Smart Money Moves: Insiders Buy the Dip

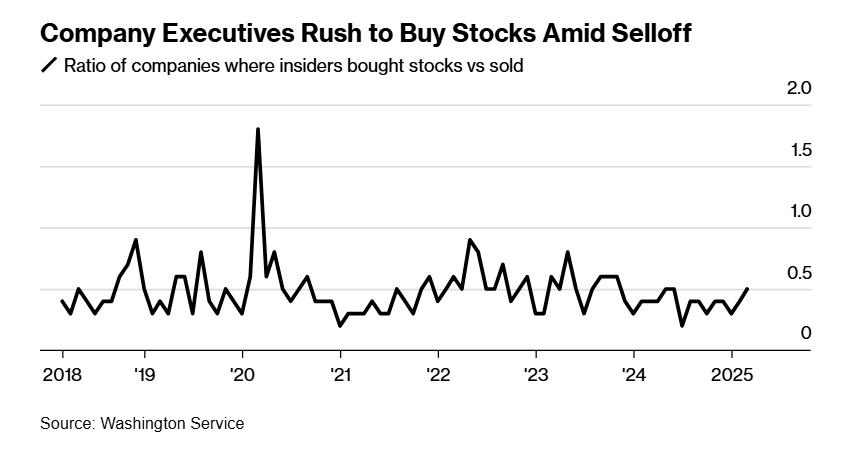

As U.S. equities enter a correction phase, investors are looking for signs of a potential bottom. One key indicator: corporate insiders, often referred to as smart money, are stepping up their stock purchases.

Data from the Washington Service shows that the insider sentiment ratio—measuring the number of buyers versus sellers—rose to 0.46 in March, up from 0.31 in January. With two weeks left in the month, this puts the ratio on track for its highest level since June and close to its historical average.

Among the notable buyers, ModernaMRNA-- Inc. CEO Stéphane Bancel acquired $5 million worth of shares in March. Directors at American ExpressAXP-- and Marathon PetroleumMPC-- also took advantage of the selloff to increase their holdings.

While insider buying can be influenced by various factors beyond market performance, when executives with deep knowledge of their businesses start accumulating shares, it often signals confidence in their companies and a belief that the market may be near a bottom.

If we see corporate insiders begin to use the opportunity in their stock prices to purchase shares, that shows that they have confidence in the underlying economy and in their underlying businesses, said DaveDAVE-- Mazza, CEO of Roundhill Investments. That differs from just the headlines, because the headlines are scary.

The last time insider buying reached similar levels was in mid-2024 when the S&P 500 surged to record highs, fueled by strong corporate earnings, a booming economy, and expectations of Fed rate cuts.

Companies Ramp Up Stock Buybacks

Insider buying is just one piece of the puzzle for assessing market direction. Another critical factor is corporate stock buybacks, a major source of demand for equities.

According to Birinyi Associates, announced stock buybacks in 2025 have already reached $298 billion, making it the third-highest level in history. However, buybacks have slowed significantly in March, partly due to uncertainty surrounding the Trump administration's tariff policies.

Despite these concerns, seasonality is favoring the bulls. Historical data from SentimentTrader suggests that the S&P 500 is entering one of its most reliable seasonal uptrends. Since 1953, the index has gained an average of 3.9% during this period, with a 70% probability of positive returns.

For 2025, this bullish window spans from March 14 to April 22, giving investors another reason to watch the market closely.

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet