Top Rated Stock | Dread It, Or Run From It, Will Make You Regret Missing These Chances

In a pessimistic market, it's easy to panic and get frustrated. However, it's also easy to find undervalued assets. This week, we won't tell you where the safest place to put your money is, but we will show you where you could make the biggest profit after all these sell-off dramas are over.

HERE ARE OUR PICKS FOR THIS WEEK!

----------------------------------------------------------

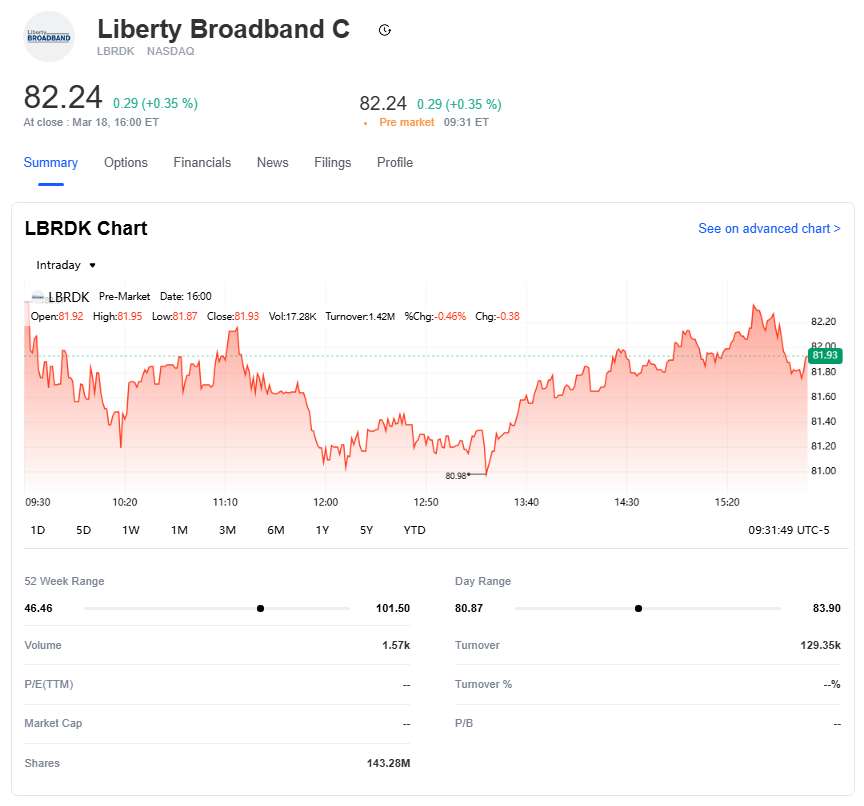

Liberty Broadband Corp (LBRDK): Expanding with Broadband Connectivity

Current Share Price: $82.24

Median Target Price: $88.00

Recommendation: Hold

Liberty Broadband Corp (LBRDK) is an emerging leader in the broadband communications industry, playing a crucial role in advancing internet connectivity across various markets.

From a fiscal perspective, Liberty BroadbandLBRDK-- demonstrates substantial growth and resilience. The company's total revenue stands at $1.02 billion, reflecting a modest revenue growth of 5.2%. Complementing this revenue are gross profits amounting to $759 million, indicating a robust gross margin of 74.71%. The EBITDA margin is strong at 29.43%, with an EBITDA of $299 million, showcasing the company's efficiency in managing its operating costs.

Liberty Broadband's profitability metrics are impressive, especially the profit margin which stands at an exceptional 85.53%. This underscores the company's ability to retain a significant portion of its earnings post-expenses. However, the operating margin is somewhat lower at 4.94%, suggesting room for improvement in operational efficiency. The return on assets (ROA) is low at 0.36%, while the return on equity (ROE) is a more promising 9.23%, indicating effective use of equity to generate returns.

In terms of liquidity, Liberty Broadband has $163 million in cash reserves ($1.14 per share) and an operating cash flow of $104 million. Despite these strengths, the company's free cash flow is negative at -$44.75 million. The company also has significant total debt amounting to $4.14 billion, resulting in a debt-to-equity ratio of 42.19%. Yet, with a quick ratio of 1.79 and a current ratio of 2.12, Liberty Broadband is well-positioned to manage its short-term obligations.

Analysts generally have a Hold rating for Liberty Broadband, with mean price targets ranging from $75.00 to $130.00, and a median target at $88.00. Though the outlook is positive, indicating growth potential, some caution is advised due to the negative free cash flow and modest operating margins.

In summary, Liberty Broadband Corp is a promising investment within the broadband communications sector. With its strong revenue growth, efficient management of costs, and substantial market presence, the company is poised for long-term growth, although investors should be mindful of its operational and liquidity challenges.

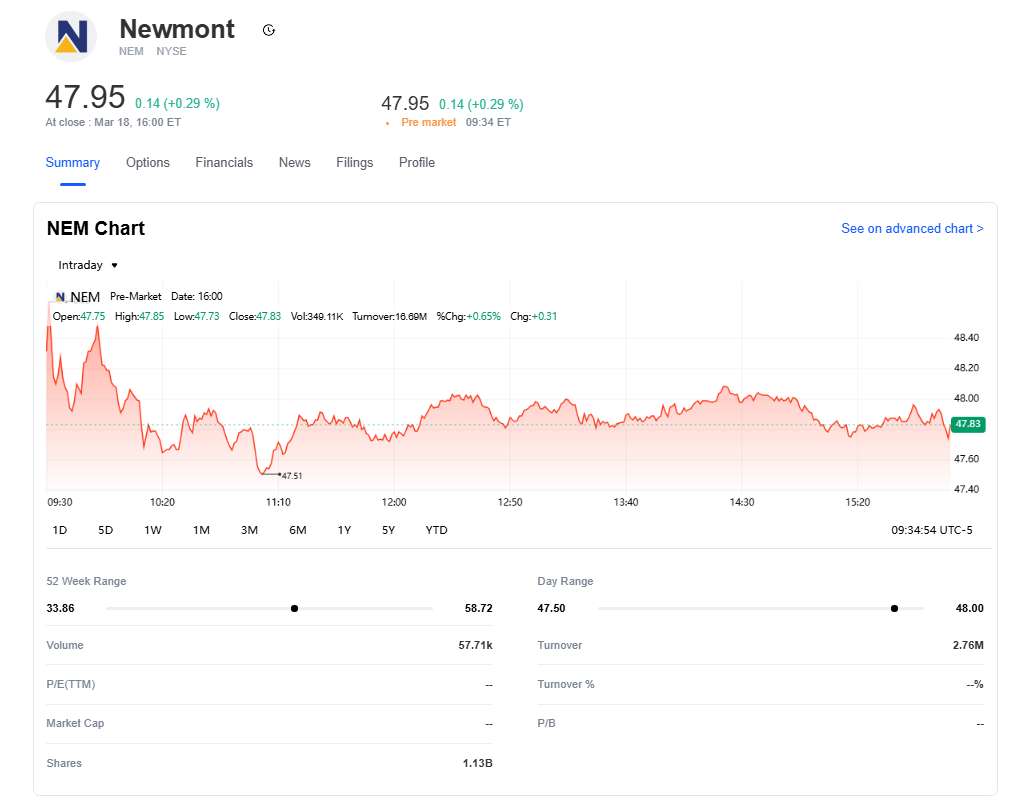

Newmont Corporation (NEM): Securing Value in Gold Mining

Current Share Price: $47.95

Median Target Price: $52.50

Recommendation: Buy

Newmont Corporation (NEM) stands as a powerful entity in the gold mining sector, boasting a significant global footprint that ensures it remains a key player in the supply of this precious metal.

Key financial metrics highlight Newmont's robust fiscal health. The company's revenue has surged to an impressive $18.68 billion, showcasing a robust year-on-year growth of 42.8%. This revenue growth is complemented by substantial gross profits amounting to $9.39 billion, yielding a gross margin of 50.27%. These figures are a testament to Newmont's operational efficiency and its ability to effectively manage its cost structure.

From a profitability standpoint, Newmont exhibits strong metrics, including an operating margin of 40.85% and an EBITDA margin of 46.71%. This high level of profitability underscores Newmont's operational proficiency and its ability to generate significant earnings before interest, taxes, depreciation, and amortization.

The company also demonstrates commendable liquidity, with total cash reserves of $3.64 billion ($3.21 per share) and a solid operating cash flow of $6.36 billion. However, it is noteworthy that Newmont maintains a significant debt load, with total debt standing at $8.97 billion, resulting in a debt-to-equity ratio of 29.80%. Despite this, the company's strong cash flow positions it well to manage its debt obligations effectively.

Profitability indicators are also positive, with a return on assets (ROA) of 6.61% and a return on equity (ROE) of 11.17%. These figures highlight Newmont's efficiency in utilizing its assets and equity to generate profits. Further, the profit margin of 17.92% reinforces the company's strong profitability outlook.

Analysts are optimistic about Newmont's future, assigning a Buy rating with a mean recommendation score of 1.95. Price targets for the stock range from $45.00 to $65.43, with the median target standing at $52.50. This optimistic outlook suggests that Newmont is well-positioned to continue its upward trajectory amidst market volatility.

In conclusion, Newmont Corporation presents a compelling investment opportunity in the gold mining sector, supported by its robust financial performance, efficient operations, and significant market position. For investors looking to gain exposure to precious metals, Newmont offers stability and potential for substantial returns.

Independent investment research powered by a team of market strategists with 20+ years of Wall Street and global macro experience. We uncover high-conviction opportunities across equities, metals, and options through disciplined, data-driven analysis.

Latest Articles

Unlock Market-Moving Insights.

Subscribe to PRO Articles.

Already have an account? Sign in

Unlock Market-Moving Insights.

Subscribe to PRO Articles.

Already have an account? Sign in

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.