Musk Has Helped Tesla Short Sellers Make Over $16 Billion In The Past 3 Months

Over the past three months, the market value of TeslaTSLA--, led by Elon Musk, has halved, while short sellers have reaped substantial profits during this period.

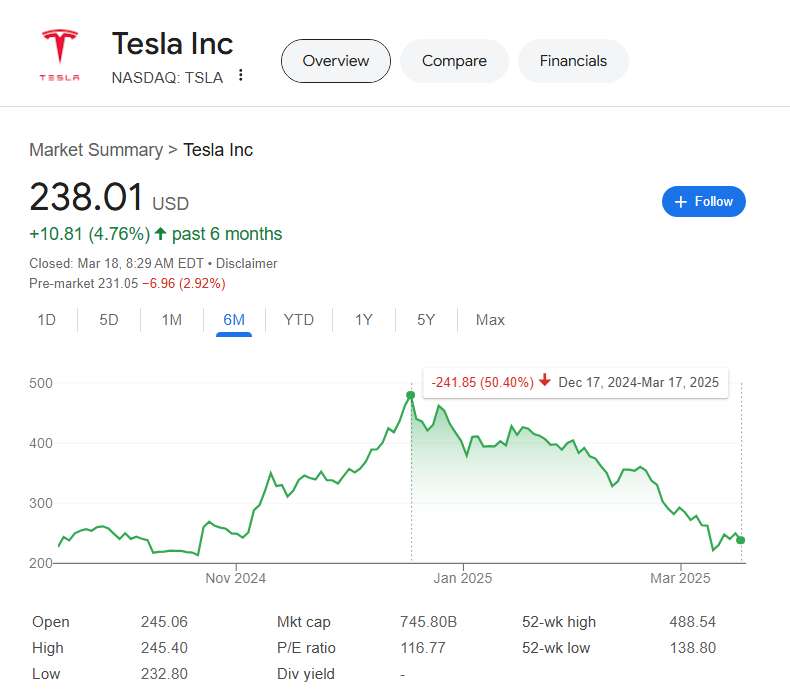

According to data from S3 Partners, since the stock's closing high on December 17, its price has been cut in half, and investors profiting from the decline have accumulated $16.2 billion in paper gains.

As of Monday's (March 17) close, Tesla's market capitalization has plummeted by more than $700 billion from its historical high in December last year, completely erasing its post−election gains. Musk's net worth has also evaporated by over $100 billion.

Previously, the Tesla CEO's public interventions in European politics, including his support for far-right parties, led to a decline in Tesla's car sales across Europe. In the U.S., his role as the head of the Government Efficiency Department (DOGE) and his significant cuts to federal government spending have sparked dissatisfaction among some Americans, which has also impacted Tesla's sales.

Per Lekander, a Tesla short seller and managing partner of the $1.5 billion hedge fund Clean Energy Transition, stated, Tesla had a very strong brand value and Elon has managed to totally destroy it. Musk is on the wrong side of his buyership. It's not people with cowboy boots who buy Teslas.

Last week, JPMorgan lowered Tesla's year-end target price from $135 to $120, writing in a report, We struggle to think of anything analogous in the history of the automotive industry, in which a brand has lost so much value so quickly.

In contrast, Tesla's short sellers have recently achieved profits, marking a partial reversal of the painful trades they have endured in recent years.

Data from S3 shows that since Tesla's IPO in 2010, short sellers have incurred a total of $64.5 billion in paper losses (even after accounting for recent gains). Before this recent decline in Tesla's stock price, many hedge funds were forced to abandon their short positions due to mounting losses.

Over the past month, the number of Tesla shares sold short has increased by 16.3%, reaching a total of 71.5 million shares, accounting for 2.6% of the company's total shares.

Reflecting on the post-U.S. election period when investors flocked to Tesla stock, hoping it would benefit from Musk's friendly relationship with Trump, it is clear that Trump's second term has been a wild ride for both Tesla bulls and bears.

Since last month, widespread selling in U.S. stocks has occurred due to concerns over President Donald Trump's aggressive tariffs. More Wall Street investment banks have also lowered their target prices for Tesla.

On Monday, Mizuho analysts reduced Tesla's target price from $515 to $430, citing expected weak demand for automakers amid tariff uncertainties.

Last week, analysts from Wells Fargo and JPMorgan lowered Tesla's target prices to $130 and $120, respectively, suggesting that the stock still has significant room to fall.

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet