Senator Warren Accuses Trump Tariffs of Causing Market Volatility, Calls for Probe

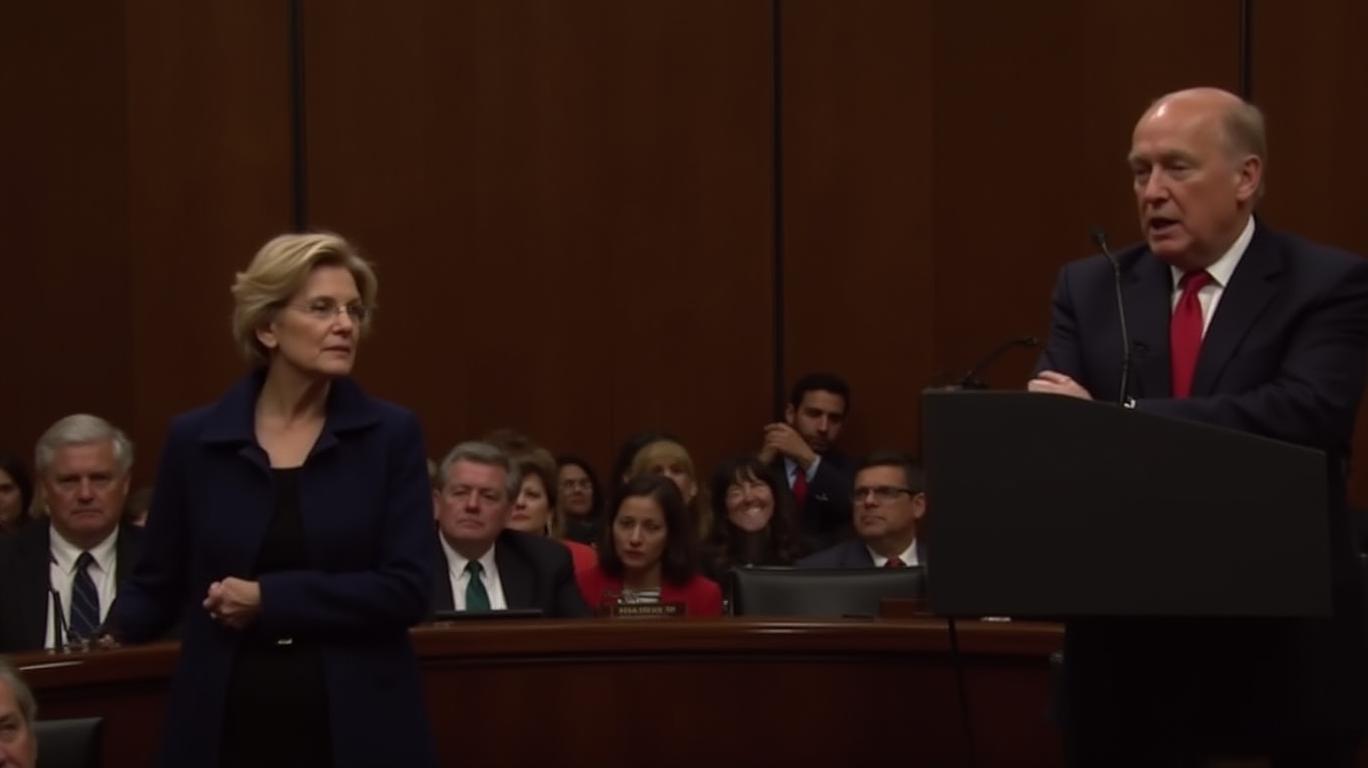

Senator Elizabeth Warren has launched a scathing attack on Donald Trump's tariff policies, accusing him of manipulating markets to benefit his wealthy associates. In a Senate address on April 10, Warren demanded an investigation into Trump's erratic tariff measures, which she claims were designed to favor insiders while disrupting global markets and extending volatility into the crypto market. Warren's allegations center on Trump's sudden increases in tariffs on China, followed by temporary delays, which she argues created favorable conditions for Wall Street insiders and billionaire allies at the expense of the U.S. economy.

Warren highlighted the ripple effect of Trump's tariff decisions on the crypto market, noting that the volatility caused by an uncertain economy could exacerbate the already volatile nature of digital assets. She claimed that Trump's actions sometimes allowed insiders to buy before the markets crashed, raising questions about potential conflicts of interest and insider trading. Warren also criticized Trump's secretive approach to policy-making, which she said has aggravated fears of inflation and recession. She urged Congress to intervene and prevent further tariff chaos, asserting that American businesses and consumers are suffering as a result.

Warren's call for an independent investigation into Trump's tariffs could reshape U.S. trade and economic strategy. Her allegations of market manipulation and corruption underscore the need for greater transparency in tariff implementation, as these effects ripple across global markets and the crypto sector. Congress could act on Warren's lead to remove economic uncertainty and restore investor confidence. Failure to do so could invite further inflation, long-term recession risks, and market volatility, particularly in sensitive sectors like crypto. Warren's critique underscores the broader debate about Trump's tariffs as strategic levers rather than political tools, with implications extending beyond trade relations and consumer prices into corporate accountability. This would require bipartisan reform and oversight to prevent further economic disruption and ensure tariffs serve national interests rather than special ones.

Warren has also called for a thorough investigation into Trump's decision to pause tariffs for 90 days, suggesting potential ulterior motives. She described the current trade war as "the dumbest trade war in history," emphasizing the economic turmoil and market volatility it has caused. Warren's comments were made during an interview, where she stressed the need for bipartisan action to address the crisis. She urged Republicans to join Democrats in Congress to end what she describes as the "sabotage" caused by Trump's tariff policies, believing that a bipartisan resolution is necessary to stabilize the market and prevent further economic damage. Warren's warnings about the potential fallout in the cryptocurrency market are particularly noteworthy, as the sector's volatility could be exacerbated by the uncertainty caused by Trump's tariff policies. Her concerns highlight the interconnected nature of global markets and the potential for tariff policies to have far-reaching effects.

Warren's broader effort to hold the administration accountable for its economic decisions includes her vocal criticism of Trump's trade policies, which she argues are harmful to both the U.S. economy and global markets. Her calls for a probe into the tariff pause and for bipartisan action to address the crisis reflect her commitment to economic stability and her belief in the importance of bipartisan cooperation. In summary, Senator Elizabeth Warren has criticized President Trump's tariff policies, warning of potential market fallout, particularly in the cryptocurrency sector. She has called for a probe into the tariff pause and urged Republicans to join Democrats in Congress to address the crisis. Warren's criticism highlights the economic turmoil caused by Trump's tariff policies and the need for bipartisan action to stabilize the market.

Quickly understand the history and background of various well-known coins

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet