Tariff Shockwave Slams Small Business: We're Bleeding!

Many small businesses don't have the same range of options or ability to navigate a trade war that America's biggest companies do.

President Trump said his tariff measures may cause a little turbulence for the economy. But for small businesses like Quake City Casuals, the impact has already struck like a thunderbolt.

This Los Angeles–based hat retailer took preemptive steps before the 10% tariff on Chinese imports came into effect in February. The company absorbed about half the cost increase and stockpiled $500,000 worth of inventory.

However, these measures failed to prevent a 40% drop in sales this year. Quake City's end customers—companies that order custom hats and beanies through distributors for promotional use—have delayed their orders due to tariff concerns. Company President John Glucksman said that if the situation doesn't improve by the end of March, he'll be forced to lay off part of his 45-person workforce.

"There's only so much we can do to cut costs," Glucksman said. He's already reduced working hours for American employees doing screen printing and embroidery by 10% and scaled back on trade show participation.

Unlike large corporations, small and midsize enterprises (SMEs) lack a wide range of options to cope with a trade war. Most don't have large cash reserves, leverage to negotiate better deals with suppliers, or diverse product lines that can absorb cost increases through price hikes. Many are cutting spending, halting expansion plans, and some say layoffs are imminent.

Quake City has requested discounts from its Chinese manufacturing partners to offset the higher tariff costs and is still waiting for a response.

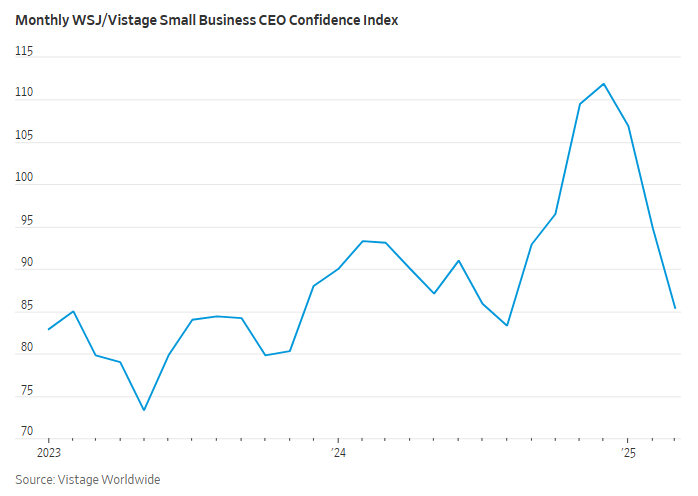

According to a survey by Vistage WorldwideVTGN-- conducted for the Wall Street Journal, small business confidence declined again in March after a sharp drop in February. More than 40% of respondents said current economic conditions are worse than a year ago, up from 22% in February. Those expecting improvements in the next 12 months dropped from 54% in January to 27%.

Tariffs are a major concern: nearly two-thirds of respondents said tariffs and other trade issues would hurt their business, while only 8% expected to benefit.

Some SMEs struggle just to understand the impact. At Candor Threads, a branded apparel supplier in Chicago with seven employees, two logistics staff are busy reviewing every customs invoice to calculate the additional costs from new tariffs. CEO Becky Feinberg-Galvez said, "We don't have a dedicated team that can work on this all day."

She added that her logistics team found that tariff levels vary depending on materials used. Until they fully determine the cost increase, they won't adjust prices.

The gloomy outlook is also affecting hiring plans. According to the National Federation of Independent Business (NFIB), February marked the second-highest level of uncertainty among small business owners in its 51-year survey history, topped only by October before the U.S. presidential election.

NFIB data shows that only 15% of small business owners planned to add jobs in the next three months—down three percentage points from January. These companies typically have fewer than 500 employees but account for nearly 46% of U.S. private-sector jobs.

Pulsar Products, a Cleveland-based supplier of stationery, novelty items, and souvenirs with 36 employees, had planned to hire six more staff this year, including four designers to develop new notebook patterns. However, due to tariffs on Chinese imports, the company cut back on expanding its product lines, shelving those hiring plans.

Through supply chain shifts, Pulsar has reduced reliance on China. Two years ago, Chinese suppliers made up 80% of sourcing; that has now dropped to 50%, with some procurement moved to Vietnam.

However, Pulsar said reshoring manufacturing to the U.S. is not feasible due to high labor costs and a lack of suitable partners. The company has started passing some of the tariff burden to customers. Sticker books and journals, currently priced at $4.95–$5.95, may see a $1–$2 increase. It's also actively seeking new partners in tariff-free markets like Australia and the U.K. Meanwhile, tighter cash flows have made the company more aggressive in collecting receivables.

Trump's tariff policy has indeed brought some manufacturing back to the U.S. Thomas Instrumentation, an electronics design and manufacturing firm in Cape May Court House, New Jersey, has seen its semiconductor import costs from China rise. However, CEO Cassandra Cummings said the company is now receiving three times more quote requests from potential clients seeking U.S.-based suppliers.

"These customers don't want to get dragged into the chaos," she said. Some are still in the exploratory phase, but a few inquiries have already converted into new orders. The company currently employs 14 people and serves other manufacturers and biopharmaceutical firms.

However, for other manufacturers, the Trump administration's constantly shifting tariff policies have meant paralysis.

Timberline Pallet, a custom pallet and packaging company in East Moline, Illinois, typically places weekly lumber orders. Earlier this month, anticipating tariffs on Canadian imports, timber prices surged, prompting the company to skip a week's order for fear of buying at a peak. CEO Michael Kelker said Timberline is a small firm that can't lock in bulk pricing or afford to stockpile. This week, he has notified customers of impending price hikes.

Lumitex, a medical lighting product manufacturer in Brecksville, Ohio, faces similar hurdles. CEO Peter Broer said that preparing for new tariffs and tracking policy changes has taken focus away from improving operations, developing new technologies, and exploring business opportunities. Lumitex currently employs 150 people.

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet