Top Rated Stocks | Losing Money Won't Make You A Fool Today, But Ignoring These Stocks Will

As Wall Street recovers from another rollercoaster week—where even the bulls seemed to question their optimism—investors might wonder if the market's recent stumble was just an elaborate April Fools' prank. But behind the volatility lie opportunities sharper than a jester's wit. While some sectors wobbled, a select few companies have quietly fortified their foundations, blending resilience with growth potential. In our view, these companies are where the real treats might hide.

HERE ARE OUR PICKS FOR THIS WEEK!

----------------------------------------------------------

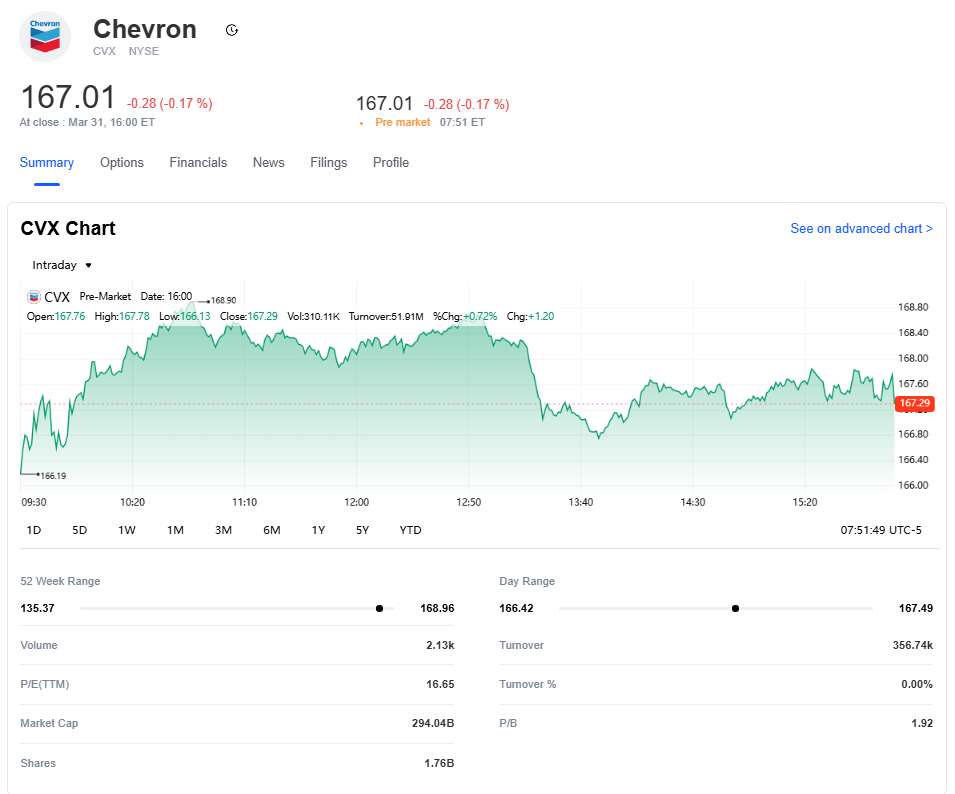

Chevron Corporation (CVX): Fueling Progress with Energy Solutions

Current Share Price: $167.01

Market Capitalization: $294.04B

Median Target Price: $185.00

Recommendation: Buy

Chevron Corporation (CVX) is a globally recognized energy giant known for its extensive operations in oil, gas, and renewable energy. Committed to innovation and sustainability, ChevronCVX-- is at the forefront of addressing global energy needs.

Financially, Chevron showcases robust health. The company reports a total revenue of $143.58 billion, reflecting strong demand and market presence. This substantial revenue is complemented by impressive earnings, with an EPS of 11.21, indicating high profitability and efficient operations.

Chevron's operational efficiency is further highlighted by an operating margin of 17.58% and an EBITDA margin of 22.45%, demonstrating adept management of costs and optimizing earnings before interest, taxes, depreciation, and amortization. The company's return on equity (ROE) stands at an impressive 18.76%, signifying the effective use of shareholders' equity to generate profits.

Liquidity remains a strong suit for Chevron, with $6.8 billion in total cash reserves and an operating cash flow of $29.4 billion. This substantial liquidity ensures Chevron is well-equipped to meet short-term obligations and invest in future growth initiatives.

Despite leveraging a total debt of $31.4 billion, Chevron maintains a balanced approach with a manageable debt-to-equity ratio, underscoring stable financial management. The company's strategic investments in renewable energy and technological advancements position it as a future leader in sustainable energy solutions.

Analysts express positive sentiment toward Chevron, with a Buy recommendation and mean price targets ranging from $165.00 to $200.00, with a median target at $185.00. This optimistic outlook is driven by Chevron's strategic investments in renewable energy and commitment to sustainability, promising substantial growth potential.

Overall, Chevron CorporationCVX-- represents a compelling investment opportunity in the energy sector. With sustained revenue growth, efficient cost management, and promising innovations in renewable energy, Chevron is well-positioned for long-term success. Investors looking to capitalize on energy solutions will find Chevron a valuable addition to their portfolio.

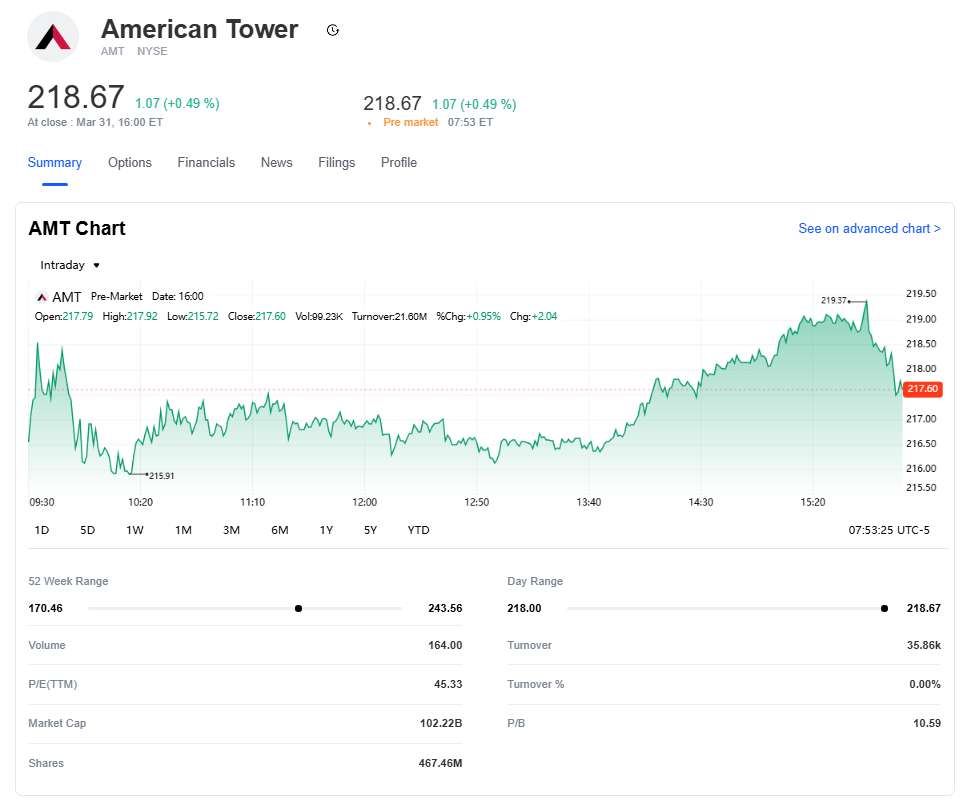

American Tower Corporation (AMT): Scaling Heights in Telecommunications

Current Share Price: $218.67

Market Capitalization: $102.22B

Median Target Price: $235.00

Recommendation: Buy

American Tower Corporation (AMT) stands as a global leader in the telecommunications infrastructure sector, owning and operating wireless and broadcast communications towers. This company's extensive portfolio spans across several continents, facilitating robust connectivity and driving digital transformation.

From a financial perspective, American Tower exhibits strong fiscal health. The company reports substantial total revenue of $9.34 billion, reflecting consistent demand and expansive market presence. This revenue is complemented by significant earnings per share (EPS) of 8.12, showcasing high profitability and effective operations.

Operational efficiency is evident with American Tower's operating margin standing at 38.22% and an EBITDA margin of 60.45%. These metrics highlight the company's adept management of costs and superior earnings before interest, taxes, depreciation, and amortization. Additionally, AMT's return on equity (ROE) of 29.47% underscores the efficient utilization of shareholders' equity to generate substantial profits.

Liquidity remains a potent asset for American Tower, marked by a healthy operating cash flow of $4.65 billion. This considerable liquidity ensures the company is well-equipped to meet short-term obligations and invest in future growth initiatives.

Despite leveraging a total debt of $25.54 billion, American Tower maintains a balanced approach with a manageable debt-to-equity ratio, evidencing stable financial management. The company's strategic acquisitions and expansion initiatives further strengthen its market position, fostering long-term growth potential.

Analysts express positive sentiment toward American Tower, with a Buy recommendation and price targets ranging from $215.00 to $260.00, with a median target of $235.00. This optimistic outlook is driven by AMT's strategic emphasis on expanding its infrastructure portfolio and enhancing connectivity services, promising substantial growth potential.

In conclusion, American Tower Corporation represents an attractive investment opportunity in the telecommunications infrastructure sector. With sustained revenue growth, efficient cost management, and promising expansion initiatives, AMT is well-positioned for long-term success. Investors seeking exposure to telecommunications infrastructure will find American Tower a valuable addition to their portfolio.

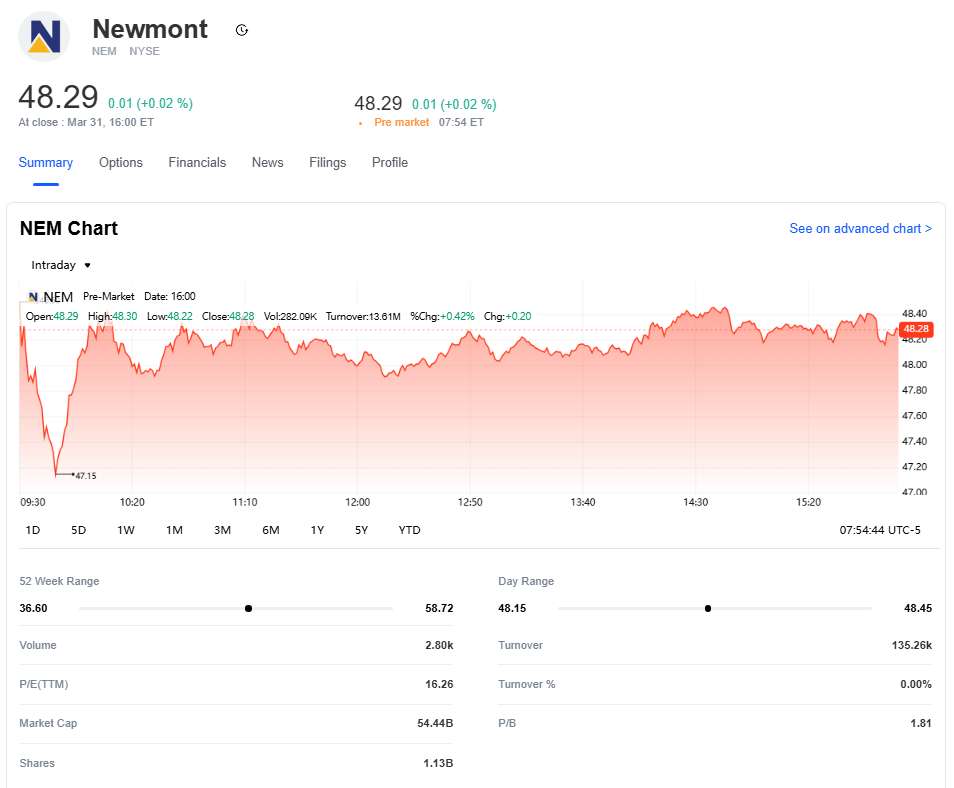

Newmont Corporation (NEM): Pioneering Sustainability in Mining

Current Share Price: $48.29

Market Capitalization: $54.44B

Median Target Price: $56.00

Recommendation: Buy

Newmont Corporation (NEM) stands as a global leader in gold and copper production, with a strong presence across multiple continents. Renowned for its commitment to sustainability, Newmont continues to set benchmarks in mining efficiency and ecological responsibility.

Financial analysis reveals Newmont's robust fiscal health. The company reports a total revenue of $18.68 billion, reflecting substantial market demand and production capacity. This revenue is bolstered by a healthy gross profit margin, signifying effective cost management and operational efficiency.

Profitability metrics indicate Newmont's strong performance, with an earnings per share (EPS) of 2.09 and a return on equity (ROE) of 11.17%. These figures emphasize the company's capacity to generate significant returns for shareholders and maintain profitable operations.

Operational efficiency is further evidenced by Newmont's revenue per share, standing at $16.30, and an EBITDA margin that calls attention to the company's adept management of earnings before interest, taxes, depreciation, and amortization. The mining giant also enjoys considerable liquidity, marked by a total cash position of $5.14 billion, ensuring readiness to address short-term obligations and invest in future ventures.

Newmont's strategic emphasis on sustainability and innovation in mining technologies positions it as a frontrunner in ecological responsibility. The company's investments in reducing environmental impact and enhancing community engagement underline its commitment to sustainable practices.

Analysts maintain an optimistic outlook towards Newmont, with a Buy recommendation and price targets ranging from $50.00 to $65.00. The median target stands at $56.00, reflecting strong confidence in Newmont's future growth potential, driven by its pioneering efforts in sustainability and consistent production efficiency.

In summary, Newmont Corporation is an attractive investment within the mining sector, offering sustainable growth prospects and robust financial health. Investors seeking exposure to environmentally responsible mining operations will find Newmont a valuable addition to their investment portfolio.

Independent investment research powered by a team of market strategists with 20+ years of Wall Street and global macro experience. We uncover high-conviction opportunities across equities, metals, and options through disciplined, data-driven analysis.

Latest Articles

Unlock Market-Moving Insights.

Subscribe to PRO Articles.

Already have an account? Sign in

Unlock Market-Moving Insights.

Subscribe to PRO Articles.

Already have an account? Sign in

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.