"Trump 2.0" Roadmap: A Grand Chess Game for U.S. Debt Restructuring

Recently, Jim Bianco, President and Macro Strategist of Bianco Research, participated in an interview on the Kai Hoffmann podcast. Since 1990, his objective and incisive views have provided unique insights into the global economy and financial markets. Previously, he served as a technical analyst for stocks at UBSUBS-- Securities, as well as a market strategist for equity and fixed income research.

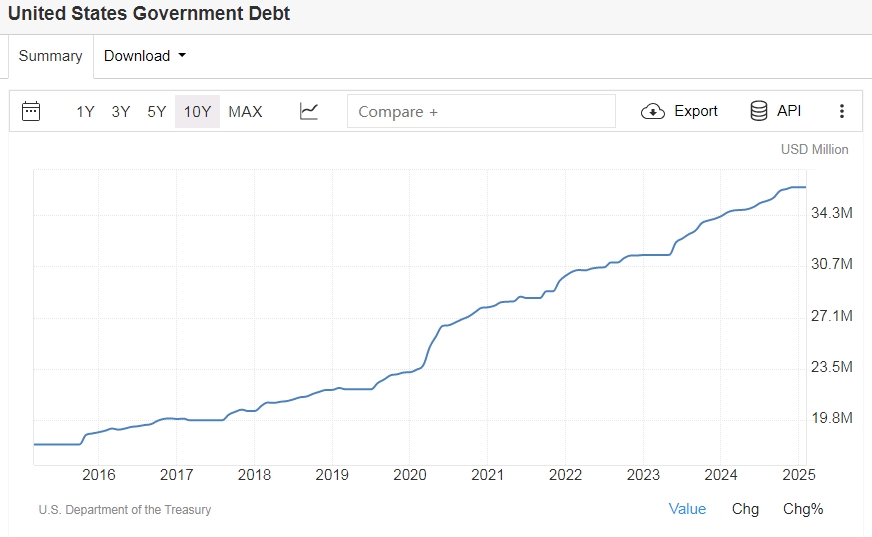

Bianco pointed out that the global economy and financial markets are facing a major transformation. The high level of debt and interest payments in the United States have already exceeded the defense budget, making the pattern of the past 70 years unsustainable.

Donald Trump used tariffs as a trading tool, aiming to devalue the US dollar, promote the return of manufacturing to the United States, and force other countries to make concessions. Trump targeted major trading partners such as Canada and Mexico first because he believed that these countries were responsible for the hollowing out of the US manufacturing industry.

Although Trump's series of policies may bring uncertainties and fluctuations, Bianco believes that they can ensure the long-term prosperity and national security of the United States. The Mar-a-Lago Accord is at the core of this transformation. In essence, it is a means for the United States to export inflation to the rest of the world and make other countries foot the bill for the US debt.

Bianco also predicted that in the coming years, the returns on money market funds, bonds, and stocks will stabilize at around 4%, 5%, and 6% respectively. Bonds are no longer the traditional crash insurance but have become an alternative to the stock market.

Despite the challenges, the current situation is not a forced recession but a necessary adjustment to deal with the unsustainability of the current status quo.

The following are the highlights of the interview(The content below is based on the interview but not entirely verbatim):

• The Mar-a-Lago Accord does not actually exist. It is just a parody of the idea of naming something after a resort or hotel. However, the goal is to reduce the value of debt, devalue the US dollar, and cut costs. It is carried out under the pretext that this is the bill for the security we have provided over the past 70 years, and now others must start paying for it.

• Any major power whose interest costs exceed its defense spending is no longer a major power. In 2022, the interest payments of the United States had already exceeded its defense spending.

• We need to bring manufacturing back to the United States. That's why Trump strongly promoted companies like SoftBank and IntelINTC--, which began talking about making large-scale investments in the United States to bring people back to work. Therefore, tariffs are used as a lever to devalue the US dollar.

• Trump is pushing for Europe to increase its defense spending, hoping that allies will share the cost of maintaining world order and ease the US fiscal burden. The United States has been playing the role of the world's policeman for many years, and now it's time for other countries to pay for it.

• So, I don't think it's a coincidence who Trump targeted first when he came up with tariffs and wanted to start changing things. Canada and Mexico. Why did he target them? Because they are the two largest trading partners of the United States.

• I think that, naturally speaking, the yen carry trade is coming to an end, but it has always been more related to emerging markets rather than the United States.

• But I have always believed that in the coming years, what I call the 4, 5, 6 market will see money market funds bring you a return of 4%, bonds bring you a return of about 5%, and the index level of US stocks bring you a return of about 6%. However, within the stock market, there will be other opportunities to earn more.

• Bonds are just a low-volatility version of the stock market with a coupon. The returns are slightly lower, and the volatility is slightly lower. It has been redefined. The previous 60/40 investment portfolio existed because it was a kind of crash insurance. But that's not the case now. Bonds are now an alternative to the stock market.

• I don't think we are entering a forced recession because I don't think anyone wants that. But I do think that they feel the current situation is unsustainable. It all boils down to the fact that we have no choice. We have to make this adjustment.

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet