TLT: A Potential Investment Gem Amidst Changing Interest Rate Dynamics

Key Observations:$TLT(TLT)TLT--

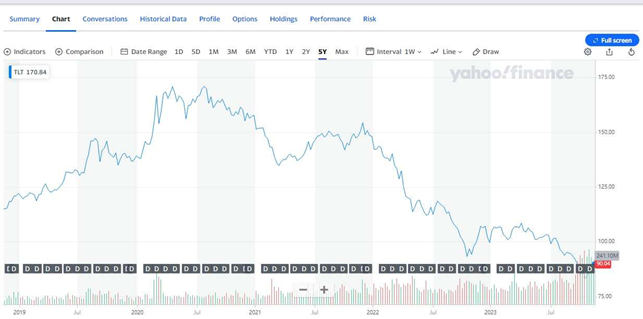

Bond Market Downturn: Over the past three years, the iShares 20+ Year Treasury Bond ETF has seen a notable decrease in value, plummeting from 166 to 89.

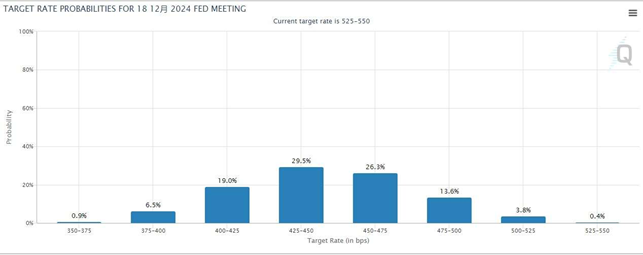

CPI Data and Interest Rates: Recent cooling in the Consumer Price Index (CPI) suggests a potential peak in interest rates. CME Group's FedWatch gauge points toward a full percentage point of interest rate cuts by the end of 2024.

Historical Insights: Drawing from historical trends, the opportune time to invest in bonds often coincides with the conclusion of the interest rate hike cycle.

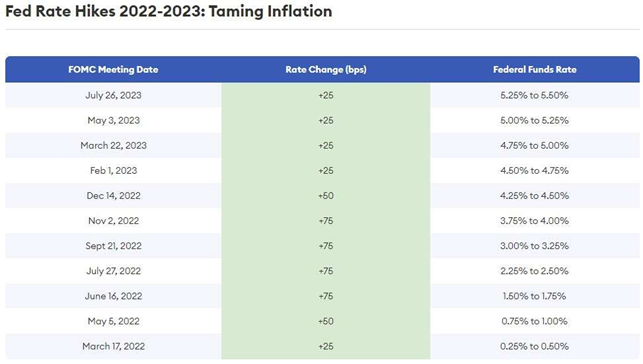

The Federal Reserve's Actions:The Federal Reserve's most recent rate hike, the seventh consecutive increase in 2022, has raised the benchmark rate 11 times to address inflation concerns. With the federal funds target rate now between 5.25% and 5.50%, the impact on the economy is evident.

Forbes reports that the high-interest rates have influenced U.S. consumer prices, which remained unchanged in October. The annual rise in underlying inflation was the smallest in two years, signaling a potential conclusion to the Federal Reserve's interest rate hikes. CME Group's FedWatch gauge reinforces this, pointing to a full percentage point of cuts by the end of 2024.

Impact on TLT:Under the influence of interest rate hikes, the iShares 20+ Year Treasury Bond ETF has experienced a significant decline, dropping over 50% from its peak. Notably, TLT's price has never witnessed three consecutive years of decline over the past two decades.

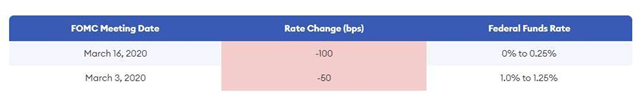

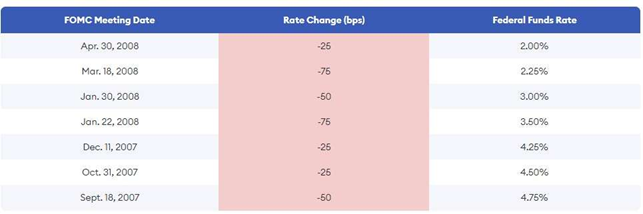

Interest Rate Cut Cycle:Analyzing past cases reveals that once interest rates begin to fall, the decline process is swift. The COVID-19 pandemic in 2020 prompted unscheduled emergency meetings where the Federal Open Market Committee (FOMC) delivered substantial rate cuts, returning the federal funds target rate range to zero to 0.25%. Similar actions occurred in response to the 2005-2006 rate hike campaign, with rates slashed by 2.75 percentage points in less than a year starting September 2007.

TLT's Position:As a fixed income ETF, TLT represents an expression of views on 20-year rates through its holdings of treasuries. The belief is that the cycle top in long rates has been reached, and the trajectory for 20-year treasury yields involves an uneven move towards 4%. In such a scenario, investing in TLT is anticipated to yield significant returns.

Conclusion:The current scenario of approximately 5% interest rates on the long end of the U.S. Treasury curve presents an attractive risk-reward opportunity. Risk assets, such as stocks, are less sensitive to rates below 5%, but rates exceeding this threshold can significantly impact their prices. With a risk-free rate above 5%, TLT emerges as a compelling choice for individual traders seeking stability in a shifting interest rate environment, offering potential for substantial returns.

Professional quant trader.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet