U.S. Stocks Rebound, Morgan Stanley Predicts Further Gains

U.S. stocks surged on Monday, with TeslaTSLA-- soaring 11% in a single day. Morgan StanleyMS-- equity strategist Michael Wilson attributes the rally to multiple factors.

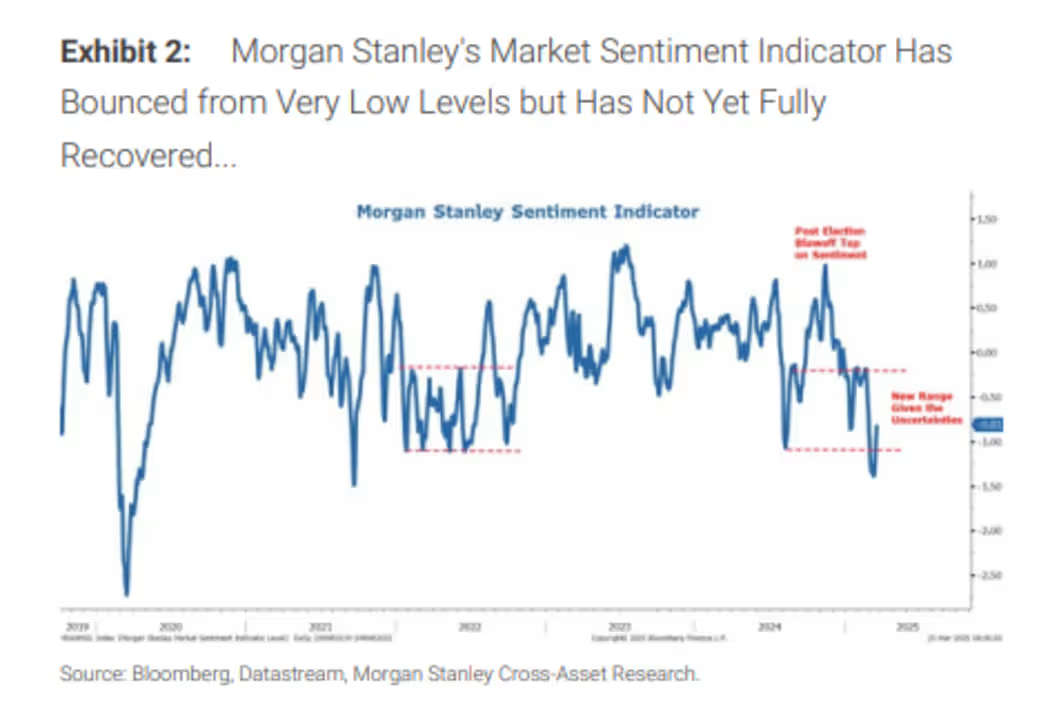

First, last week's market appeared oversold, as indicated by a sharp decline in the Relative Strength Index (RSI) and Morgan Stanley's proprietary market sentiment gauge, which reached what they describe as an "extreme low."

Investor positioning had turned increasingly bearish, which itself serves as a contrarian indicator. Additionally, seasonality trends are now more favorable for equities. Wilson also expects month-end and quarter-end investment flows to further support the stock market.

A weaker dollar and declining U.S. Treasury yields have also provided additional tailwinds. Wilson believes the Federal Reserve's dovish stance in last week's meeting has reinforced this trend.

Overall, these factors have helped the S&P 500 bounce back as it approached the lower bound of Wilson's projected first-half trading range of 5,500 to 6,100 points.

Can the Rally Continue?

Wilson describes the ongoing surge as a "tradeable rally," with market-favorite stocks regaining momentum. "As expected, low-quality, high-beta stocks are leading the charge, and this trend may persist in the short term," he noted. However, from a medium-term perspective, he continues to recommend holding high-quality stocks in core portfolios.

The next potential hurdle comes on April 2, when the Trump administration's reciprocal tariffs take effect. Wilson suggests that while this deadline may provide some clarity on tariff rates and affected countries or products, it is more likely the starting point for negotiations rather than a definitive resolution.

For now, Wilson argues that the "Fed put" offers stronger market support than any potential "Trump put." The "put" concept refers to the idea that policymakers—either the Fed or the White House—might intervene if markets fall below a certain threshold.

Multinationals to Benefit from a Weaker Dollar

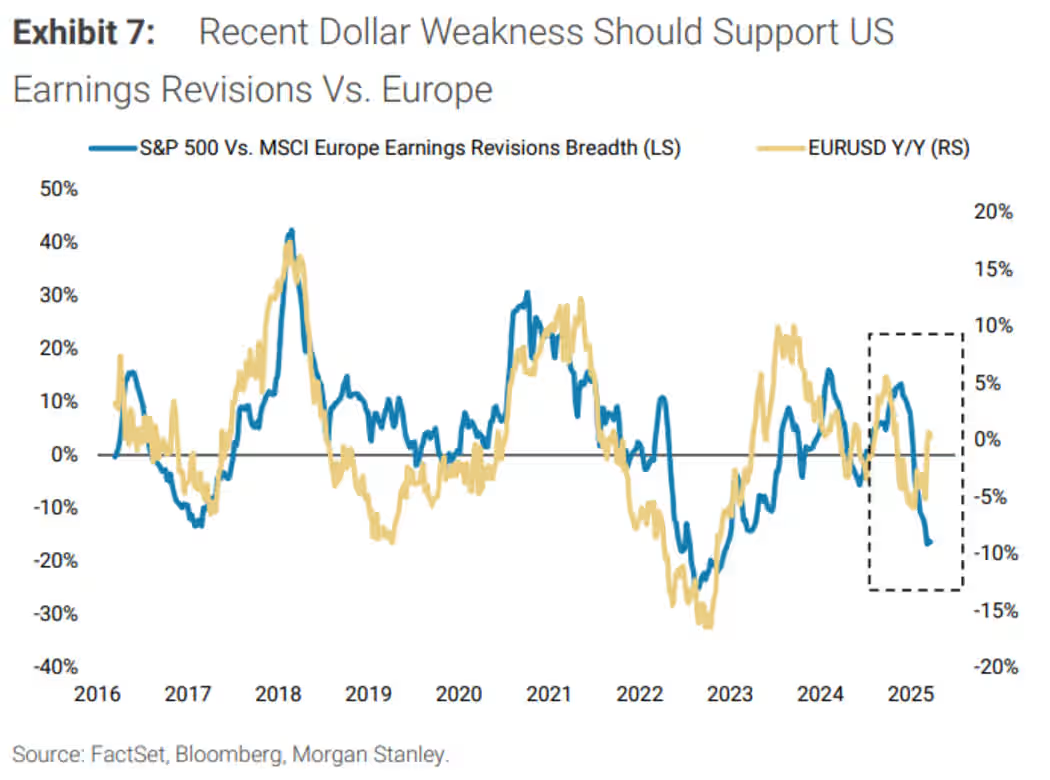

Multinational companies could benefit from a softer U.S. dollar, which might lead to upward revisions in earnings forecasts. As shown in recent data, this trend could broadly improve corporate profit expectations.

Morgan Stanley's team believes this dynamic is one reason why U.S. equities may regain their relative outperformance against other developed markets in the short to medium term.

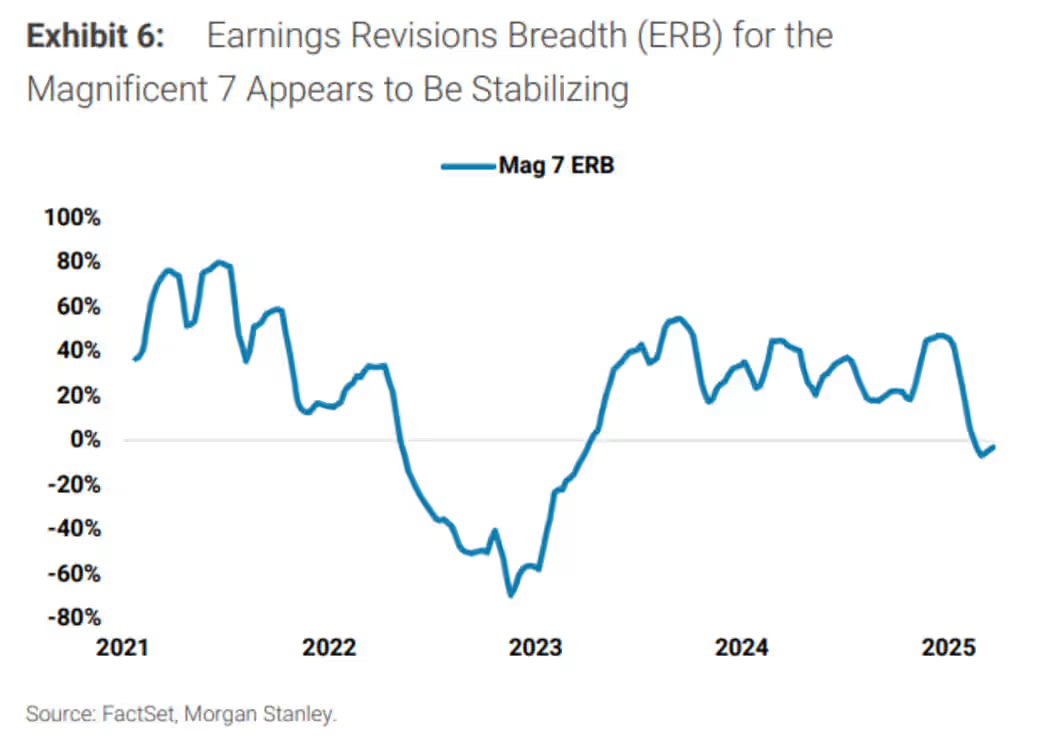

A key driver of the U.S. market's renewed strength could be the rebound of the Magnificent Seven, a group of high-performing tech giants that bore the brunt of recent sell-offs. With earnings estimates stabilizing and earnings season approaching, these market leaders may experience a short-term boost.

Sector Outlook: Cautious on Consumer Discretionary

Despite the overall optimism, Wilson's team remains cautious on consumer discretionary stocks due to concerns about slowing household spending and potential tariff impacts.

Fantastic stocks and where to find them

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet