Goldman Sachs Reveals Hedge Funds Are 'Crowding' In Tech Stocks

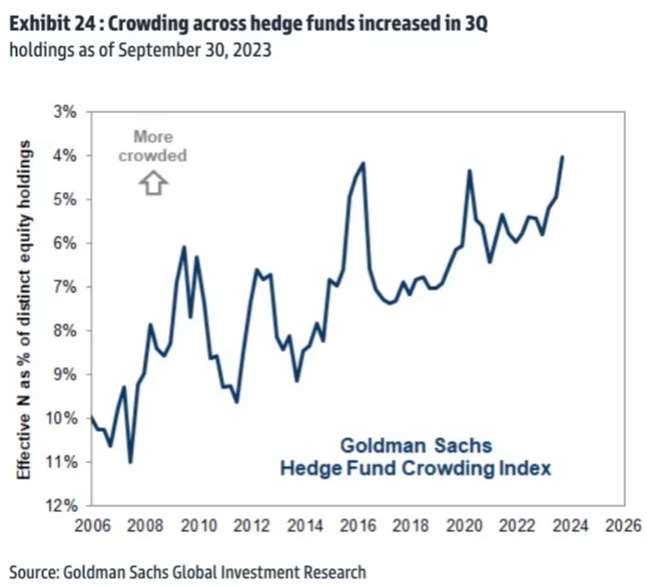

After analyzing the recent 13-F filings of 735 hedge funds, Goldman Sachs found that the current level of crowding in hedge fund investments has reached a record high.

Goldman Sachs noted in a Tuesday report that these asset management firms have doubled their investments in the Mag Seven—large-cap growth and tech stocks now make up 13% of hedge fund portfolios—while reducing their investments in sectors like energy and healthcare.

As the main force driving U.S. stock markets this year, increasing investments in tech stocks led by the Mag Seven indeed can significantly enhance portfolio returns and excess earnings. According to the Goldman Sachs report, stocks like Amazon and Microsoft, which are popular among fund managers, have seen returns of 31% this year, compared to the S&P 500's increase of only 19%.

However, as loads of money flow into these stocks, the risk associated with market concentration due to excessive capital accumulation is also growing.

Goldman Sachs wrote in the report that on average, these hedge funds have invested more than 70% of their portfolios in their top ten positions, the highest level in 22 years. This high concentration of capital makes contrarian stock trading more difficult over time, as the market will be full of sellers but lacking enough buyers.

In other words, these hedge funds could be trapped, with potentially up to $2.4 trillion of capital stuck.

Therefore, Goldman Sachs indicates that since many firms hold the same stocks, this leads to a high correlation between their investment strategies and returns, thereby increasing the risk of a large-scale collapse.

The market has had record low dispersion and hedge funds are paid to generate alpha, and excess returns, unlike long-only that are effectively forced to be indexers. So if they are concentrated and making money that's what they should be doing said Michael Oliver Weinberg, a family investment officer.

However, although hedge funds are flocking to tech stocks, GLP-1 drugs like Ozempic are also attracting hedge funds to shift again to the healthcare sector.

Goldman Sachs' report shows that benefiting from the growing demand for weight loss drugs, pharmaceutical stocks like Eli Lilly and Novo Nordisk are also becoming popular among hedge funds.

In summary, while following market trends can be interesting, it also has a tendency to crash suddenly. Given the large proportion of some big tech stocks in hedge fund portfolios and the fact that some of their gains this year were actually caused by massive purchases by hedge funds, any reversal in trends could have an extremely severe impact on these institutional investors and even the entire market.

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet