At Least, Trump's New Tariffs Are Making Fed More Likely To Cut Rate Next Month

Trump's reciprocal tariffs not only spark concerns about a global trade war and economic recession but also make traders lean toward the Federal Reserve cutting interest rates at its May policy meeting.

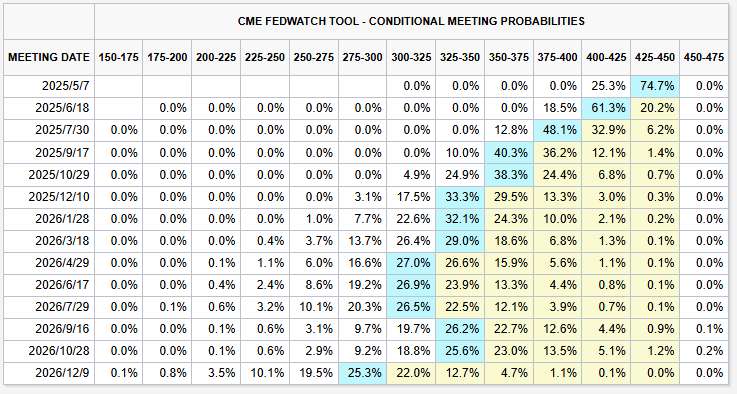

According to the CME Group's FedWatch Tool, the probability of a Fed rate cut in May surged to 25% on Thursday, significantly higher than the 11% recorded a day earlier and 12% a week ago.

Additionally, the likelihood of a Fed rate cut in June also increased to 61.3%, up from 60.6% a day earlier, but the probability of consecutive 25-basis-point cuts from May to June has risen to 18%.

Market traders still broadly expect the Fed to cut rates three times this year, but the probability of four cuts has climbed over 30%.

Former U.S. Treasury Secretary Lawrence Summers warned that the Trump administration's tariff hikes could deliver an economic shock comparable to the oil crisis, undermining productivity, driving up prices, and increasing unemployment. Summers cautioned that these policies would not only have profound economic consequences but also impact diplomatic relations and national security. He noted that, in the short term, the tariffs would push prices higher, further affecting employment and investment.

Fitch Ratings experts issued a stark warning, stating that if Trump's new global tariff policy takes effect, the average U.S. import tariff rate would skyrocket from the current 2.5% to 22%—an eightfold increase.

Under the proposed policy, while the U.S. sets a 10% global baseline rate, the actual tariffs imposed on most trade partners would far exceed this level. Olu Sonola, Head of U.S. Economic Research at Fitch, noted: That rate was last seen around 1910, This signals a return to century-old trade protectionism.

The economist bluntly stated: "This is a game changer, not only for the US economy but for the global economy.Many countries will likely end up in a recession. You can throw most forecasts out the door, if this tariff rate stays on for an extended period of time."She emphasized that deeply integrated global supply chains would amplify cost cascades, ultimately backfiring on U.S. consumers and businesses.

Notably, even before Trump formally announced the reciprocal tariffs on Wednesday, markets had already begun warning that his policies would heighten U.S. recession risks. Goldman SachsGBXC-- recently raised its U.S. recession probability forecast from 20% to 35% in a report and lowered its 2025 GDP growth expectation from 2.0% to 1.5%.

JPMorgan economists also projected a 40% chance of a U.S. recession, up 10 percentage points from earlier this year. They warned that tariff hikes could severely drag down business activity, potentially tipping the U.S. and global economy into recession.

Moody's Chief Economist Mark Zandi similarly raised his U.S. recession probability estimate to 40%, citing Trump's tariffs and federal workforce cuts. He noted that the probability stood at just 15% in early 2025 but had climbed due to troubling data, including weakening consumer confidence, slowing spending, and persistent inflation.

Fed Officials Push Back on Rate-Cut Expectations, Warn Tariffs Could Worsen Inflation

Last week, Boston Fed President Susan Collins and Chicago Fed President Austan Goolsbee—both voting members of the Fed's FOMC in 2025—stressed that persistent price pressures in the U.S. justify keeping interest rates higher for longer.

This week, New York Fed President John Williams, who holds a permanent FOMC vote, echoed concerns, stating that while baseline forecasts suggest inflation will stabilize, Trump's tariffs introduce significant upside risks, raising the bar for rate cuts. Williams acknowledged that the long-term economic impact of the tariffs remains unclear but said the Fed would closely monitor policy developments and economic data—particularly price and activity trends in affected industries. He added that indirect effects could take years to materialize.

Goolsbee reiterated warnings this week that uncertainty from tariffs could dampen consumer spending and business investment, with negative spillover effects. While one-off tariffs should theoretically have temporary price effects, Goolsbee noted they could have longer-lasting consequences, particularly if retaliatory tariffs or duties on intermediate goods—components used in domestic production—disrupt supply chains.

On Wednesday, Federal Reserve Governor Adriana Kugler emphasized the need to maintain current interest rates until inflation risks subside significantly. She acknowledged that while inflation has retreated from 2022's 40-year highs, recent data shows progress stalling, compounded by policy shifts and rising inflation expectations.

Kugler stated clearly: "I will support maintaining the current policy rate for as long as these upside risks to inflation continue, while economic activity and employment remain stable." She stressed a data-dependent approach, signaling flexibility in future decisions. Kugler added that progress toward the Fed's 2% inflation target may have stalled, citing potential price pressures from announced and prospective policy changes.

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet