Trump's 'Reciprocal Tariffs' Rattle Global Markets: Here's How Wall Street Views It

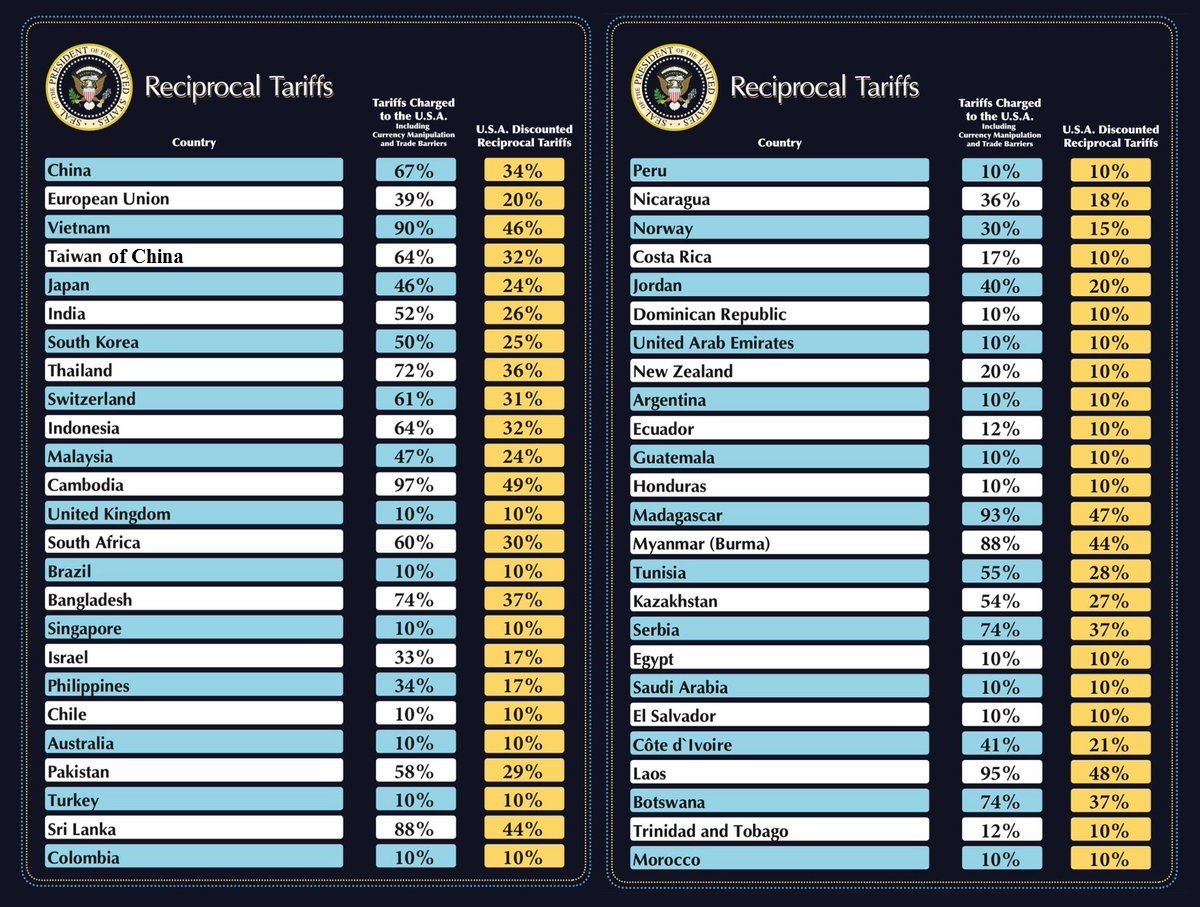

After the US stock market closed on April 2nd, Trump's reciprocal tariffs were officially implemented. It was announced that the US would set a minimum benchmark tariff of 10% for its trading partners and impose higher tariffs on certain trading partners.

According to Trump, the logic for imposing these tariffs is 50% of the trade barriers (converted into tariff rates) that non-US countries impose on the US, with a minimum value of 10%. The severity of this policy significantly exceeds market expectations.

After the announcement of the tariffs, the global market was severely impacted. US stock index futures tumbled after hours, with the Dow Jones Industrial Average futures falling by more than 1,000 points at its peak. All of the major US technology giants plummeted, with Apple's stock price dropping by more than 7%. Asian-Pacific stock markets all opened significantly lower.

Investors did not receive the anticipated last-minute relief, and it seems that the Trump administration doesn't care about the short-term reaction of the market either. So, how significant will the subsequent impact be and what should the market pay attention to? Let's take a look at how Wall Street analysts view these tariffs.

Relatively Pessimistic

KPMG: Tariffs Increase the Likelihood of a Slowdown in the US Economy

Diane Swonk, Chief Economist of KPMG, said, This is basically our worst-case scenario. She stated that tariffs increase the likelihood of a slowdown in the US economy. Swonk and other economists believe that Fed officials may delay interest rate cuts to cushion the economy while assessing the potential impact of tariffs on inflation.

Morgan Stanley: Tariff Escalation Will Damage the Global Economy

Seth CarpenterCRS--, Chief Global Economist of Morgan StanleyMS--, said in an interview on Bloomberg TV on Wednesday morning before the tariff announcement, If there is a scenario of tariff escalation, then the productivity of the global economy will fundamentally decline. This is not a zero-sum game. It could actually be a net loss for the entire global order.

Bloomberg: A More Stagflationary Outlook Lies Ahead

Michael BallBALL--, a strategist at Bloomberg, said that the initial level of reciprocal tariffs is higher than expected, which will keep uncertainty and volatility at a high level for a certain period. There are still many things to be determined, but the initial reaction to Trump's tariff statement indicates that a more stagflationary outlook lies ahead in the future.

RSM US LLP: The New Tariff Regime May Lead to a Recession in the US

Joseph Brusuelas, Chief Economist of RSM US LLP, believes that the new tariff regime is much tougher than many analysts expected and will increase the likelihood of a recession in the US economy. He said, I expect the inflation rate to reach 3% - 4% by the end of this year. He also added that the Fed is unlikely to cushion the economy by cutting interest rates in the short to medium term. The actions taken by the White House today put the Fed in a more difficult situation because it faces pressure on both aspects of its mandate.

Charles Schwab: There May Be a Reassessment of the Probability of an Economic Recession Soon

Liz Ann Sonders, Chief Investment Strategist of Charles Schwab, said, I think we may soon see a reassessment of the probability of an economic recession. I won't be surprised at all if we see these probabilities rise. At least, we will see further downward pressure on the expected profitability of companies in 2025. From now on, the path of least resistance for earnings is a significant decline.

Janus Henderson Investors: Laying the Groundwork for More Pain and Uncertainty

Adam Hetts, Global Multi-Asset Head of Janus Henderson Investors, believes that reciprocal tariffs leave room for negotiation, but also lay the groundwork for more pain and uncertainty. Implementing astonishing tariffs on a country-by-country basis is clearly a 'negotiation strategy', which will keep the market in a state of tension in the foreseeable future. We have already seen that the government has an astonishingly high tolerance for market volatility. Now the big question is, as the negotiations unfold, how much tolerance it has for real economic pain.

Miller Tabak+Co.: The Stock Market Will Face Greater Resistance

Matt Maley, Chief Market Strategist of Miller Tabak+Co., said, There hasn't been the last-minute relief that some investors were expecting recently. Therefore, it seems that the Trump administration is not worried about the short-term impact of these tariff policies on the market. This means that earnings expectations will receive much attention in the coming weeks. If earnings expectations continue to decline, the stock market will face greater resistance.

Relatively Optimistic

Barclays: Market Volatility Will Continue

Venu Krishna, Head of US Equity Strategy at Barclays, said that in any case, this announcement means that volatility will continue. After the tariffs, issues such as retaliation from trading partners, rising inflation, shrinking consumer spending, and declining industrial production remain unresolved.

However, Krishna of Barclays still has a positive attitude towards large technology stocks. He believes that the price-to-earnings ratios of AppleAAPL--, Amazon, Alphabet, Meta, Microsoft, and NVIDIA have dropped by 25% from the recent peak of 32 times to about 24 times, making this sector an ideal place for risk aversion.

Federated Hermes: There May Be Buying Opportunities

Steve Chiavarone, Head of the Multi-Asset Group at Federated Hermes, also believes, If the most severe tariff level is announced today - and the subsequent news flow is about how countries negotiate to reduce tariffs - this could be beneficial for the market. This may cause sufficient selling in the next day or so, thus creating buying opportunities.

Alexis Investment Partners: The Worst Phase of the Correction May Be Coming to an End

Jason Browne, President of Alexis Investment Partners, a Texas-based investment consulting firm, said that if the market can stabilize, rebound, and break through the 5750-point level on Thursday, it will support the view that the worst phase of the correction has passed. He believes that the selling on Wednesday means that it has already reached the highest stage of uncertainty.

Remaining on the Fence

UBS: Tariffs Have a Negative Impact on Europe and Asia, Suggest Focusing on Specific European Stocks

Mark Haefele, Chief Investment Officer of UBS Global Wealth Management, wrote in a report, The announced tariffs will have a negative impact on Europe and China. After the market's rise so far this year, there may be a period of de-risking in the short term, especially if retaliatory measures are announced. We recommend selective investment, favoring the beneficiaries of increased fiscal spending in Europe and small- to mid-cap stocks.

Wells Fargo: Tariffs Put the Fed in a Dilemma

Jay Bryson, Chief Economist of Wells Fargo & Co., said, This puts the Fed between a rock and a hard place. On the one hand, if economic growth slows down and the unemployment rate rises, they want to adopt a more accommodative policy and cut interest rates. On the other hand, if inflation starts to rise from now on, they want to raise interest rates. So it really makes their situation difficult.

Franklin Templeton: Remain Neutral Across Regions and Sectors

Max Gokhman, Deputy Chief Investment Officer of Investment Solutions at Franklin Templeton, believes, The biggest question is whether countries can easily avoid the fierce impact of reciprocal tariffs as they have in the past. If not, and a real trade war sweeps the world, then stagflation seems likely to occur, leaving only wounded losers. However, since this is still a major unknown, we will not change our position for now and remain neutral across regions and sectors.

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet