Opinion: It's About Valuation Depression, and Too Early to Call the Correction Over

Stocks caught a breather as inflation data came in lower than expected and the market digested Trump's new round of tariffs. Some investors rushed to buy the dip, believing the turmoil is about to end. However, we think it is too early to make that call, given Trump's policy priorities and the market's modest valuation. Here's what could happen next with Trump's economic agenda and why this correction is ultimately driven by valuation depression from both a technical and fundamental perspective—suggesting further downside risks.

Within two months of his inauguration, Donald Trump has significantly reshaped the U.S. economy in various ways: mass deportations of illegal immigrants to bring low-paying jobs back to Americans, a global tariff war to reduce the trade deficit, pressure on tech giants to invest in the U.S., and layoffs of redundant federal employees to balance the government budget. While these measures aim to restore U.S. economic independence and long-term prosperity, they come at the cost of short-term stock market volatility.

To understand Trump's economic strategy, we must first understand his priorities. His second-term agenda revolves around three key objectives: balancing the trade deficit, reducing the national deficit amid record debt, and compelling global corporations to invest in the U.S. without direct incentives.

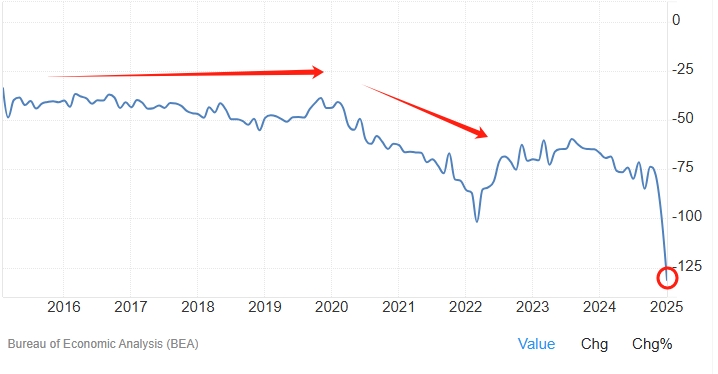

Booming Trade Deficit

Trump believes the current trade structure is unfair, as foreign countries have benefited at the expense of U.S. manufacturers. Over the past decade, the trade deficit has surged, particularly since February 2020 (Covid period), as Americans have become increasingly reliant on imports. Some attribute this trend to the Biden administration's generous spending, which pushed inflation to a 40-year high.

In January, the trade deficit reached a record $131.4 billion—nearly double the previous year's level and a 34% month-over-month increase—partly due to companies rushing to import goods ahead of Trump's tariff policies. While this spike may be temporary, the post-pandemic monthly deficit remains significantly higher than during Trump's first term, where it averaged $48 billion per month. To address this, the president is expected to aggressively use tariffs to make imports more expensive and bring the deficit down.

Which regions have benefited the most from trade with the U.S.? These will be Trump's primary targets. According to the U.S. Census Bureau, the top 10 trade deficits in January were with China ($29.7B), the European Union ($25.5B), Switzerland ($22.8B), Mexico ($15.5B), Ireland ($12.4B), Vietnam ($11.9B), Canada ($11.3B), Germany ($7.6B), Taiwan ($7.5B), and Japan ($7.4B).

Trump has already imposed an additional 20% tariff on Chinese imports, a 25% tariff on select goods from Canada and Mexico (products in line with the 2020 USMCA agreement extended exemptions for another month), and a 25% tariff on global steel and aluminum products. However, more tariffs are likely in April, as retaliation against the EU has yet to materialize, and additional tariffs on Mexico and Canada could be enforced due to the widening trade imbalance. Trump also prefers a gradual tariff approach, so we may see incremental hikes on Chinese imports.

With the deficit far exceeding the $48 billion Trump considers acceptable, the administration aims to close an $80 billion gap. To do so, further tariff measures are inevitable. However, to avoid a market shock, Trump will likely take a phased approach—leading to prolonged stock market uncertainty.

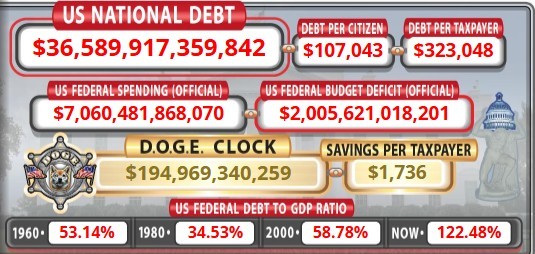

Record National Deficit Amid High Interest Rates

Another major challenge for Trump is the soaring national debt, which is why Musk-led DOGE is initiating mass layoffs of federal employees. The administration has also shifted toward punitive measures rather than financial incentives to encourage investment in the U.S.

The national debt now exceeds $36 trillion, with the federal deficit reaching $1.15 trillion in the first five months of fiscal 2025—a 38% year-over-year increase. As debt levels rise and the Federal Reserve maintains a moderate 4.25%-4.5% interest rate, the government's interest payments will continue to balloon, worsening the deficit.

However, Trump cannot directly influence the Fed's monetary policy, as Jerome Powell remains committed to the central bank's dual mandate of inflation control and employment stability. Instead, Trump may use tariffs to reshape the economy and induce a controlled mild recession—potentially explaining why he has not ruled out a downturn in recent interviews.

Trump has repeatedly criticized investors for focusing too much on short-term data, arguing that GDP growth should be assessed with a long-term perspective. His strategy is to use tariffs as a tool to slow economic activity temporarily while fostering domestic production. If successful, this could reduce America's reliance on imports and create a more self-sufficient economy. However, the transition will be bumpy, with short-term pain and uncertainty.

Punishment Over Subsidies

Trump's second-term agenda is centered on cost-cutting rather than spending, which is why he secured massive private-sector investments—such as OpenAI, SoftBank, and Oracle's $500 billion Stargate project, Apple's $500 billion U.S. investment, and TSMC's $100 billion expansion—without offering subsidies. He has also halted federal clean energy programs, called for the end of the CHIPS Act subsidies, and ruled out cryptocurrency purchases for the national reserve.

This approach is likely to extend to emerging industries such as AI, autonomous driving, and robotics. Instead of federal funding, Trump's administration may offer tax incentives and deregulation to support these sectors, but the implementation timeline could be longer, as his primary focus remains on trade policy.

Stock Market: More Pain Ahead?

Trump's hardline stance on trade and his dismissive attitude toward a potential recession could further pressure the stock market. The S&P 500 is already down 9% from its February highs, and the correction has not been severe enough to force Trump to adopt a more market-friendly approach.

Market corrections are not uncommon. The S&P 500 dropped 10% in a single month starting in July 2024, fell 11% over two months in August 2023, and declined 10% from February to March 2023. In 2022, the index tumbled 28% over an eight-month period. Given the current volatility and Trump's policy trajectory, he is unlikely to change course unless the market declines by another 15-20%.

Many stocks will likely experience further downside as tariff uncertainties force companies to scale back orders and tighten spending. Trump has repeatedly emphasized that short-term pain is necessary, arguing that many corporations have taken advantage of government support to grow and must now pay back through self-sufficiency.

From a technical standpoint, the S&P 500 is currently trading below its 200-day moving average. The last two times this happened were in October 2023 and April 2022. The 2023 correction was short-lived, as stocks quickly rebounded to record highs. However, in April 2022, concerns over inflation led to an additional 17% drop after the index first dipped below the MA(200). Using this as a reference, the market could still face significant downside ahead.

To conlude, Trump's economic strategy prioritizes long-term structural changes over short-term market stability. His trade-first agenda, cost-cutting policies, and reluctance to subsidize industries suggest ongoing volatility ahead. While tariffs may eventually lead to a more self-sufficient U.S. economy, the transition will come with uncertainty and potential further downside for stocks.

For now, investors should remain cautious—this correction is about valuation depression, and the bottom may not be in yet.

Independent investment research powered by a team of market strategists with 20+ years of Wall Street and global macro experience. We uncover high-conviction opportunities across equities, metals, and options through disciplined, data-driven analysis.

Latest Articles

Unlock Market-Moving Insights.

Subscribe to PRO Articles.

Already have an account? Sign in

Unlock Market-Moving Insights.

Subscribe to PRO Articles.

Already have an account? Sign in

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.