Elon Musk Admits DOGE Role Harms Tesla Stock, Calls It "A Very Expensive Job"

Elon Musk, the enigmatic entrepreneur, has publicly acknowledged that his role as head of the Department of Government Efficiency in the Trump administration is taking a significant toll on Tesla's stock price. Speaking at a town hall in Green Bay, Wisconsin, Musk described his DOGE responsibilities as a very expensive job, directly linking them to the huge plunge in Tesla's stock value since he took on the position.

Musk's Candid Take on DOGE's Cost and Tesla's Stock

During the Green Bay town hall, where Musk notably gave away $1 million each to two voters, he didn't shy away from addressing the financial fallout of his DOGE involvement. This is a very expensive job, is what I'm saying, Musk remarked, underscoring how his political activities have contributed to Tesla's stock woes. He revealed the personal impact as well, noting, My TeslaTSLA-- stock and the stock of everyone who holds Tesla has gone, went roughly in half. I mean, it's a big deal.

Despite the grim numbers, Musk struck an optimistic tone about Tesla's future, suggesting that the current stock drop could be a buying opportunity for long-term investors. This perspective reflects his confidence in Tesla's underlying value and growth potential, even as his DOGE responsibilities pull him away from the company's day-to-day operations. Musk's comments highlight a tension between his immediate political commitments and his belief in Tesla's resilience, leaving investors to weigh whether his optimism is warranted or overly rosy given the company's challenges.

Tesla's Stock Price Plunge and Sales Dilemma

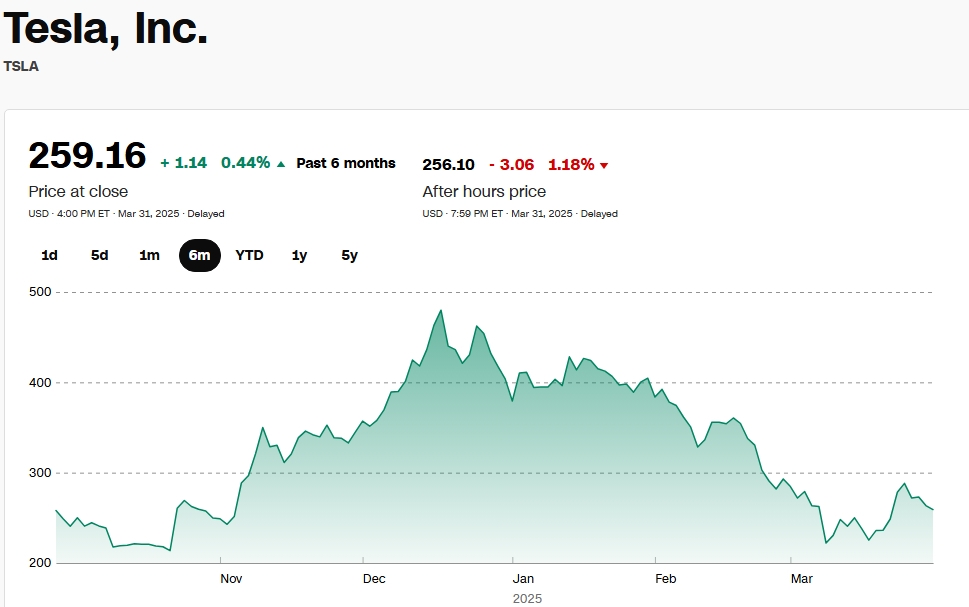

Tesla's stock has been on a downward spiral since Musk assumed his DOGE role, dropping from a peak of $488.54 to a low of $217.02—a decline over 50%. As of today, the stock closed at $259.16, reflecting ongoing investor unease. Wall Street analysts have grown increasingly bearish on Tesla's production outlook, with Visible Alpha's average estimate from 15 analysts projecting that Tesla delivered approximately 373,000 vehicles in the January-March period. This figure represents a 3.6% decrease from the 386,810 vehicles delivered in the same period last year, driven by softening demand for electric vehicles.

However, some investors and analysts believe even this reduced estimate may be overly optimistic. Thomas Martin, a senior portfolio manager at Globalt Investments and a Tesla shareholder, warned that actual deliveries could fall well below expectations. I think that the numbers are going to come in below 400,000 and, maybe as low as 350,000, Martin said. Such a shortfall would signal deeper troubles for Tesla, compounding the pressure from its plummeting stock price and raising questions about the company's ability to maintain its market dominance amid Musk's divided attention.

Expert Calls for Tesla to Ditch Musk

Not everyone shares Musk's confidence in Tesla's trajectory under his leadership. Branding expert Allen Adamson has voiced a starkly negative opinion, arguing that Tesla's best chance to rebuild its tarnished brand is to part ways with Musk entirely. Adamson points to Musk's lack of focus on Tesla—exacerbated by his high-profile political role with DOGE and other ventures—as a key factor in the company's struggles. The backlash from Musk's political activities has fueled protests and boycotts, further eroding Tesla's once-sterling reputation among consumers.

Tesla's brand is in trouble, Adamson stated, emphasizing that Musk's divided attention and controversial persona are dragging the company down. For a brand that once symbolized innovation and sustainability, this shift in perception poses a significant risk. Adamson's suggestion that Tesla should ditch Musk underscores a growing sentiment among some observers that the CEO's outsized influence may now be more of a liability than an asset.

Conclusion

Tesla is currently facing significant challenges, including a declining stock price, concerns over sales, and external pressures tied to CEO Elon Musk's political involvement. The future remains uncertain, with critical details about upcoming tariffs still unpublished as of April 2. These tariffs could have a substantial impact on Tesla's operations and financial outlook.

However, there is potential for optimism. If Tesla can capitalize on the bullish stock market trend often seen in April, it might see a much-needed lift in its stock price. Furthermore, should the tariff policies released on April 2 indicate a relaxation of tensions, this could ease some of the strain on the company.

Ultimately, Tesla's path forward hinges on its ability to navigate these challenges and successful launching AI products like Cybercab and Tesla bot Optimus. Stakeholders will be keenly watching both the tariff developments and April's market performance to assess what lies ahead for the company.

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet