Fed's Rate Holds Firm: What Wall Street's Reading Between the Lines

On March 20, 2025, the Federal Reserve concluded its latest monetary policy meeting by opting to maintain interest rates at their current range of 4.25% to 4.50%. This decision reflects the central bank's ongoing effort to balance economic growth and price stability amid a backdrop of resilience and uncertainty. Fed Chair Jerome Powell, in his post-meeting press conference, provided insights into the Fed's reasoning and the state of the U.S. economy.

Powell described the economy as being "in a good place," highlighting a solid labor market with low unemployment and inflation trending closer to the Fed's 2% target. Recent economic data bolstered his optimism GDP grew at an annualized rate of 2.3% in the fourth quarter of 2024, driven largely by robust consumer spending. However, he tempered this positive outlook with a note of caution, pointing to "elevated levels of uncertainty" stemming from external factors, notably President Donald Trump's tariff policies. Powell emphasized that the Fed remains "intently focused" on its dual mandate of maximum employment and stable prices, but acknowledged that the path forward is complicated by these uncertainties.

The Fed's updated economic projections also shed light on its thinking. While it held rates steady, it forecasted two quarter-point rate cuts later in 2025, signaling a cautious easing of policy if conditions warrant. At the same time, the Fed raised its core inflation forecast to 2.8% by year-end, up from 2.5%, partly due to potential tariff-driven price pressures. Powell noted that it's "too early" to fully assess the inflationary impact of tariffs, underscoring the Fed's data-dependent approach moving forward.

Wall Street's Reaction to the Meeting

Wall Street greeted the Fed's decision to hold rates steady with little surprise, as analysts had widely anticipated this outcome given the mixed economic signals and looming trade policy uncertainties. The focus quickly shifted to the Fed's economic projections and tone, which revealed a central bank adopting a "wait-and-see" stance.

Analysts pointed to the Fed's revised forecasts—lower growth at 1.7% for 2025 (down from 2.1%) paired with higher inflation at 2.8%—as carrying a "stagflationary" undertone, a term suggesting weaker growth alongside rising prices. This combination raised eyebrows, with some questioning whether the Fed's projection of two rate cuts in 2025 was overly optimistic given the inflationary risks tied to tariffs. Major financial institutionsFISI-- noted that the Fed appears in no rush to lower rates, preferring to monitor how Trump's trade policies and other factors play out.

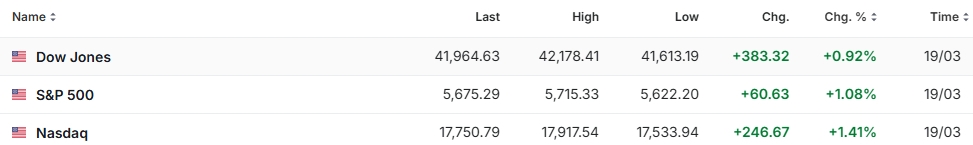

Despite these concerns, markets responded positively, with stock indexes climbing after the announcement (Nasdaq increased 1.41%, S&P 500 increased 1.08% and Dow Jones increased by 0.92%). Investors seemed relieved that the Fed avoided a hawkish pivot, which some had feared amid the upward inflation revision. The central bank's emphasis on patience and flexibility—rather than aggressive tightening—provided a sense of stability, even as analysts cautioned that uncertainties around tariffs could keep markets volatile in the months ahead.

Interpreting Powell's Remarks and Their Implications

Jerome Powell's post-meeting comments struck a cautious yet optimistic chord, offering a nuanced view of an economy that is strong but facing significant unknowns. Analysts latched onto his repeated references to "unusually elevated" uncertainty, particularly around tariffs, as a sign that the Fed is bracing for a complex road ahead.

Powell's assertion that the economy is "fine" provided some reassurance, but his lack of clear guidance on future rate cuts left room for interpretation. Many saw his remarks as an indication that the Fed is prepared to remain patient, tolerating slightly higher inflation in the near term—especially if driven by temporary factors like tariffs—while keeping a close eye on longer-term trends. He warned, however, that the Fed would act if inflation expectations began to drift in a way that threatened its 2% goal.

The tariff question loomed large in Powell's talk. He acknowledged that these policies could "feed inflation" depending on their scope and implementation, though he refrained from definitive predictions. Analysts interpreted this as a signal that the Fed is closely watching how trade policies affect prices and growth, with some suggesting that tariff-driven volatility could delay rate cuts if inflation accelerates.

Overall, Powell's remarks painted a picture of a Fed confident in the economy's resilience but wary of external shocks. For Wall Street, this translates to a period of heightened vigilance, as investors and analysts alike await clearer signals on how tariffs and other factors will shape the Fed's next moves.

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet