Graph Worth 1000 Words: Signs Point to a Market Bottom

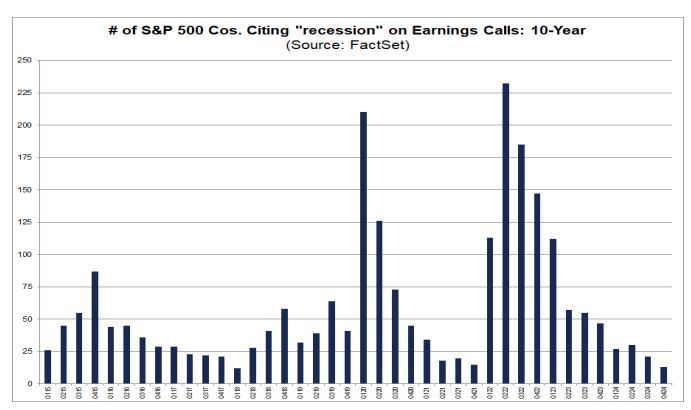

The U.S. economy remains strong, showing no signs of a recession. During the entire Q4 earnings season, only 13 companies mentioned recession in their earnings calls—the lowest number since Q1 2018.

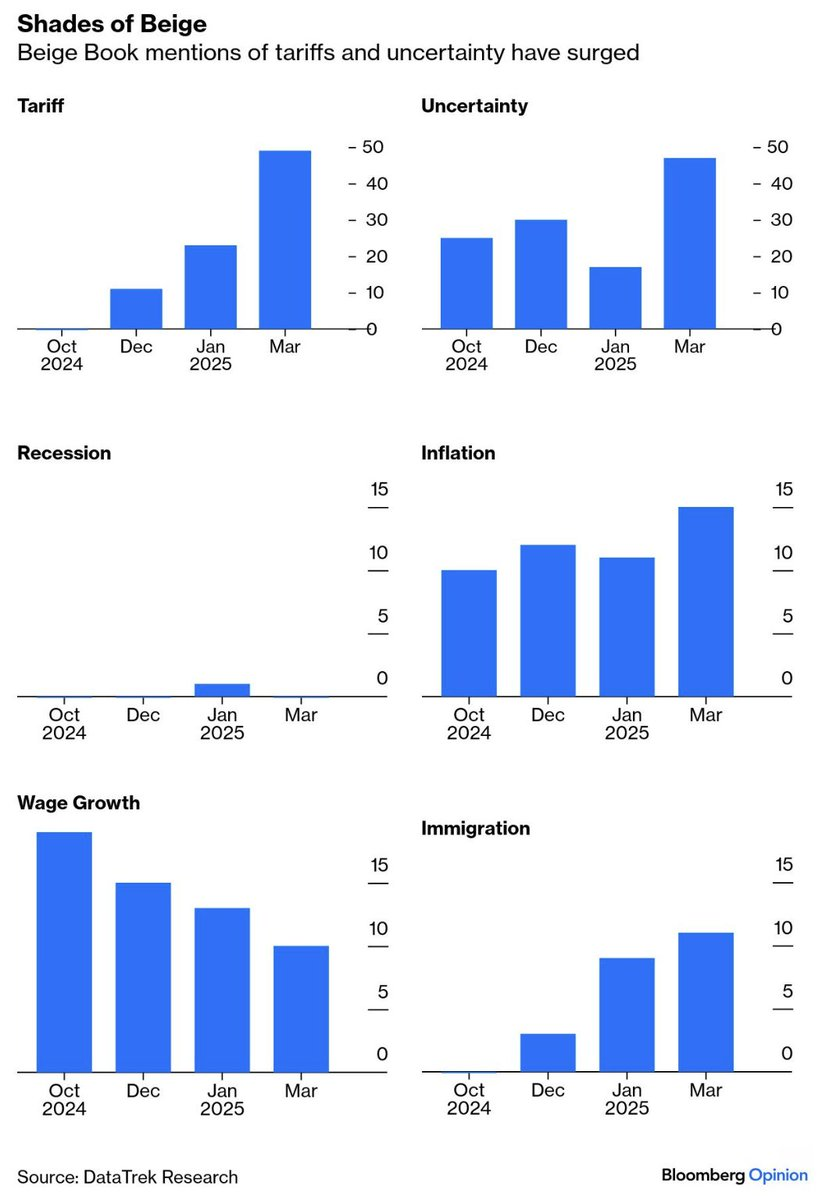

According to word frequency analysis of the Federal Reserve's March Beige Book, concerns about tariffs and uncertainty are rising, but there is almost no discussion of a potential recession.

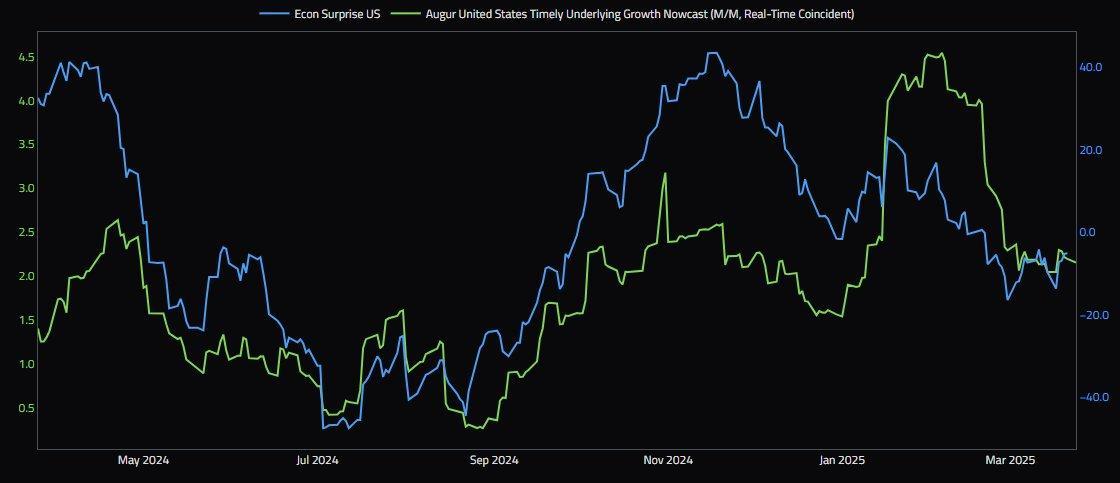

On the data front, Nowcasts' economic growth expectations (green) declined throughout February but have stabilized over the past three weeks. Meanwhile, Citigroup's Economic Surprise Index (blue) fell in January and February but has also stabilized recently. (A declining index suggests economic data is weaker than expected, while an increase indicates stronger-than-expected data.)

Does This Mean U.S. Stocks Have Bottomed?

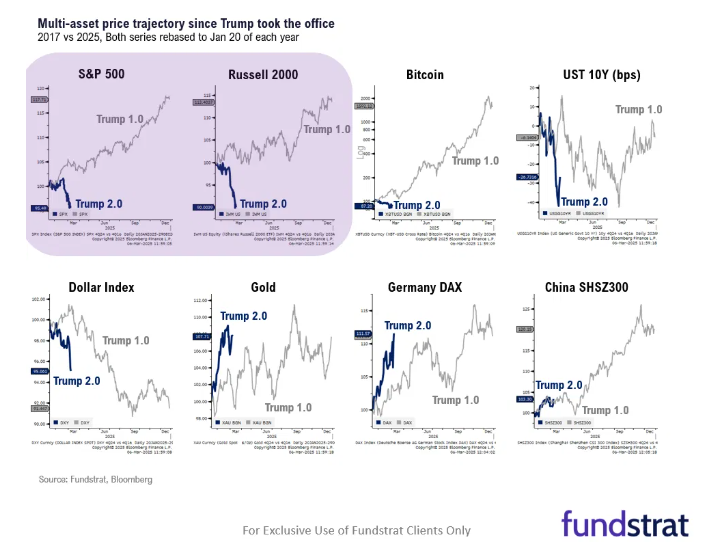

Since a recession is not imminent, it is worth discussing whether U.S. equities have already reached their bottom. The market's trajectory this year closely resembles the 2019 period during the first phase of the U.S.-China trade war.

Comparing global asset performance under Trump's two terms, U.S. stocks have significantly underperformed in Trump 2.0 compared to Trump 1.0. Currently, only gold and German equities have outperformed their previous cycle under Trump.

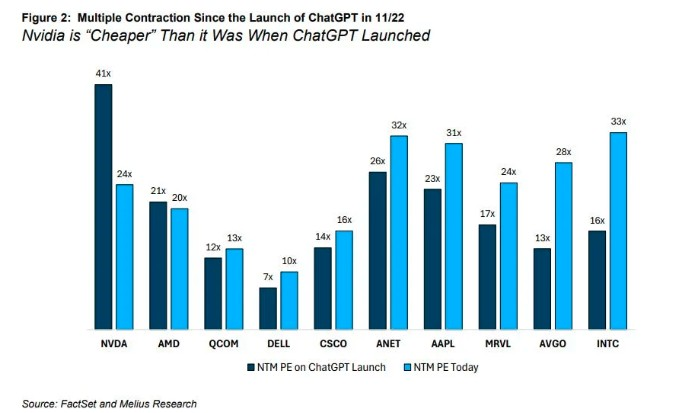

The once-dominant Magnificent 7 have turned into the Lagnificent 7, with NVIDIA's valuation now lower than when ChatGPT was first introduced.

Market Corrections: How Much More Downside?

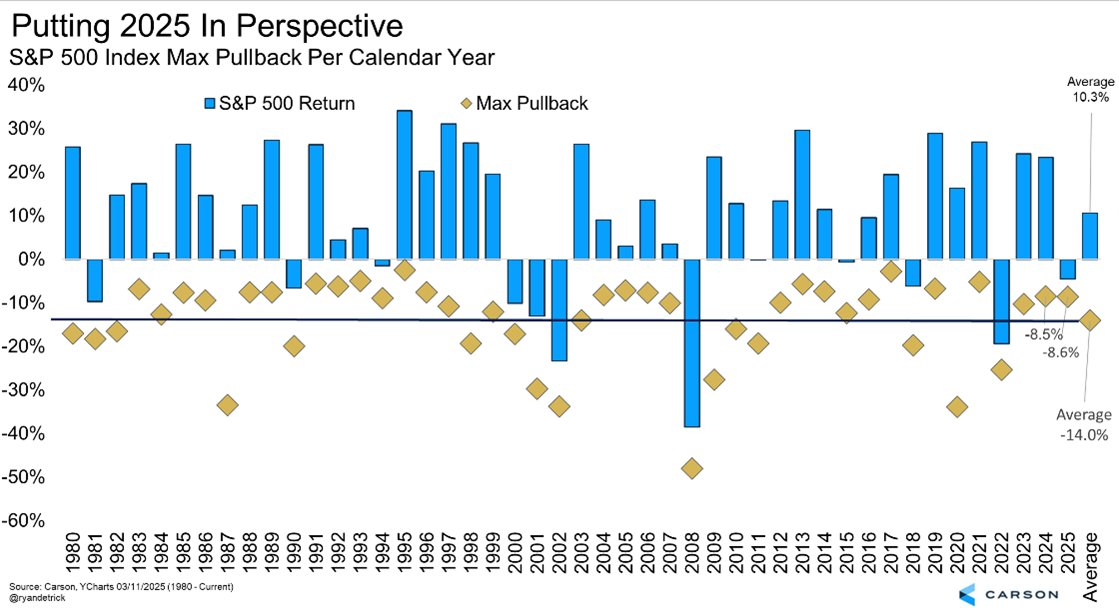

Historically, since 1980, the S&P 500 has averaged a 14% decline from peak to trough each year. However, since the end of 2023, the index has yet to experience a 10% correction.

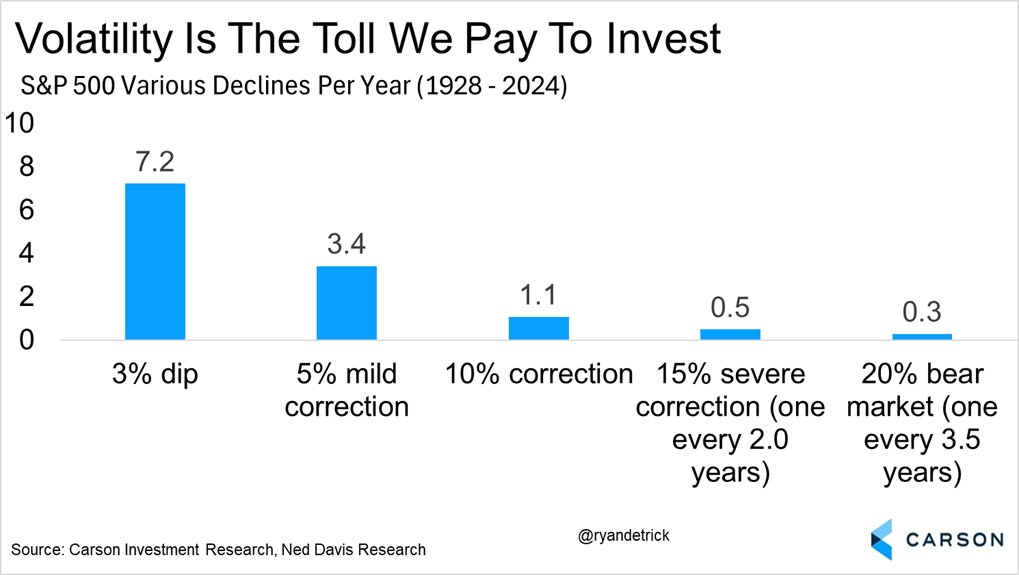

On average, the S&P 500 experiences: Seven 3% pullbacks per year, 3.4 moderate 5% corrections, 1.1 larger 10% declines, One 15% pullback every two years, and A bear market (>20% drop) every 3.5 years.

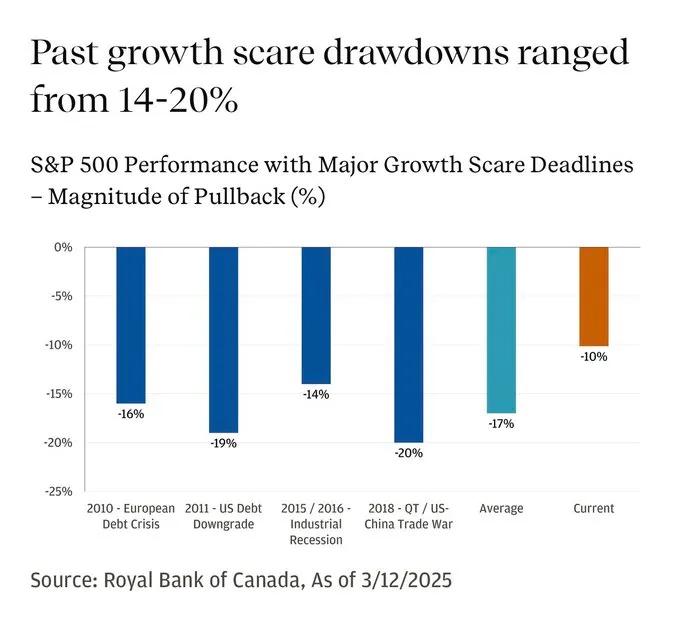

During past recession-driven sell-offs, the S&P 500 typically declined between 14% and 20%. The current pullback stands at 10%, suggesting limited additional downside.

Signs of a Market Bottom

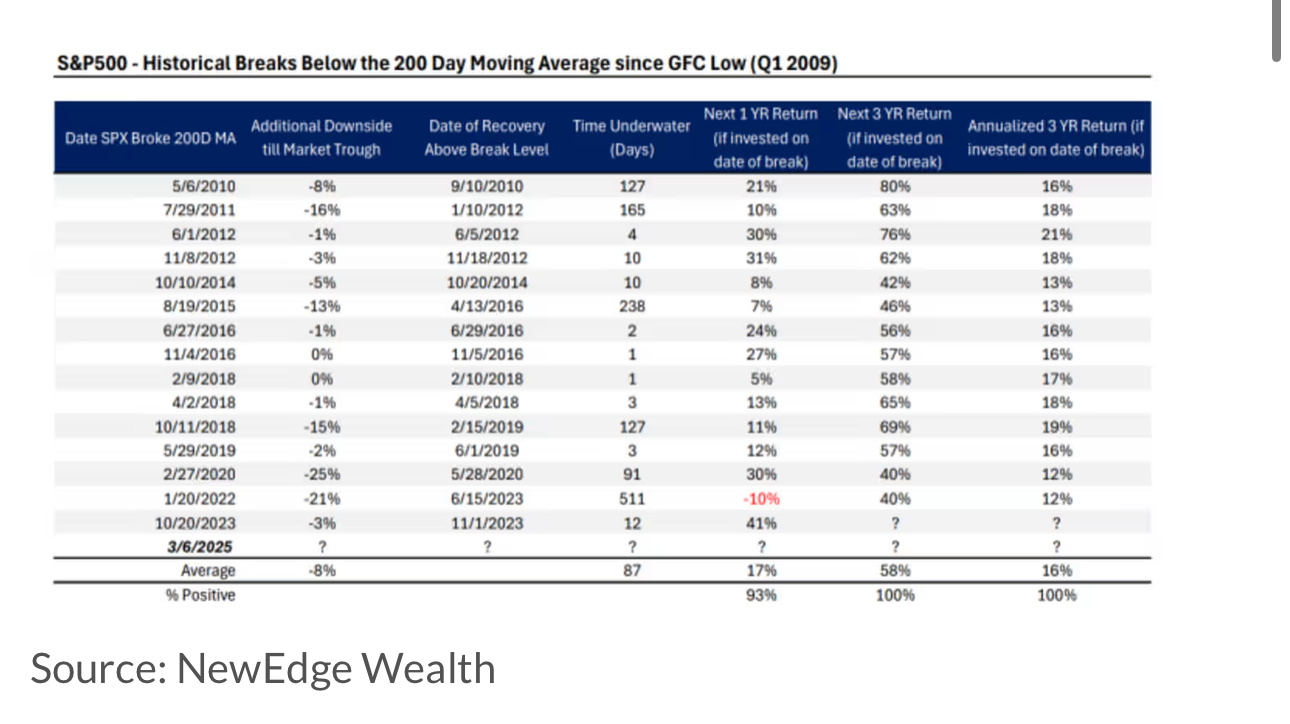

Historically, when the S&P 500 drops below its 200-day moving average, it often presents a strong buying opportunity.

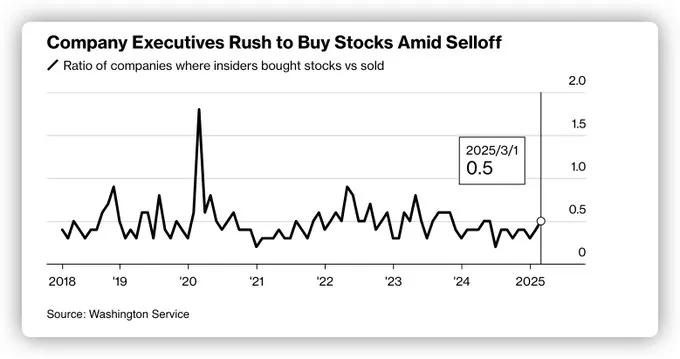

Meanwhile, corporate insiders—often referred to as smart money—have started buying. Data shows the ratio of insider buying to selling has climbed to 0.46, its highest level in six months.

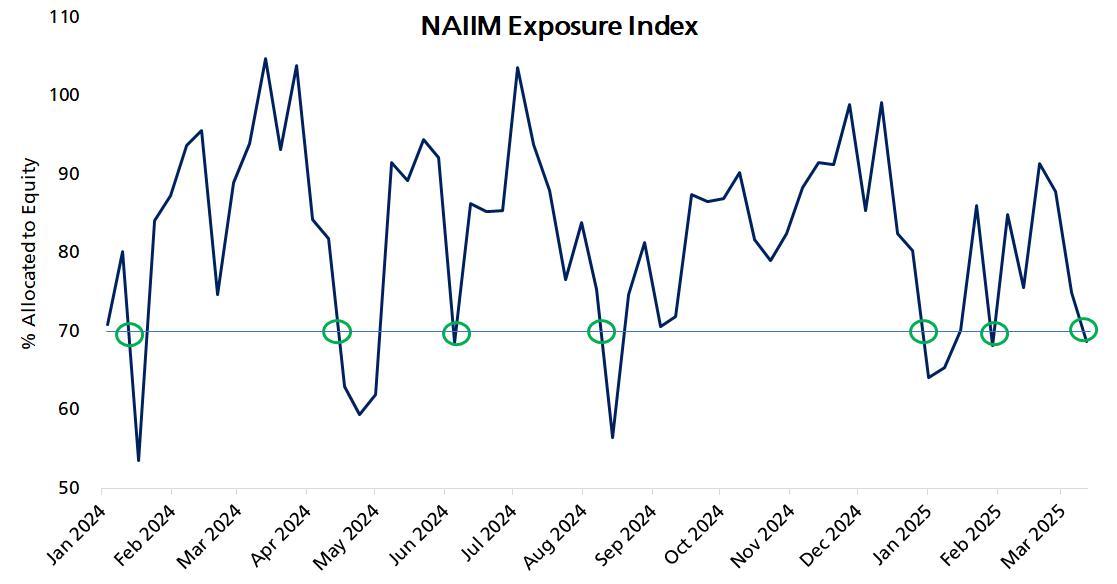

Additionally, active fund managers have reduced their stock allocations to below 70%, a level seen 126 times since 2018. Over the next 90 days, this scenario historically resulted in: A 70% chance of a market rally, with an average gain of 6%, and A 30% chance of further declines, averaging a 4% drop. From a risk-reward perspective, this suggests an attractive dip-buying opportunity.

Moreover, S&P 500 put option volumes hit their third-highest level in history this week. The previous two spikes in put volume coincided with major market bottoms.

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet