STABLE Act Passed: US Regulates Stablecoins, Bans Interest Payments

The United States has passed the STABLE Act, a significant piece of legislation aimed at regulating USD stablecoins. This act is set to impact major players in the stablecoin market, including Tether and Circle, the issuer of USD Coin (USDC). The STABLE Act, which stands for Stablecoin Transparency and Accountability for a Better Ledger Economy, imposes strict regulations on stablecoin issuers, including requirements for reserve transparency and regular audits.

One of the key provisions of the STABLE Act is the prohibition on stablecoin issuers paying interest or yield to holders. This restriction is designed to prevent stablecoins from being classified as securities, which would subject them to additional regulatory scrutiny and compliance obligations. The act specifies that permitted issuers "may not pay interest or yield to holders" of the stablecoin, a clause that has drawn criticism from industry leaders.

Coinbase CEO Brian Armstrong has been vocal about his concerns regarding this provision. He argues that stablecoins should be able to pay interest to consumers, similar to traditional savings accounts. Armstrong believes that this would provide a fairer return for users, many of whom are currently earning minimal interest on their savings. He also suggests that banks and crypto companies should be able to offer interest-bearing stablecoins, a move that could make stablecoins more attractive to users.

The STABLE Act's passage comes at a time when stablecoins are becoming increasingly popular. These digital assets, which are backed 1-to-1 by the U.S. dollar, have traditionally served as a bridge between traditional financial systems and crypto markets. However, recent years have seen a rise in yield-bearing stablecoins, which offer users interest for simply holding them. This trend has been driven by exchanges and wallet operators, rather than the stablecoin issuers themselves.

The STABLE Act's impact on the stablecoin market is expected to be significant. Traditional stablecoin issuers like Tether and Circle may face challenges in maintaining their current business models, as the act's restrictions on interest payments could reduce their revenues. However, the act also provides a framework for stablecoin regulation, which could help to build trust and stability in the market.

The passage of the STABLE Act is a major development in the regulation of stablecoins in the United States. It represents a significant step towards greater transparency and accountability in the stablecoin market, while also imposing restrictions that could impact the business models of major players. As the stablecoin market continues to evolve, the STABLE Act is likely to play a crucial role in shaping its future.

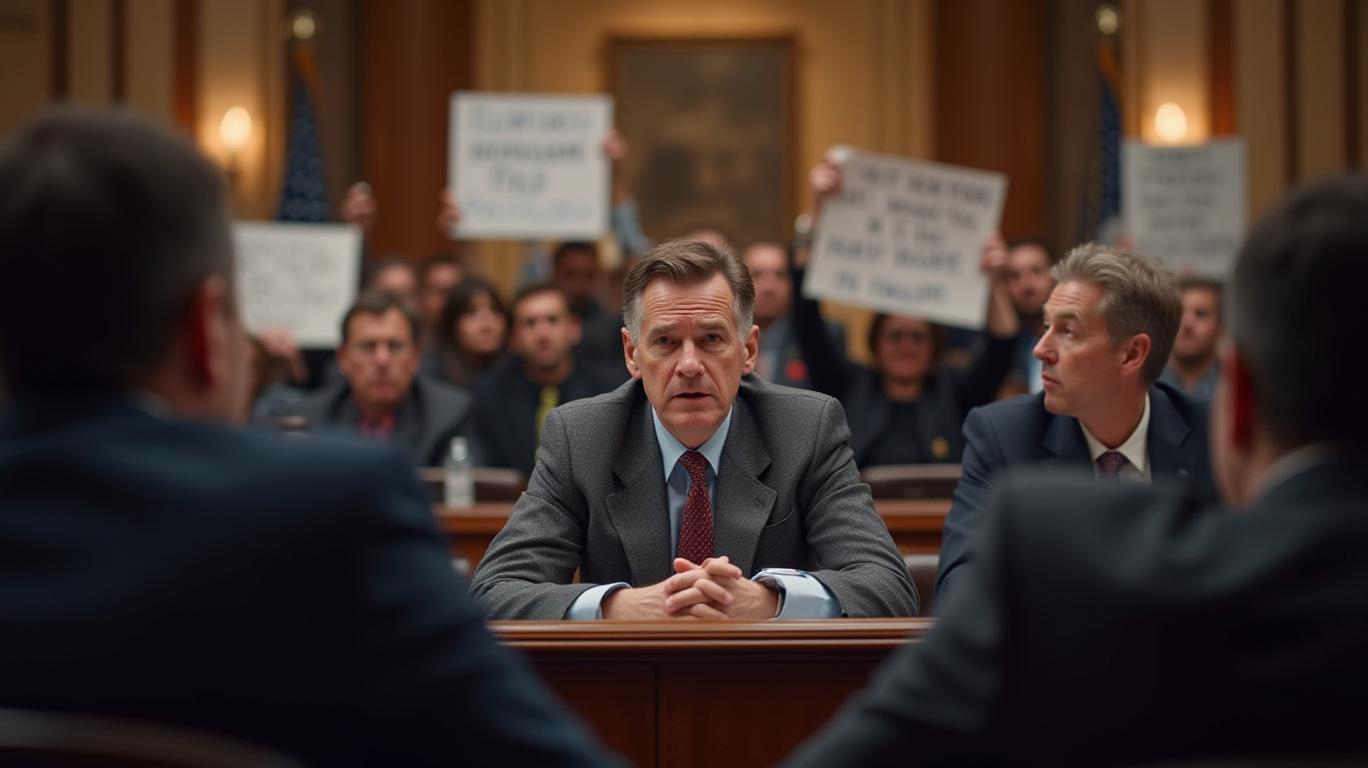

After a 13-hour-long discussion, the Financial Services Committee Chair Rep. French Hill and Subcommittee Chair Rep. Bryan Steil announced their decision to pass the much-awaited stablecoin legislation. The STABLE Act seeks to provide a comprehensive regulation for stablecoin payments to function freely in the US financial system. It would create a regulatory framework specifically designed for USD-pegged stablecoins while maintaining an effective balance between technological innovation and consumer protection. Key provisions of the STABLE Act include establishing a formal regulatory structure for payment stablecoins, creating strong consumer safeguards while allowing for continued innovation, positioning the United States to maintain leadership in digital asset development, providing clear regulatory parameters for industry participants, and modernizing the U.S. payment infrastructure.

Previously, US President Donald Trump stated that stablecoins are important to the US economy and would help maintain the dominance of the US Dollar in the global market. Speaking on the development, Congressman Dan Meuser stated: “The STABLE Act reinforces the U.S. dollar’s status as the world’s reserve currency by ensuring stablecoins operate within a secure, dollar-backed framework, in America. It will make payments faster, cheaper, and more accessible, reducing costs to the benefit of businesses and consumers alike”.

Quickly understand the history and background of various well-known coins

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet