Trump Stands by Tariffs: "Don't Want Anything to Go Down, but Sometimes You Have to Take Medicine"

In the face of a severe market rout triggered by his sweeping global tariff announcements, President Donald Trump and his economic team have shown unwavering defiance.

Speaking on Air Force One on Sunday, Trump repeatedly defended the tariff barrage, stating, We're going to become a wealthy nation again — wealthy like never before. We have all the advantages. Forget markets for a second — we have all the advantages. He also drew a firm line, saying he wouldn't strike deals to cut the highest tariffs unless they eliminated the US trade deficit with that country. To me a deficit is a loss. We're gonna have surpluses or we're going at worst going to be breaking even. And you know, I was elected on this. This was one of the biggest reasons I got elected, he emphasized.

When asked about the ongoing stock market sell - off, Trump said, I don't want anything to go down, but sometimes you have to take medicine to fix something, citing the trade deficit with China as the rationale for his tariffs plan. We have to solve our trade deficit with China. We have a trillion - dollar trade deficit with China, hundreds of billions of dollars a year we lose with China. And unless we solve that problem, I'm not going to make a deal, he added.

Trump's top economic officials echoed his stance across the airwaves on Sunday. Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick, and others declared that Trump would persist in his tariffs agenda, regardless of market reactions. Lutnick stated, The tariffs are coming. He announced it and he wasn't kidding. Bessent, despite economists at JPMorganJPEM-- predicting a US recession this year, said, I see no reason that we have to price in a recession.

White House trade czar Peter Navarro predicted that the current equity market slump would turn into a booming market, saying, We will find a bottom in this market quickly. We will hit 50,000 on the Dow easily by the end of this term. Kevin Hassett, head of the White House's National Economic Council, downplayed concerns about inflation, suggesting that worries among economists and the Federal Reserve were overblown.

However, outside the Trump administration, there was widespread concern. Pershing Square founder Bill Ackman, who had endorsed Trump in the 2024 election, called the tariffs a mistake in an X post. Former Treasury Secretary Larry Summers noted that last week's selloff was one of the largest two - day moves since World War II and warned that trouble lay ahead.

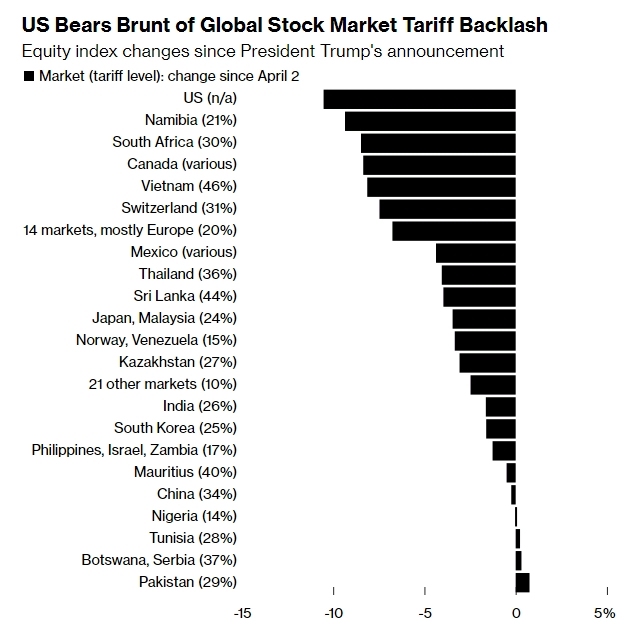

The market crash that Trump's tariffs ignited was historic. The Nasdaq 100 plunged into a bear market, over $5 trillion was wiped off the value of all US shares in two days, commodities collapsed, and corporate - bond investors rushed to buy default - protection contracts. Asian stock futures sank again in early Monday trading, continuing the downward spiral. American investorsWAR--, from corporate executives to hedge - fund moguls, are reeling from the impact. Richard Steinberg, a senior wealth adviser, is frustrated by Trump's approach, saying it lacks a level of sophistication. Jay Hatfield, CEO of Infrastructure Capital Advisors, called the tariffs unambiguously stupid and the tariff chart Trump brandished the chart of death.

The unified stance of Trump and his economic team suggests that he intends for his tariffs to be a permanent feature, seeing any short - term economic pain as a necessary medicine for the long - term transformation of the US economy. With additional tariffs set to take effect, the markets brace for further turbulence as the world watches to see if Trump's gambit will pay off.

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet