No Risk, No Reward! Lessons from Past Panics

Is Panic Selling a Golden Buying Opportunity?

Global stock markets have suffered their most brutal decline since the onset of COVID-19, triggered by President Trump's aggressive tariff policies. Yet, as history suggests, panic often presents buying opportunities. What usually happens after such sharp sell-offs?

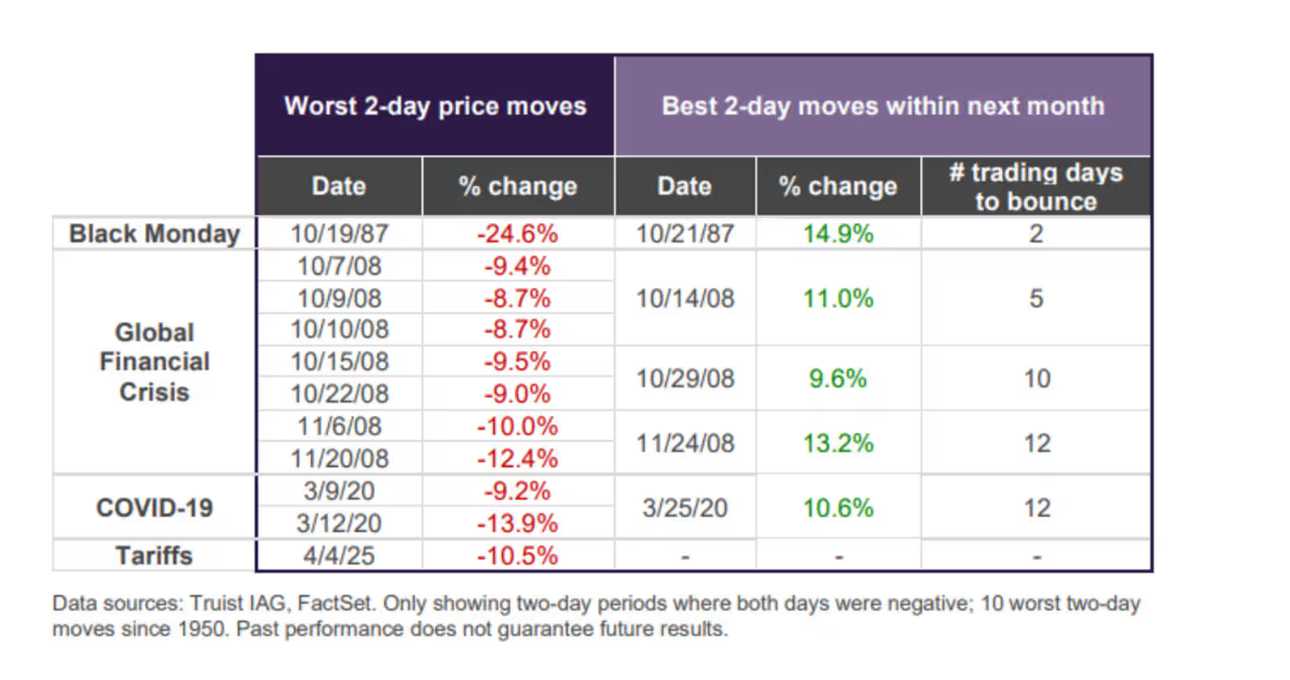

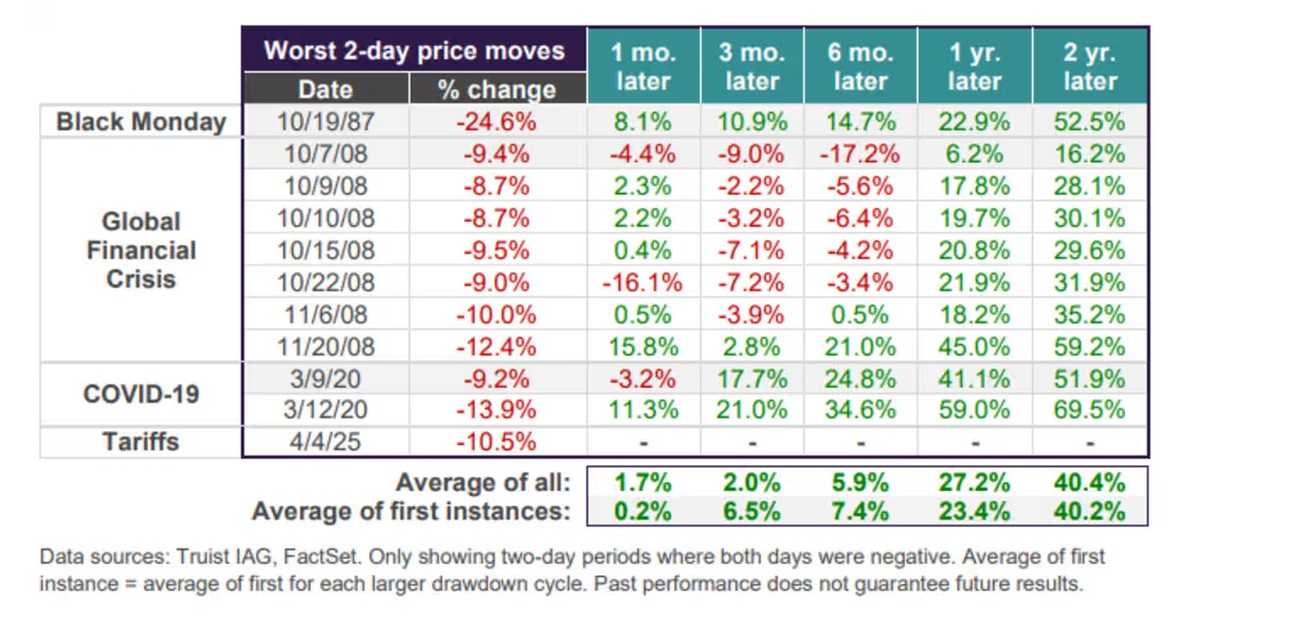

Investment bank Truist compiled a history of the steepest two-day declines in the S&P 500 Index since the 1987 Black Monday crash — and the strong rebounds that followed.

As shown in the chart, they offer three key insights:

1. Violent rebounds often follow violent drops

According to historical data, the S&P 500 tends to post some of its strongest 30-day rallies after experiencing severe two-day sell-offs.

2. Three month returns are less certain

Following sharp two-day declines, short-term returns remain uncertain. For example, after the 2008 financial crisis, markets continued to fall after the initial crash. But in the 2020 COVID panic, markets bounced back quickly.

3. One-year returns are consistently positive

If investors buy during a two-day crash and hold for a year, history shows positive returns in every case.

Recession Risk is the Key Variable

The critical factor that affects short-term equity returns after a crash is whether the economy slips into recession.

Truist's economists estimate that Trump's tariffs now give the U.S. economy a 50-50 chance of falling into recession. The longer tariffs stay in place, the greater the risk. Historically, the median S&P 500 decline during a recession is 24%.

From the February peak to now, the S&P 500 has dropped 17%, implying that markets have already priced in 60–70% of a potential recession.

The pessimistic view is that if a recession materializes, markets still have room to fall — and it could be worse than a 'typical' recession, Truist said.The optimistic take is that markets have already priced in much of the recession risk since February's highs. And once a bottom is found in a recession, stocks usually rebound quickly.

What Should Investors Do Now?

From a technical standpoint, the index is nearing the 50% retracement level of the 2022–2025 bull market, which could act as short-term support.

Truist, which has recommended a cautious stance since February, now advises against panicking. Given the sharp recent selloff, they argue that the market has now better priced in some of the uncertainty. While further downside risk remains, even a small piece of good news could trigger a sizable rebound.

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet