Trump's First 100 Days: A Cascade of Challenges and Disappointing Outcomes Across Scoreboard

As April 30 approaches, marking the 100th day of Donald Trump's second term as president, his administration has been characterized by a whirlwind of activity and significant controversy.

Trump has affixed his signature to an unprecedented 130 executive orders as of April 17, eclipsing Franklin D. Roosevelt's 99 during his first 100 days in 1933 amidst the Great Depression. These orders span a wide range of issues, from energy and education to diversity initiatives, overwhelming opponents of his Make America Great Again agenda and leveraging the sluggish pace of judicial challenges.

Senior administration officials have hailed their swiftly enacted immigration policies as a triumphTGI--, significantly reducing illegal crossings at the US Southern border. However, this rapid pace has also propelled the administration into economic and political turbulence.

Trump's hastily introduced and often-revised tariff policies have sown confusion among trading partners and financial markets, with economists warning that these levies heighten the risk of a US recession—a potentially crippling blow to a president who campaigned on curbing inflation and ushering in prosperity.

A former Trump aide, noted, "The president was elected to tackle the border crisis and to address the economy. One he is doing well and one he is not." Meanwhile, former Treasury Secretary Larry Summers has labeled this period the "Least Successful 100 Days" since World War II. Additionally, Elon Musk's DOGE cost-cutting campaign has sparked chaos, rapidly terminating thousands of federal employees and slashing programs, including some favored by Republicans.

Trump's Approval at 100 Days: Lower Than Any President in Seven Decades

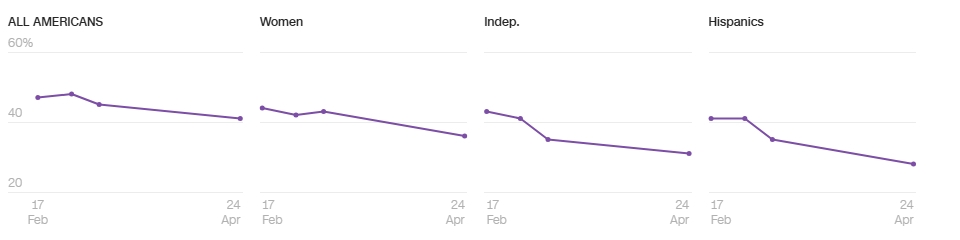

Approaching his 100-day milestone, Trump's approval rating stands at a mere 41%, the lowest for any newly elected president at this juncture since at least Dwight Eisenhower. This figure marks a decline of 4 points since March and 7 points since late February, with only 22% strongly approving of his performance—a new low—while 45% strongly disapprove. Notable drops in support have occurred among women and Hispanic Americans, each falling 7 points to 36% and 28%, respectively. Among political independents, approval has slipped to 31%, matching its lowest point from his first term. Partisan divides remain stark, with 86% of Republicans approving and 93% of Democrats disapproving, reflecting a deeply polarized public response to his early tenure.

Trump's 100 Days In: Stocks Have Only Seen Damage

Trump promised a "boom like no other," but the stock market tells a different story.

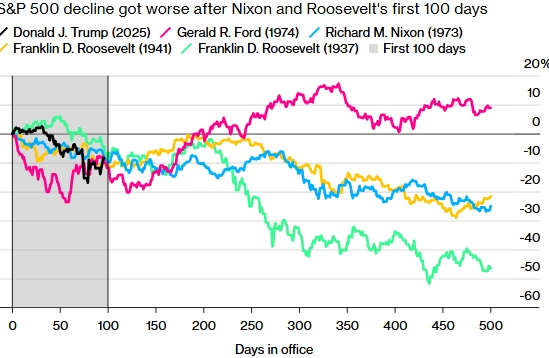

By April 30, the S&P 500 Index is down approximately 8% since his inauguration, poised for its worst performance during a president's first 100 days since Gerald Ford's tenure in 1974 following Nixon's resignation.

This decline follows two years of over 20% gains, defying expectations of a pro-growth agenda. Instead, markets have been rocked by volatility from Trump's sweeping tariffs—imposed, suspended, and adjusted across numerous countries—coupled with an escalated trade war with China. The administration's aggressive deportation of undocumented workers and mass firings of federal employees have further rattled investors, driving the S&P 500 into its seventh-fastest correction since 1929. "The volatility has been wholly different from anything we have experienced in the past," said the Chief Investment Officer at Siebert, describing it as a textbook example of systematic risk fueled by unpredictable policy shifts.

Meanwhile, the declines in equities since Trump's inauguration on Jan 20 have been led by the consumer discretionary and information technology sectors, with footwear company Deckers OutdoorDECK-- Corp., semiconductor equipment manufacturer TeradyneTER-- Inc., and specialty chemicals producer Albemarle Corp. among the biggest losers. Other companies with struggling share prices include Elon Musk's electric-vehicle maker Tesla Inc., United Airlines Holdings Inc., Delta Air Lines Inc., and Norwegian Cruise Line Holdings Ltd.

Consumer goods makers and the chip industry are grappling with the risk of higher costs from new tariffs, while travel companies are expected to feel the pinch as consumers tighten their purse strings if the economy starts struggling.

"There is irreparable damage done," analyst said. "Trend and momentum are extremely important in the stock market and they really reflect investor sentiment. Unfortunately, these things are very hard to turn back around when they go down so fast."

Wall Street is bracing for more. Speculators just widened their net-short position on S&P 500 futures to the highest since December, according to the latest data released on Friday.

Inflation Expectations Jump

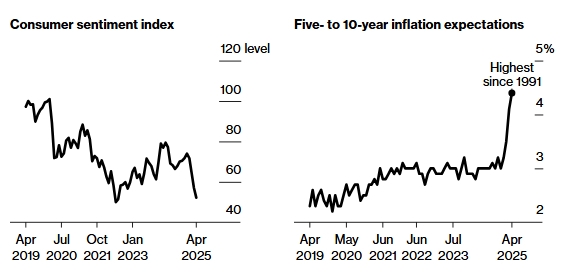

US consumer sentiment has plunged to near-record lows, with the University of Michigan's April sentiment index dropping to 52.2 from 57 the previous month—the fourth-lowest since the late 1970s.

Long-term inflation expectations have soared to 4.4% annually over the next five to ten years, the highest since 1991, while short-term expectations hit 6.5% for the coming year, the highest since 1981. These shifts coincide with Trump's tariff announcements, including a 90-day pause on higher tariffs for some partners and a staggering 145% duty on Chinese goods.

The trade policies have intensified economic and labor market anxieties, with the expectations index falling to 47.3, the lowest since 2022. Joanne Hsu, director of the survey, highlighted consumers' bleak outlook on income growth, signaling potential weakness in future spending amid pervasive economic warning signs.

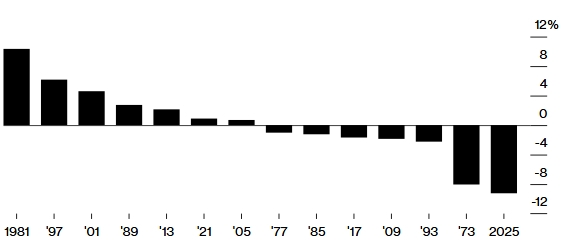

Dollar Poised for Worst First 100 Days Since Nixon

The US dollar is on track for its weakest performance during a president's first 100 days since Richard Nixon's era, with the dollar index shedding about 9% between January 20 and April 25. This marks a stark departure from the average 0.9% gain seen in the initial 100 days of presidencies since 1973. Trump's tariff policies and heightened rhetoric against trading partners like China have driven investors to favor foreign assets, boosting currencies such as the Euro, Swiss Franc, and Yen by over 8% each against the dollar, alongside a rise in gold.

"The ubiquity of the US dollar and its role in international trade and finance came with deep trust in US institutions, low trade and capital barriers as well as a predictable foreign policy," said the managing director at BMO Global Asset Management. "Now? There are clear signs of erosion which points to change in global asset allocation trends which don't favor the US dollar. We sense this is a structural shift," he said.

This decline echoes the Nixon shock of 1971, which ended the Bretton Woods system, underscoring the profound impact of Trump's early economic moves on the global financial landscape.

Trump's second-term debut has been a high-stakes gamble, blending bold action with significant risks. While immigration gains are touted, the economic fallout—evident in slumping stocks, rising inflation fears, and a faltering dollar—paints a challenging picture. With approval ratings at historic lows, the administration faces an uphill battle to reconcile its ambitious agenda with the stability Americans crave.

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet