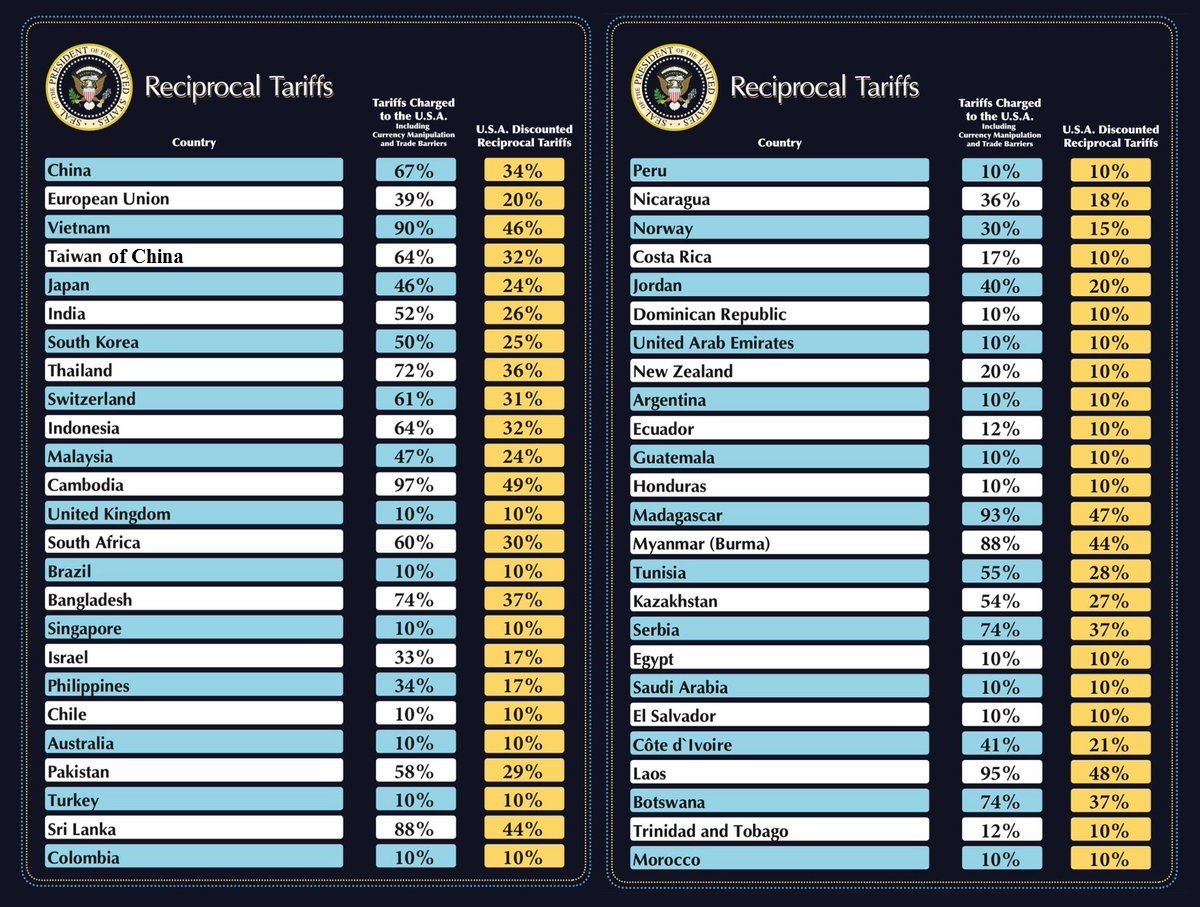

The carnage was widespread across sectors. Tariffs on manufacturing countries like Vietnam and Indonesia sent shockwaves through consumer - facing stocks. NikeNKE-- Inc. plummeted 14%, and other apparel - related stocks such as Lululemon Athletica Inc.LULU--, Abercrombie & Fitch Co., and Gap Inc. also declined. Automakers General Motors Co. and Ford Motor Co. saw their shares fall, and the retail sector was decimated, with Best Buy dropping 18% and Dollar Tree sliding 13%.

Tariff - Induced Panic

On Wednesday, President Donald Trump imposed the steepest American tariffs in a century. He announced a 10% tariff on all exports to the US, with even higher duties on some 60 nations. The European Union faces a 20% levy, Japan a 24% tariff, and China an even steeper rate. This move sent shockwaves through the market, as the scope and scale of the tariffs were far beyond expectations.

John Cunnison, chief investment officer at Baker Boyer Bank, stated, The scope of tariffs and how many countries were hit came as a big shock, igniting fears this is an opening shot of a long trade war to come that will rattle markets and stall the economy. Economists warn that these tariffs will likely lead to higher US prices, slower growth, and potentially a recession. Credit rating firm Fitch called tariffs a game - changer for the global economy, and UBS estimated they could cut US economic growth by 2 percentage points this year and push inflation close to 5%.

Investor Responses and Analyst Outlook

Investors scrambled to shed risky assets from their portfolios, leading to a surge in market volatility. The Cboe Volatility Index soared to 30, its highest level this year. The derivatives market anticipates more turbulence ahead, with options traders betting that the S&P 500 will move approximately 1.4% in either direction on Friday following the release of the jobs report.

Legendary investor Bill Gross cautioned prospective dip - buyers to stay away. He described the sell - off as a deep market event similar to the end of the gold standard in 1971, with immediate negative consequences. Gross believes Trump won't back down easily, stating, Trump can't back down anytime soon, he's too macho for that. For now, he sees limited opportunities in domestic dividend - paying stocks like AT&T Inc. and Verizon Communications Inc., but warns they are approaching overbought territory. Analysts have revised their forecasts for the S&P 500's 2025 performance downward. Since the start of the year, they now project S&P 500 companies to grow profits by 9.5% this year, down from nearly 13% in early January.

Billionaires Bear the Brunt

The world's 500 richest people endured a staggering blow, with their combined wealth plummeting by $208 billion on Thursday. This represents the fourth - largest one - day decline in the 13 - year history of the Bloomberg Billionaires Index and the largest since the peak of the Covid - 19 pandemic. Over half of those tracked by the index saw their fortunes decline, with an average drop of 3.3%. US billionaires, including Meta Platforms Inc.'s Mark Zuckerberg and Amazon.com Inc.'s Jeff Bezos, were among the hardest hit.

What Lies Ahead

The monthly jobs report, set to be released on Friday, has taken on added significance. Portfolio manager Julie Biel emphasized its importance, saying, We are much more vulnerable to a recession now, given the tariffs than just a few months ago and this will give us a glimpse into just how strong employment was ahead of the tariff rollout. Fed Chair Jerome Powell is also scheduled to speak at the end of the week, and his remarks will be closely scrutinized for any signs of weakness in the labor market.

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet