Same As Burry, Ray Dalio's Bridgewater Is Also Betting Against U.S. Stocks and Bonds

It looks like Ray Dalio has the same opinion as Michael Burry: According to a recently released report, in late July, Bridgewater's flagship fund, Pure Alpha, took a "moderate" short position on U.S. stocks and U.S. bonds.

In fact, The fund held a bearish stance on 15 out of the 28 assets it analyzed, including the U.S. dollar, U.S. stocks and treasuries, as well as several stocks in the global market.

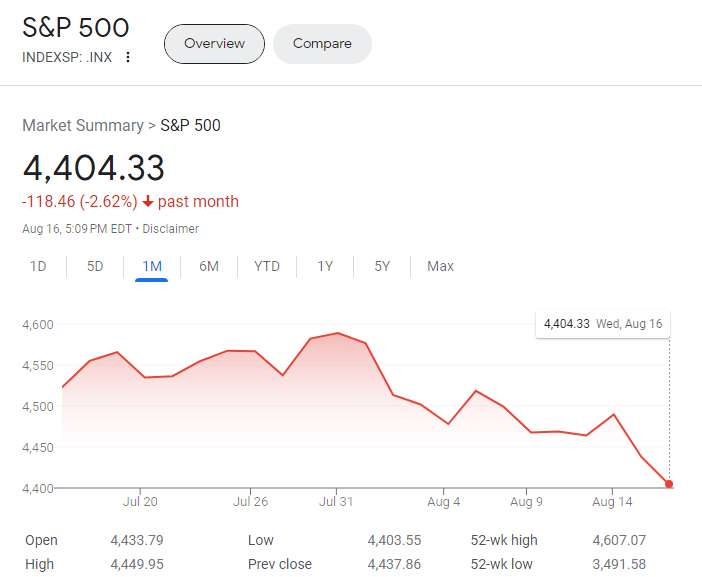

For the U.S. stock market, since the start of the year, thanks to unexpected resilience in the U.S. economy and receding inflation, U.S. stocks have been on a strong upward trajectory. The S&P 500 Index soared by more than 20% at one point within the year, while the NASDAQ 100 surged by over 45%. The significant rally in early to mid-July forced many hedge funds to abandon their short positions.

However, it eventually turns out that Bridgewater's judgment on U.S. stocks and bonds appears quite accurate. The NASDAQ 100 has dropped approximately 6% from its yearly high on July 19, and the S&P 500 Index has fallen roughly 4% from its yearly peak on July 27.

Meanwhile, as for U.S. treasuries, yields on 10-Year Treasuries, which move inversely to bond prices, just reached 4.29% and marked its peak since October 24.Bridgewater's co-CIO, Greg Jensen, even stated in a podcast on the firm's website this month that as the U.S. Treasury increases bond issuance, liquidity in the U.S. bond market is deteriorating. The rise in the volume of U.S. bond issuance might depress asset prices.

Bridgewater manages assets worth $125 billion and predicts macroeconomic trends to place bets on the movements of various assets. Bridgewater declined to comment on recent media reports. In fact, Bridgewater typically keeps its in-depth views on assets confidential.

However, it is worth noting that some media sources, citing insiders, revealed that Bridgewater's Pure Alpha 12% volatility fund yielded a return of 2.5% for the year up to August 11, while its average annual net total return since 1991 is 7.7%. In contrast, its defensive Alpha fund, less reliant on the stock market, also grew by only 2.1%.

Nonetheless, Bridgewater’s performance still beats most of the macro hedge funds, as the latest data from Hedge Fund Research (HFR) shows that during the U.S. banking crisis in March this year, macro hedge funds generally made incorrect bets, leading to an average loss of 0.36% by July.

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet