Trade Wars Return -- Are You Ready? Discover the ETFs and Stocks That Won Last Time

The U.S. has just reignited trade tensions with new tariff announcements. For investors, this means heightened volatility -- but also a window of opportunity. History might not repeat itself, but it often rhymes. And now, with our newly launched Scenario Analysis tool, you don't have to guess what might happen -- you can see what happened the last time.

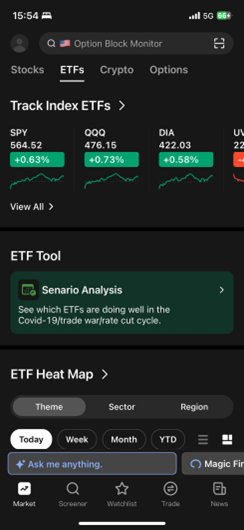

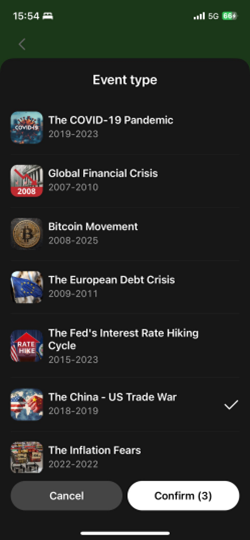

Our Scenario Analysis feature allows you to revisit major market events -- like the 2018 U.S.-China Trade War -- and instantly see which ETFs and stocks delivered the highest returns and which suffered the steepest drawdowns. Whether you're a swing trader or a long-term investor, understanding how assets performed under similar past stress conditions can give you the edge you need.

What You Can Do With It:

Find the Top Performers: Instantly discover which ETFs and stocks gained the most during past trade wars.

Assess Risk: See the maximum drawdowns during those periods to understand downside risk.

Make Informed Decisions: Use history as your map -- improve your timing, stock screener, and trade planning.

Why Now?

Trade wars can shake the market -- but they also create winners. In 2018, while some sectors struggled, others surged. Do you know which ones? With our tool, you can identify them in seconds and prepare for what's next.

Don't trade in the dark. Open the app, head to the Scenario Analysis section, and explore the 2018–2019 trade war scenario today. You'll find a full breakdown of top-performing ETFs, standout stocks, and risk metrics -- all in one place.

Expert analysis and key market insights keeping you informed on latest trends and opportunities in ETF's.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet