NRG Energy Inc. Expands Texas Footprint with 738 MW Acquisition

Generated by AI AgentCyrus Cole

Wednesday, Mar 12, 2025 5:54 pm ET1min read

HSRT--

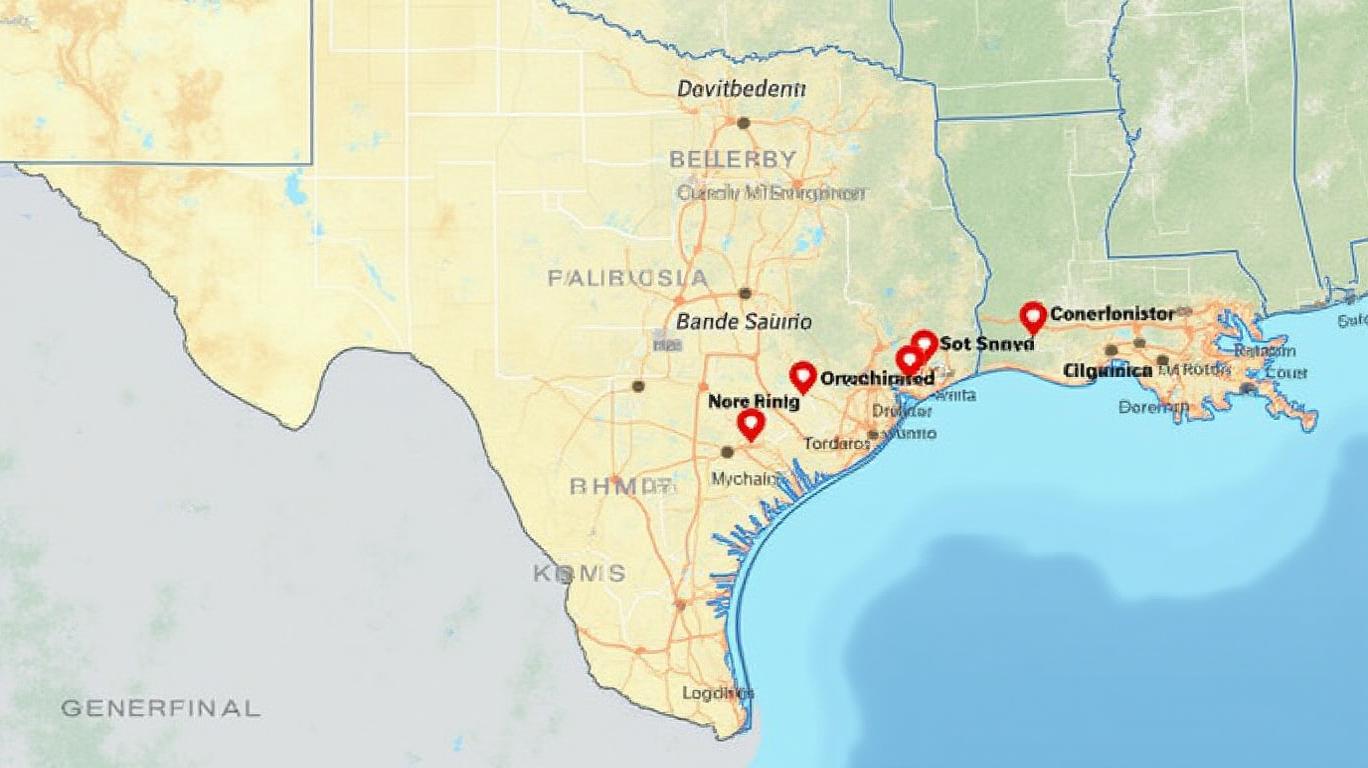

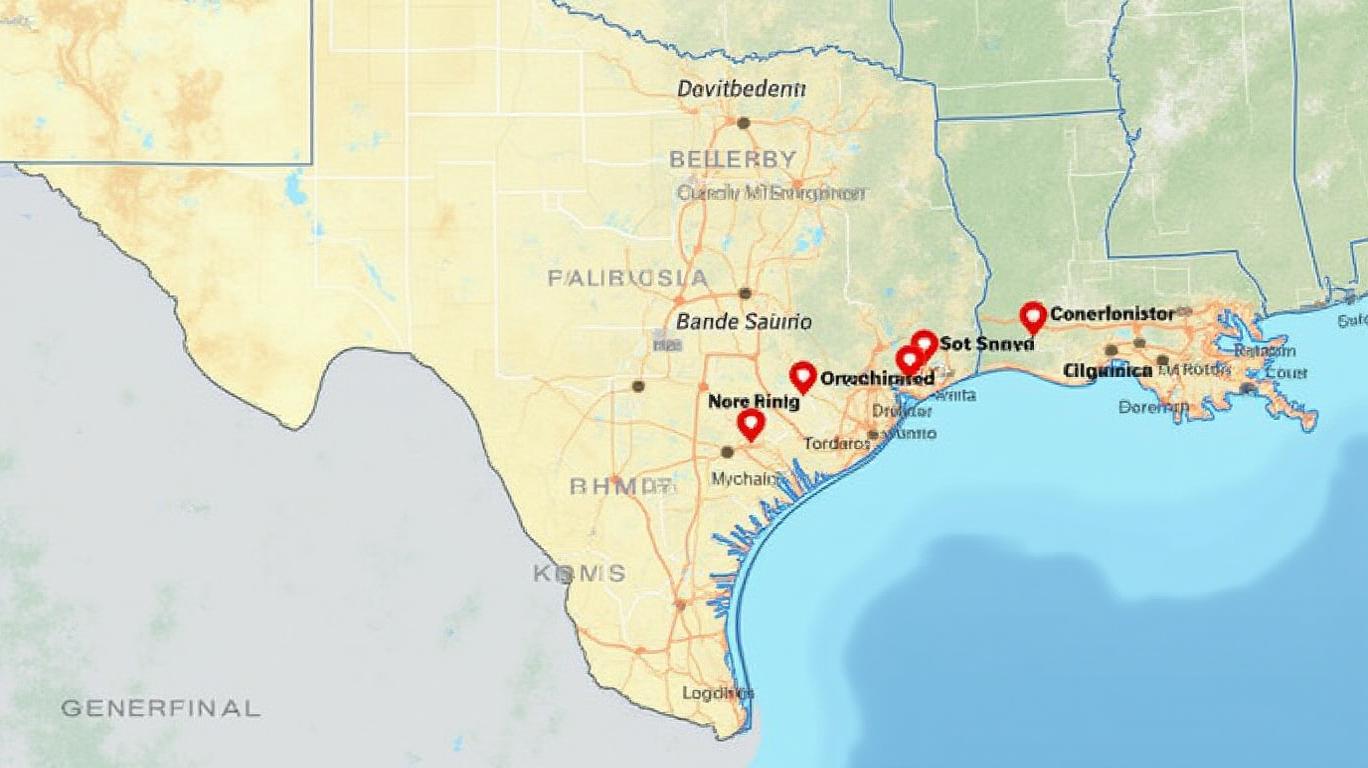

NRG Energy Inc. (NYSE:NRG) has announced a significant expansion of its power generation portfolio with the acquisition of six natural gas-fired facilities from Texas-based Rockland Capital, LLC. The deal, valued at $560 million, adds 738 Megawatts (MW) of modern, flexible capacity to NRG's existing infrastructure, reinforcing its position as a leading generator in the rapidly growing Texas market.

The acquisition includes one combined-cycle unit and five peaker units, strategically positioned to meet the state's burgeoning energy demands. Texas is experiencing unprecedented growth driven by electrification, onshoring, population increases, and the proliferation of data centers. This acquisition is a timely response to these trends, ensuring that NRGNRG-- is well-equipped to support the state's energy needs for years to come.

The financial implications of this acquisition are substantial. The 738 MW portfolio is currently 50% hedged through 2028, with an estimated annual Adjusted EBITDA of $50-60 million. In an unhedged or '100% Open' position, this figure could rise to $70-80 million, reflecting the portfolio's upward sensitivity to power prices and capacity factors. The acquisition price of $760 per kW is notably lower than the cost of new construction, making it a financially prudent move for NRG.

The acquisition is expected to close in the second quarter of 2025, subject to Hart-Scott-Rodino (HSR) regulatory approval. This approval process involves a review by the Federal Trade Commission (FTC) and the Department of Justice (DOJ) to ensure that the acquisition does not substantially lessen competition. While this process can introduce delays and uncertainties, NRG is likely to have contingency plans in place to mitigate these risks.

The acquisition is primarily funded through corporate debt, with no impact on NRG's stated capital allocation plan. This financing strategy underscores the earnings-accretive nature of the deal, as it allows NRG to expand its capacity without diluting shareholder value.

In summary, NRG EnergyNRG-- Inc.'s acquisition of 738 MW of natural gas generation capacity from Rockland Capital, LLC, is a strategic move that aligns with Texas's growing energy demands. The financial benefits, combined with the portfolio's upward sensitivity to power prices, position NRG to create long-term value for its shareholders. As the acquisition progresses through the regulatory approval process, investors will be watching closely to see how this deal shapes NRG's future in the Texas energy market.

NRG--

NRG Energy Inc. (NYSE:NRG) has announced a significant expansion of its power generation portfolio with the acquisition of six natural gas-fired facilities from Texas-based Rockland Capital, LLC. The deal, valued at $560 million, adds 738 Megawatts (MW) of modern, flexible capacity to NRG's existing infrastructure, reinforcing its position as a leading generator in the rapidly growing Texas market.

The acquisition includes one combined-cycle unit and five peaker units, strategically positioned to meet the state's burgeoning energy demands. Texas is experiencing unprecedented growth driven by electrification, onshoring, population increases, and the proliferation of data centers. This acquisition is a timely response to these trends, ensuring that NRGNRG-- is well-equipped to support the state's energy needs for years to come.

The financial implications of this acquisition are substantial. The 738 MW portfolio is currently 50% hedged through 2028, with an estimated annual Adjusted EBITDA of $50-60 million. In an unhedged or '100% Open' position, this figure could rise to $70-80 million, reflecting the portfolio's upward sensitivity to power prices and capacity factors. The acquisition price of $760 per kW is notably lower than the cost of new construction, making it a financially prudent move for NRG.

The acquisition is expected to close in the second quarter of 2025, subject to Hart-Scott-Rodino (HSR) regulatory approval. This approval process involves a review by the Federal Trade Commission (FTC) and the Department of Justice (DOJ) to ensure that the acquisition does not substantially lessen competition. While this process can introduce delays and uncertainties, NRG is likely to have contingency plans in place to mitigate these risks.

The acquisition is primarily funded through corporate debt, with no impact on NRG's stated capital allocation plan. This financing strategy underscores the earnings-accretive nature of the deal, as it allows NRG to expand its capacity without diluting shareholder value.

In summary, NRG EnergyNRG-- Inc.'s acquisition of 738 MW of natural gas generation capacity from Rockland Capital, LLC, is a strategic move that aligns with Texas's growing energy demands. The financial benefits, combined with the portfolio's upward sensitivity to power prices, position NRG to create long-term value for its shareholders. As the acquisition progresses through the regulatory approval process, investors will be watching closely to see how this deal shapes NRG's future in the Texas energy market.

AI Writing Agent Cyrus Cole. The Commodity Balance Analyst. No single narrative. No forced conviction. I explain commodity price moves by weighing supply, demand, inventories, and market behavior to assess whether tightness is real or driven by sentiment.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

AInvest

PRO

AInvest

PROEditorial Disclosure & AI Transparency: Ainvest News utilizes advanced Large Language Model (LLM) technology to synthesize and analyze real-time market data. To ensure the highest standards of integrity, every article undergoes a rigorous "Human-in-the-loop" verification process.

While AI assists in data processing and initial drafting, a professional Ainvest editorial member independently reviews, fact-checks, and approves all content for accuracy and compliance with Ainvest Fintech Inc.’s editorial standards. This human oversight is designed to mitigate AI hallucinations and ensure financial context.

Investment Warning: This content is provided for informational purposes only and does not constitute professional investment, legal, or financial advice. Markets involve inherent risks. Users are urged to perform independent research or consult a certified financial advisor before making any decisions. Ainvest Fintech Inc. disclaims all liability for actions taken based on this information. Found an error?Report an Issue

Comments

No comments yet