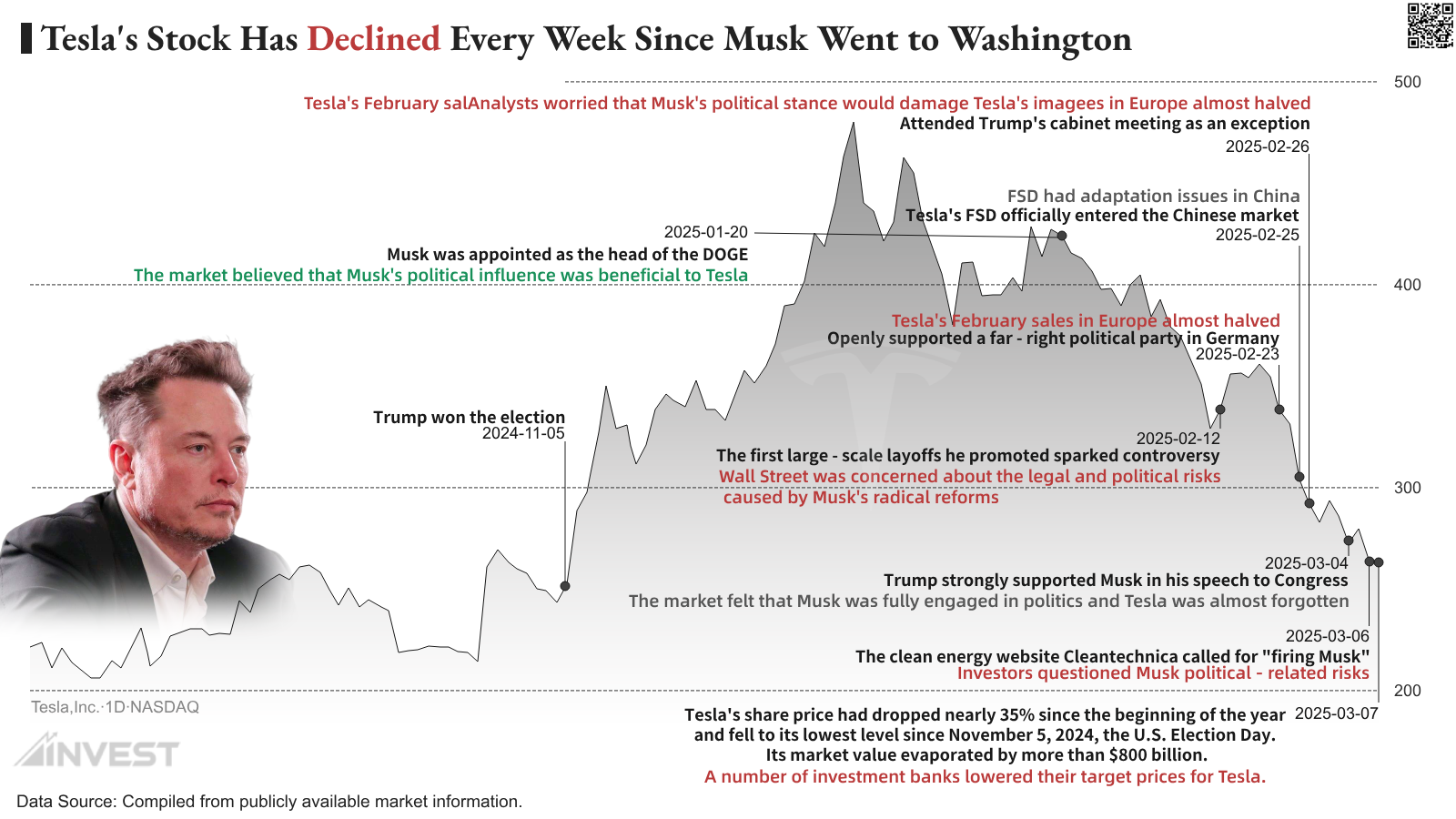

Tesla's Stock Has Declined Every Week Since Musk Went to Washington

Ever since Trump won the election, Musk, who has been serving loyally, has successfully entered the political arena. Tesla's share price also soared, reaching an all - time high in December last year.

However, the good times didn't last long. Musk, who was obsessed with the political scene and even made rash comments on other countries' affairs, eventually faced the consequences. As of last Friday's close, Tesla's stock has been in decline for seven consecutive weeks, setting the longest losing streak on a weekly basis since its listing. It has almost erased all the gains since the election on November 5 last year, and its market value has evaporated by more than $800 billion.

Last week, several investment banks lowered their target prices for TeslaTSLA--. Bank of AmericaBAC-- reduced its target price from $490 to $380, citing a decline in Tesla's new car sales and Musk's failure to announce the latest progress on the low - cost model.

Goldman Sachs also cut its target price from $345 to $320, pointing out that Tesla's electric vehicle sales declined in Europe, China, and some parts of the US market in the first two months of this year.

Baird included Tesla in its bearish fresh picks list and noted that production stoppages could affect Tesla's supply chain as the company is adjusting to the new production of the Model Y SUV.

Notably, Wall Street is assessing how much impact Musk's political stance and his work at the White House will have on Tesla, and how long this impact will last.

Admittedly, Musk is still a favorite of Trump and a representative figure in the government's efforts to reduce the size, budget, and functions of the federal government. However, his radical political remarks, even those that cross the line, have drawn protests from the public. In the United States and Europe, anti - Musk and anti - Tesla sentiment has been on the rise. A series of protests have broken out outside Tesla factories, and there have even been suspected arson and vandalism incidents.

Musk's political stance has clearly put pressure on Tesla's share price, and Tesla's brand influence and investors' confidence have been damaged. Whether Musk will ignore it and have other plans, or try to restore investors' and the market's confidence in a timely manner remains unknown for now.

But Tesla's investors should understand one thing: dealing with Musk is like being on a roller - coaster. Share price fluctuations are common, and it's always hard to predict what astonishing move Musk will make next. As Dan Ives, an analyst at Wedbush and a long - term bull on Tesla, said, this is a testing moment for Tesla.

However, if too many short - term uncertainties converge, risk aversion may be the best option.

Turning market noise into visual signal.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet