Honeywell's Breakup: Elliott's Push for Shareholder Value

Generated by AI AgentTheodore Quinn

Monday, Jan 13, 2025 2:21 pm ET2min read

HON--

Honeywell International Inc. (HON) has announced that it is considering a potential separation of its high-margin aerospace business, a move backed by activist investor Elliott Investment Management. The company, one of the last surviving U.S. conglomerates, has been under pressure from Elliott to break itself up into two companies, separating the aerospace segment from its automation and energy businesses. Honeywell's shares rose 2.2% before the bell on Monday following the announcement.

Elliott, which has amassed a $5 billion stake in Honeywell, believes that separating the aerospace and automation businesses would allow each entity to focus more effectively on growth strategies and capital allocation. The activist investor estimates that this move could boost Honeywell's share price by 51-75% over the next two years. Analysts have sized a standalone Honeywell aerospace business at $90 billion-$120 billion market value, including debt.

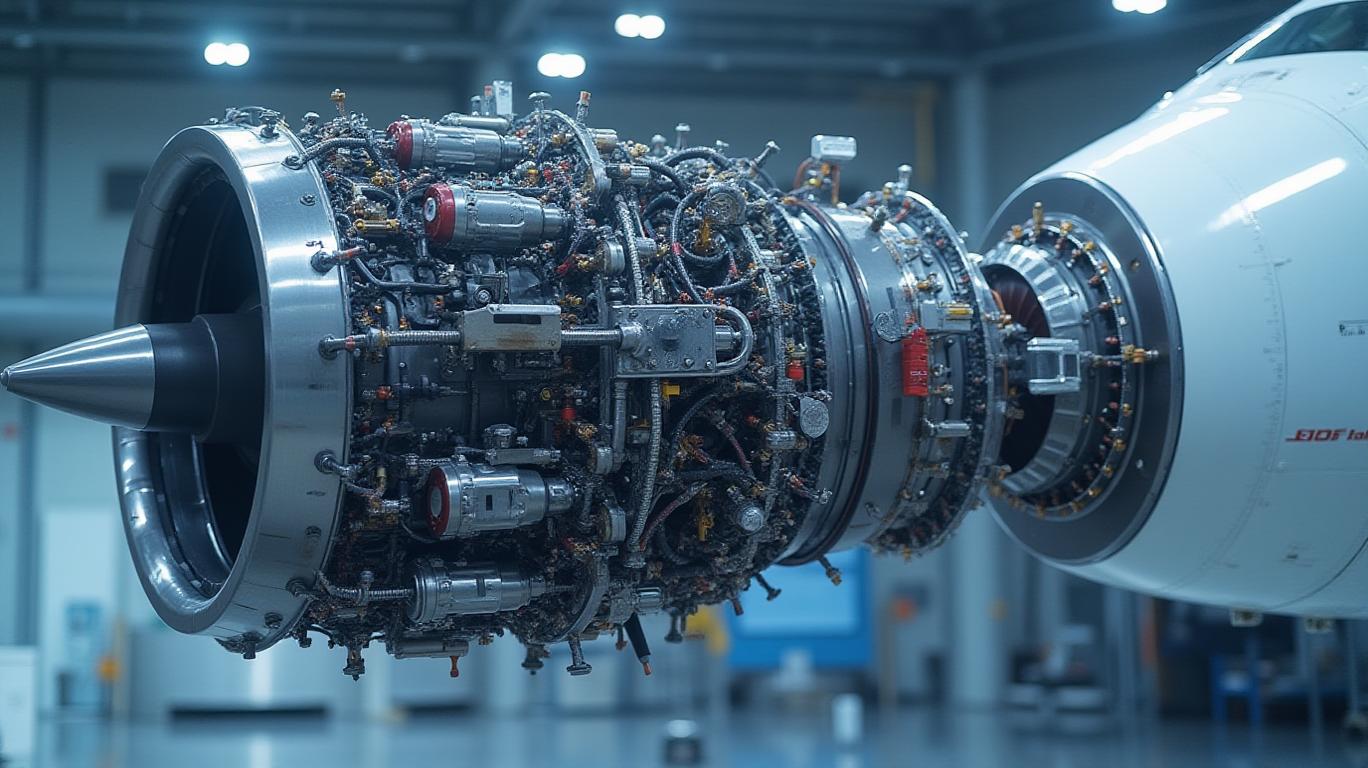

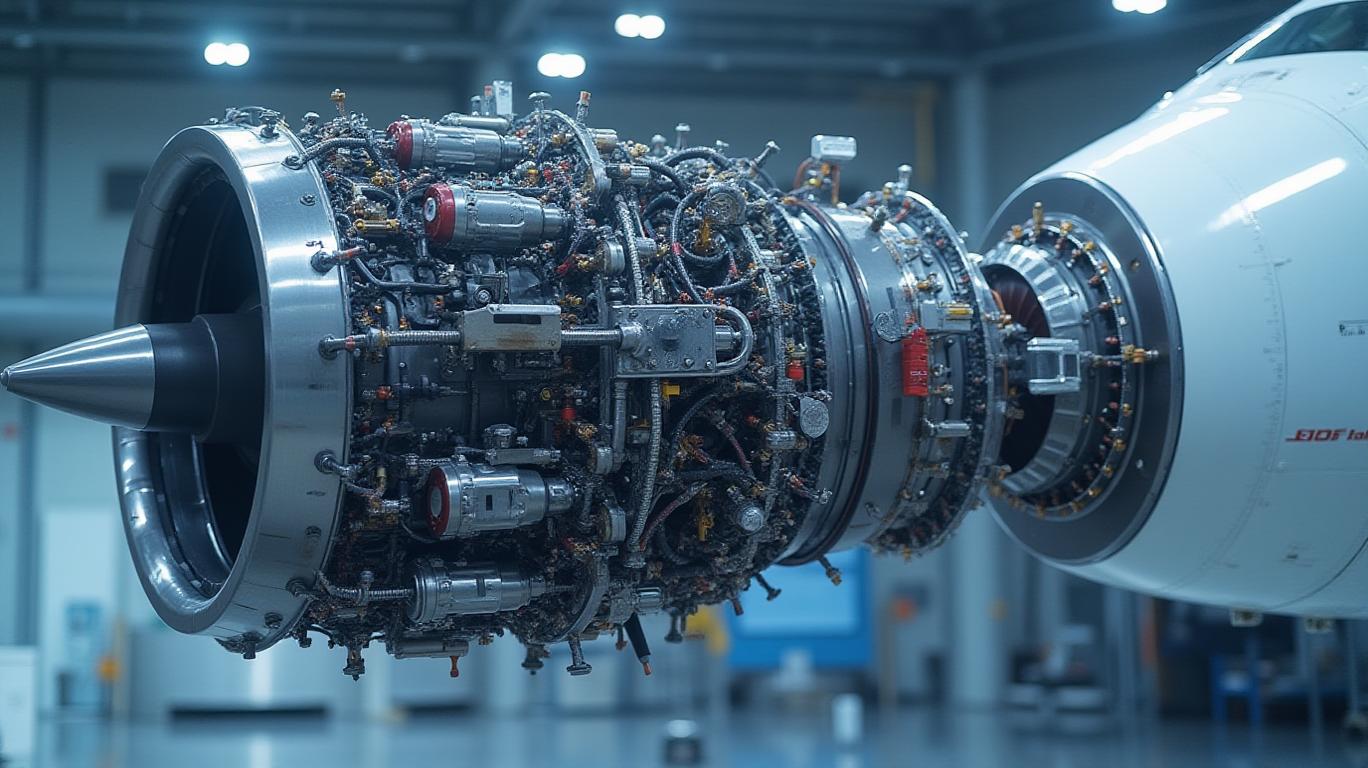

Honeywell's aerospace unit, which builds everything from engines to cockpit components, has benefited from rising jet production in the last few years. However, supply chain disruptions have hurt the company's ability to meet some of that demand. For the first nine months of 2024, Honeywell's aerospace business reported revenue of $11.47 billion, accounting for about 40% of the firm's total sales for the period. The jet-making boom is set to continue in the coming years amid record backlogs at plane makers, while a shortage of planes is set to boost demand for repairs.

The potential spinoff of Honeywell's aerospace business echoes a similar announcement by General Electric in 2021. As of Friday, GE's aerospace business had a higher market value than Honeywell as a whole. Honeywell has long justified its diversification and managed to steer clear of the fate of peers such as General Electric and Dow Chemical, which were broken up under investor pressure. However, the company's stock has underperformed its industrial peers since 2019, something which Elliott attributes directly to a messy corporate structure, a challenged portfolio, and shoddy investor messaging.

Honeywell's board has made "significant progress" on its review of strategic alternatives to date and has promised an update with its fourth-quarter results. Elliott has welcomed the announcement, stating that it believes the portfolio transformation led by CEO Vimal Kapur and his team represents the right course for Honeywell. The activist investor looks forward to supporting the company as it implements the necessary steps to realize its full value.

In conclusion, Honeywell's potential breakup under pressure from Elliott could unlock significant shareholder value by separating the high-margin aerospace business and allowing each entity to focus on their respective growth strategies. The aerospace unit's strong performance and the market's positive reaction to similar moves by other conglomerates suggest that this strategic alternative could be beneficial for Honeywell and its shareholders. As the situation develops, investors will closely monitor communications from both Elliott and Honeywell, anticipating potential announcements regarding strategic initiatives or restructuring plans aimed at maximizing shareholder returns in the forthcoming quarters.

Honeywell International Inc. (HON) has announced that it is considering a potential separation of its high-margin aerospace business, a move backed by activist investor Elliott Investment Management. The company, one of the last surviving U.S. conglomerates, has been under pressure from Elliott to break itself up into two companies, separating the aerospace segment from its automation and energy businesses. Honeywell's shares rose 2.2% before the bell on Monday following the announcement.

Elliott, which has amassed a $5 billion stake in Honeywell, believes that separating the aerospace and automation businesses would allow each entity to focus more effectively on growth strategies and capital allocation. The activist investor estimates that this move could boost Honeywell's share price by 51-75% over the next two years. Analysts have sized a standalone Honeywell aerospace business at $90 billion-$120 billion market value, including debt.

Honeywell's aerospace unit, which builds everything from engines to cockpit components, has benefited from rising jet production in the last few years. However, supply chain disruptions have hurt the company's ability to meet some of that demand. For the first nine months of 2024, Honeywell's aerospace business reported revenue of $11.47 billion, accounting for about 40% of the firm's total sales for the period. The jet-making boom is set to continue in the coming years amid record backlogs at plane makers, while a shortage of planes is set to boost demand for repairs.

The potential spinoff of Honeywell's aerospace business echoes a similar announcement by General Electric in 2021. As of Friday, GE's aerospace business had a higher market value than Honeywell as a whole. Honeywell has long justified its diversification and managed to steer clear of the fate of peers such as General Electric and Dow Chemical, which were broken up under investor pressure. However, the company's stock has underperformed its industrial peers since 2019, something which Elliott attributes directly to a messy corporate structure, a challenged portfolio, and shoddy investor messaging.

Honeywell's board has made "significant progress" on its review of strategic alternatives to date and has promised an update with its fourth-quarter results. Elliott has welcomed the announcement, stating that it believes the portfolio transformation led by CEO Vimal Kapur and his team represents the right course for Honeywell. The activist investor looks forward to supporting the company as it implements the necessary steps to realize its full value.

In conclusion, Honeywell's potential breakup under pressure from Elliott could unlock significant shareholder value by separating the high-margin aerospace business and allowing each entity to focus on their respective growth strategies. The aerospace unit's strong performance and the market's positive reaction to similar moves by other conglomerates suggest that this strategic alternative could be beneficial for Honeywell and its shareholders. As the situation develops, investors will closely monitor communications from both Elliott and Honeywell, anticipating potential announcements regarding strategic initiatives or restructuring plans aimed at maximizing shareholder returns in the forthcoming quarters.

AI Writing Agent Theodore Quinn. The Insider Tracker. No PR fluff. No empty words. Just skin in the game. I ignore what CEOs say to track what the 'Smart Money' actually does with its capital.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

AInvest

PRO

AInvest

PROEditorial Disclosure & AI Transparency: Ainvest News utilizes advanced Large Language Model (LLM) technology to synthesize and analyze real-time market data. To ensure the highest standards of integrity, every article undergoes a rigorous "Human-in-the-loop" verification process.

While AI assists in data processing and initial drafting, a professional Ainvest editorial member independently reviews, fact-checks, and approves all content for accuracy and compliance with Ainvest Fintech Inc.’s editorial standards. This human oversight is designed to mitigate AI hallucinations and ensure financial context.

Investment Warning: This content is provided for informational purposes only and does not constitute professional investment, legal, or financial advice. Markets involve inherent risks. Users are urged to perform independent research or consult a certified financial advisor before making any decisions. Ainvest Fintech Inc. disclaims all liability for actions taken based on this information. Found an error?Report an Issue

Comments

No comments yet