Trump's Tariffs Spark Chaos in the Crypto Market, Intensifying Bearish Sentiment for Bitcoin

After US President Trump announced on Wednesday that he would impose reciprocal tariffs on dozens of countries, global markets were thrown into turmoil, and the digital currency market was no exception.

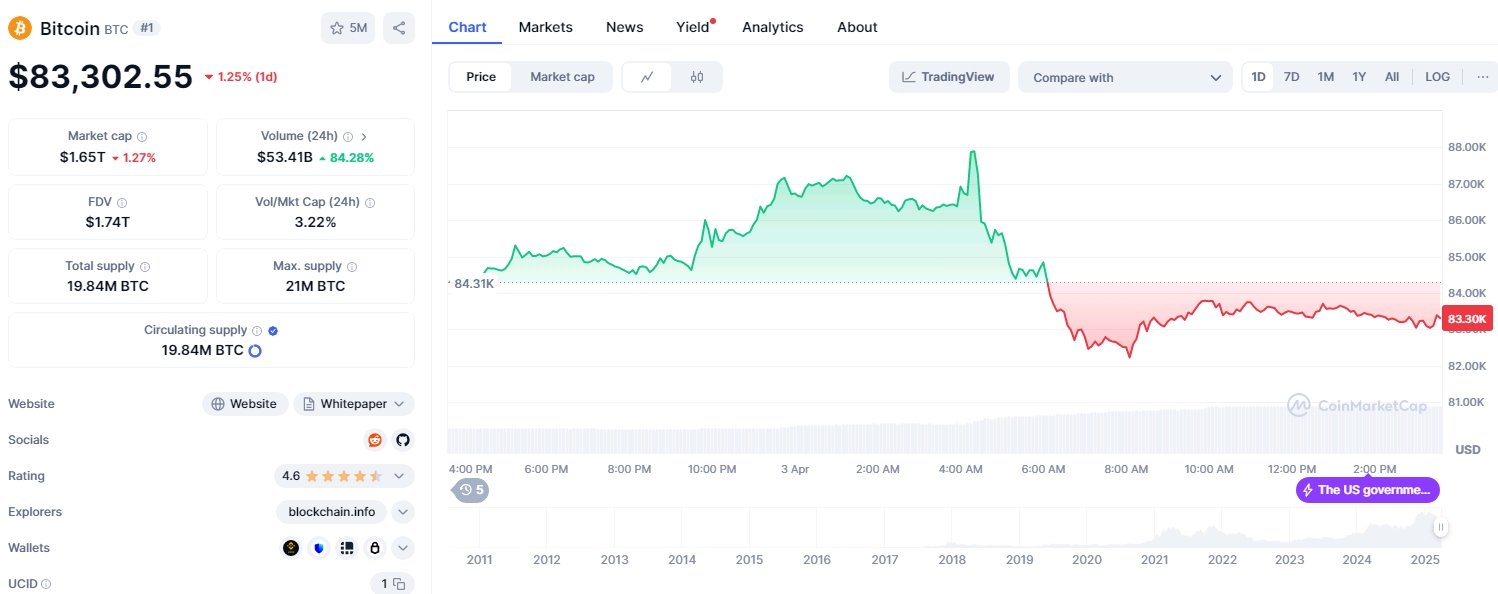

Bitcoin initially rose to $87,400 after the tariff announcement but then declined to above $82,000, with a sharp drop of 3%. Currently, Bitcoin is quoted at $83,303, and the intraday decline has narrowed to 1.25%.

According to data from Coinmarketcap, on Wednesday, there was a total net outflow of $8.6 billion from cryptocurrency - related ETFs, with the net outflow from Bitcoin - related ETFs reaching as high as $8.7 billion.

Although Bitcoin has a hedging property, in recent times, speculative activities have outweighed its hedging nature. With the increase in economic uncertainty, traders are increasingly favoring more traditional safe - haven assets such as gold. On Wednesday, gold broke through the $3,150 mark for the first time.

Increasing Bearish Pressure

Trump's tariff policy has cast a shadow over the entire crypto market. The total value of the market shrank by 1.37% within 24 hours, with a lowest point of $2.64 trillion. Ethereum, the second - largest cryptocurrency, once dropped by 6%, and currently the decline has narrowed to 2.8%.

In addition, several stocks related to Bitcoin also experienced significant declines. The stock price of Strategy, a major Bitcoin buyer, fell by 5.85% after - hours trading. The stock price of the crypto exchange CoinbaseCOIN-- dropped by 7.63% after - hours, and the stock price of the financial services company Robinhood declined by 10.75% after - hours.

The collective decline in the crypto market means that digital currencies are under huge selling pressure, reflecting investors' strong concerns about trade tensions and the broader impact of tariffs on the economy.

Bitcoin has long been known as digital gold, but in recent months, its price has become increasingly correlated with the US stock market.

The TrandingView indicator shows that the correlation between the price of Bitcoin and the Nasdaq index is currently as high as 0.74. This means that for every 10% decline in the Nasdaq, the price of Bitcoin will follow with a 7.4% drop.

As Trump's tariffs continue to affect the market, the US stock market is expected to be dominated by bearish sentiment in the short term, and it will be difficult for Bitcoin to stage a rally.

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet