Trump's Tariff Tsunami: No Country Spared, Fed Struggles to Steer Economy

On April 2, 2025, President Donald Trump officially announced a sweeping set of tariffs targeting U.S. trading partners worldwide, marking his most aggressive move yet to reshape global trade.

Speaking at the White House Rose Garden event, Trump outlined a tariff regime aimed at protecting American workers, while also placing the Federal Reserve in a challenging position as it grapples with inflation and economic stability.

Trump's Rose Garden Announcement and Tariff Specifics

During a 48-minute address in the Rose Garden, President Trump framed the tariffs as a long-overdue correction to an unfair global economic system that he claims has disadvantaged American workers. Surrounded by union members and workers from industries like steel, oil, gas, and autos, Trump emphasized the need to prioritize American prosperity.

For years, hard-working American citizens were forced to sit on the sidelines as other nations got rich and powerful, much of it at our expense, Trump declared. But now it's our turn to prosper.

He presented the tariffs as a tool to bring jobs and factories back to the U.S., using large boards to display each nation's new tariff rate in a dramatic show of intent. The announcement was a fulfillment of months of campaign promises to assert U.S. economic power and revive domestic manufacturing, appealing directly to the blue-collar voters who supported his 2024 election bid.

Specific Tariff Rates by Country

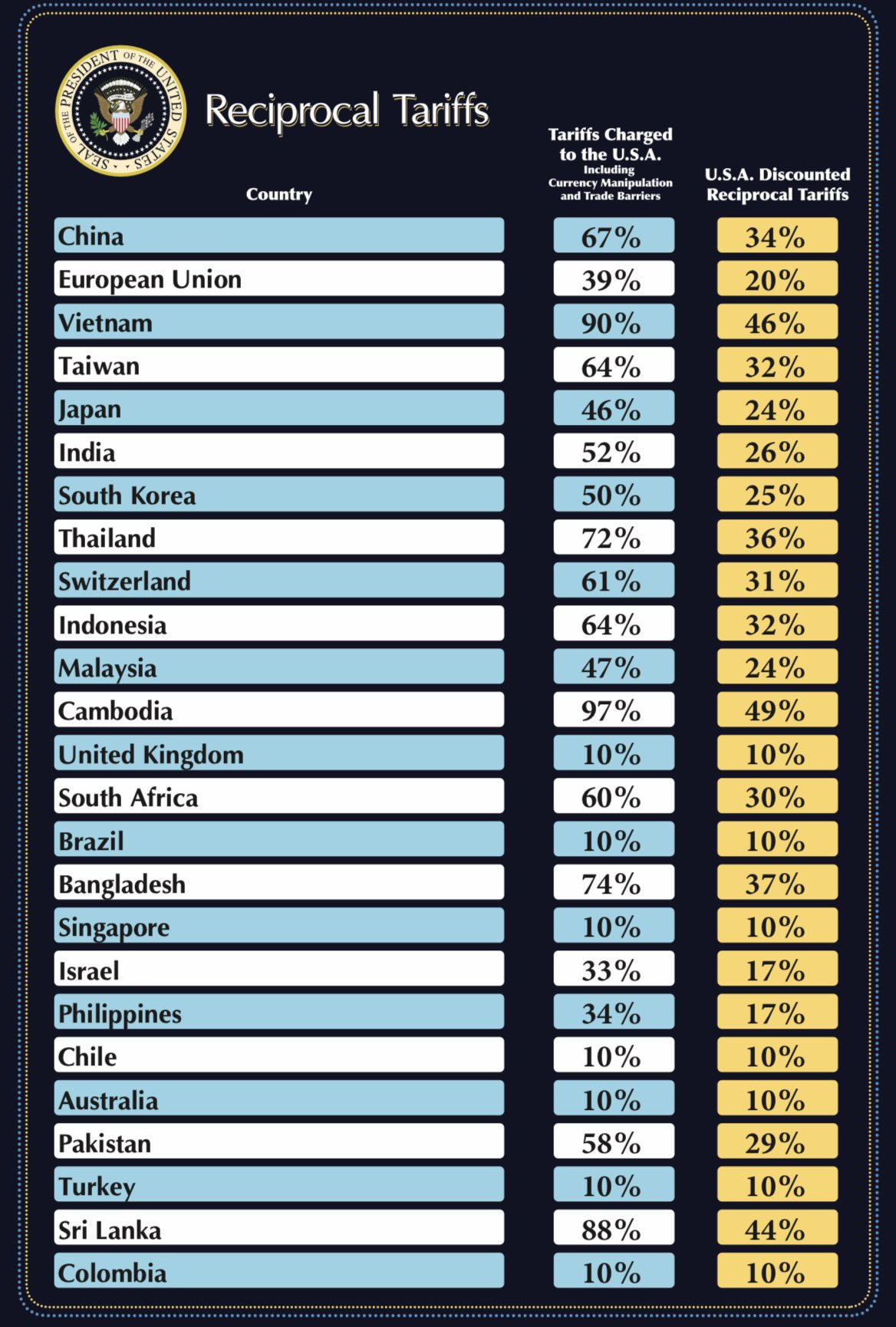

Trump outlined a two-tiered tariff structureGPCR-- affecting nearly all exporters to the U.S.:

First, Baseline Tariff, a 10% tariff that will apply to all goods imported into the U.S., effective after midnight on Saturday, April 5, 2025. This universal levy aims to level the playing field for American businesses.

Then, there is Reciprocal Tariffs. Around 60 countries that have the largest trade imbalances with the U.S. will face additional, higher tariffs starting at 12:01 a.m. on April 9, 2025. These rates are calculated as half the levies and non-tariff barriers those nations impose on U.S. goods, according to a government tally.

The impact of the newly announced tariff varies across countries.

For Canada and Mexico, the situation remains relatively more optimistic. Exemptions on goods covered by the USMCA North American trade agreement Trump brokered in his first term will stay. They already face 25% tariffs tied to drug trafficking and illegal migration, and those will remain in place and the US's two largest trading partners will not be subject to the new tariff regime as long as the separate tariffs are in effect.

On the other hand, Asian and European Countries face particularly grim circumstances. Under Trump's new tariff regime, China faces the steepest levies, with a cumulative tariff of at least 54% on many goods, comprising a new 34% levy stacked on top of an existing 20% duty tied to fentanyl trafficking, alongside pre-existing tariffs on items like solar panels. Other major trading partners are also significantly impacted: the European Union is subject to a 20% tariff, while Vietnam faces a substantial 46% rate. Across Asia, Japan is set at 24%, South Korea at 25%, and China Taiwan at 32%, with India at 26% and Cambodia bearing one of the highest rates at 49%. This new structure reflects a broad approach to imposing varying tariff rates on key global economies.

The White House stated that these measures are designed to penalize nations Trump labels as the worst offenders in trade practices, with Treasury Secretary Scott Bessent warning trading partners against retaliation, suggesting that compliance could cap the tariff rates at their current levels.

Trump's tariff plan is a high-stakes gamble with far-reaching implications. Proponents argue it will protect American industries and encourage domestic production, but economists warn of significant risks. The immediate market reaction was negative, with equity benchmarks dropping over 2% and automaker stocks and crude oil prices declining, reflecting concerns over disrupted supply chains and higher costs.

International Economics expert described the tariffs as much worse than we feared, predicting a dramatic rerouting of global trade. Economics estimates that China's exports to the U.S. could fall by 90% by 2030 under the 54% tariff. The levies are expected to raise the cost of trillions of dollars in imported goods annually, potentially sparking a global trade war if countries retaliate with their own tariffs on U.S. exports.

For American consumers, the tariffs could mean higher prices as the cost of imported goods—like electronics, clothing, and fuel—increases. Critics warn that this inflationary pressure, combined with potential supply chain disruptions, could push the U.S. economy into a recession, though any benefits, such as a restructured manufacturing base, might take years to materialize.

Federal Reserve's Dilemma and Potential Economic Consequences

The tariffs have placed the Federal Reserve in a precarious position as it balances its dual mandate of controlling inflation and supporting employment. With inflation already a concern following pandemic-era price spikes, the new levies threaten to exacerbate the problem by raising the cost of imported goods. Economics estimates the average effective tariff rate in the U.S. could rise to around 22% (from 2.3% in 2024), while analysts from Inflation Insights projects a range of 25-30%.

This potential inflationary surge complicates the Fed's strategy. Many Wall Street analysts exhibit concerns about the skyrocketing probability of economic slowdown or even recession.

It puts the Fed between a rock and a hard place, said th chief economist at Wells Fargo. If growth slows and the unemployment rate comes up, they want to be cutting rates. On the other hand, if inflation goes up from here, they kind of want to be raising rates.

Investors have responded by increasing bets on at least three Fed rate cuts in 2025, with a fourth by year's end becoming more plausible. However, economists from RSM US suggest the Fed is unlikely to lower rates soon, predicting inflation could climb to 3-4% by year-end. Fed Chair Jerome Powell, scheduled to speak at a conference on April 4, 2025, will likely face intense scrutiny over how the central bank plans to navigate this uncertainty.

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet