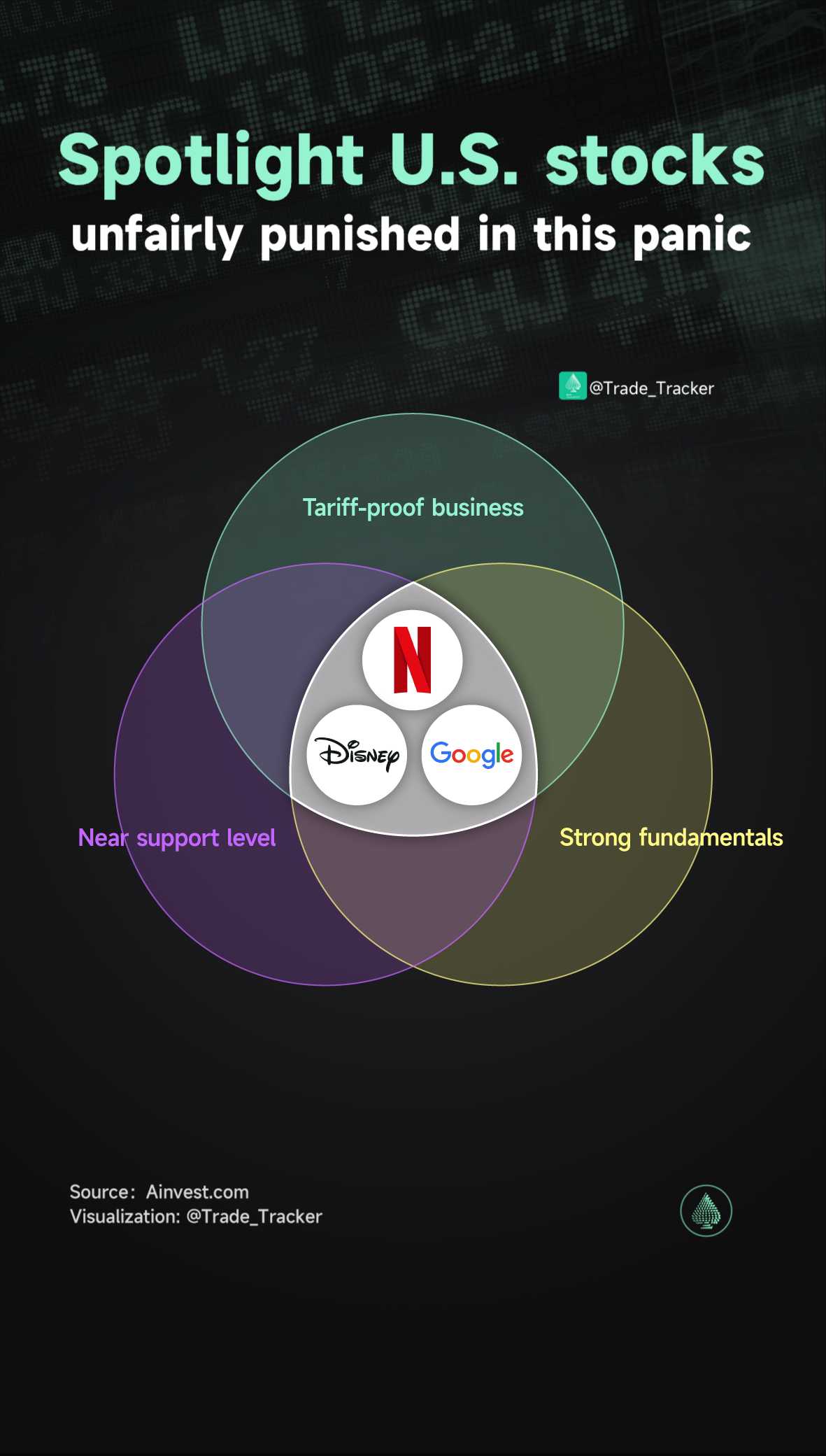

Netflix: Resilient Amid Tariff Turmoil

Netflix is like the champ in the streaming world, but when Trump's tariffs came around, the market got a little jittery. Some folks thought NetflixNFLX-- might take a hit, but hey, the company's fundamentals are strong, and it's actually set up pretty well to handle this storm. Let's dive into why Netflix is falsely killed and why those tariffs might actually be a thumbs up for the stock.

Trump's Tariffs: A Brief Backstory

Trump's recent tariffs are like a big, global tax on imports, and they've got markets shaking in their boots. The US president announced higher rates for trading partners, causing a stir in the global economy. China, for example, hit back with its own tariffs, which are quite hefty at 34%. Meanwhile, Japan and other allies are feeling the heat, with Tokyo calling the tariffs a national crisis. It's a complex web of trade tensions, and Netflix is caught in the middle.

Netflix's Resilience: Income Statement Analysis

Netflix's income statement is looking pretty solid. They reported a whopping $8.7 billion in net income for 2024, with revenue hitting $39 billion, up 16% from the previous year. Their operating income climbed to $10.4 billion, up from $7 billion in 2023, with an operating margin of 27%, a nice jump from 21% the year before. These numbers show Netflix is profitable and growing, which is great news for investors.

Cash Flow and Balance Sheet Strength

Netflix's cash flow is on the rise, with a free cash flow of $2.1 billion in Q1, more than double what it was the year before. They're also managing their debt well, with a total debt of $15.7 billion, but don't worry, they've got cash and short-term investments to cover it. This balance sheet stability is a big thumbs up for Netflix's financial health.

Valuation and Growth Prospects

In Conclusion: A Strong Buy Signal

Dive into Nancy Pelosi's portfolio: Holdings & trades with clear charts from public data. Visit http://Ainvest.com for more.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet