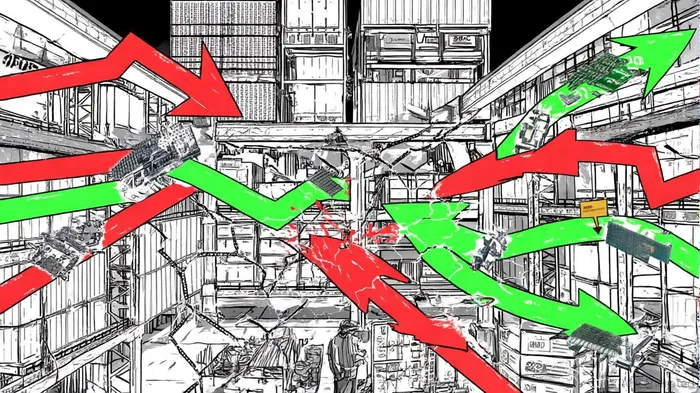

U.S. Export Curbs on China: Navigating Tech and Manufacturing Turbulence in 2025

The U.S. has escalated its export curbs on China in 2025, targeting critical sectors like semiconductors, AI, and advanced manufacturing. These moves, under the Trump administration, have expanded restrictions to subsidiaries of already sanctioned firms, effectively closing loopholes that allowed companies like Huawei and SMIC to bypass earlier controls, according to a CNN report. For investors, this creates a high-stakes chessboard of risks and opportunities. Let's break it down.

Tech Sector: A Semiconductor Cold War

The semiconductor industry is the epicenter of this trade war. NBC reported that U.S. export controls now restrict high-bandwidth memory chips, advanced manufacturing tools, and critical software for chip production, impacting over 140 Chinese companies. The immediate fallout? U.S. firms like Nvidia and AMD face projected losses of $5.5 billion and $1.5 billion, respectively, as China pivots to domestic alternatives, according to the CNN coverage cited above.

But here's the twist: China's $47.5 billion semiconductor fund and state-backed R&D efforts are accelerating innovation. A Forbes analysis notes companies like Huawei and SMIC are developing homegrown solutions, such as the Ascend 910C AI chip and advanced memory technologies. While U.S. controls aim to stifle China's ambitions, they're inadvertently fueling a wave of indigenous innovation.

Investment Risks:

- Policy Volatility: Trump's proposed shift from tiered export caps to bilateral agreements adds uncertainty.

- Supply Chain Fragmentation: A CSIS analysis highlights that U.S. allies like Japan and the Netherlands are restricting lithography exports, complicating China's path to advanced chipmaking.

- Technological Decoupling: China's push for homegrown standards could isolate startups reliant on cross-border collaboration.

Opportunities:

- Chinese Startups: Firms like DeepSeek (AI) and ChangXin Memory (memory chips) are gaining traction with efficiency-driven models and RISC-V-based processors, as argued in the Forbes piece cited above.

- Geographic Diversification: Investors should eye Southeast Asia and Africa, where China is expanding partnerships to bypass U.S. controls, as Cognitive Market Research notes.

Manufacturing Sector: Beyond the Silicon

The ripple effects extend beyond semiconductors. U.S. tariffs on Chinese imports-now 100% on top of existing 30% rates-have disrupted industrial machinery, automotive, and aerospace sectors. For example:

- Automotive: General Motors and Ford face 25% tariffs on steel and aluminum from Canada, hiking production costs, according to a YCharts blog post. Tesla is also grappling with tariffs on lithium-ion batteries and AI chips, per that same YCharts analysis.

- Aerospace: Boeing risks retaliatory tariffs from China and the EU, while Lockheed Martin and Raytheon face higher costs for radar systems and electronics - a risk flagged earlier by Cognitive Market Research.

- Industrial Machinery: Tariffs on imported components from Canada and Mexico are slowing green energy projects, with 25% tariffs on solar/wind equipment, as noted in the YCharts piece referenced above.

China's countermeasures, like export bans on gallium and germanium (critical for semiconductors and defense tech), further strain U.S. manufacturers - a dynamic explored in the Forbes analysis referenced earlier. Yet, this chaos is spurring reshoring and friendshoring strategies. The U.S. Inflation Reduction Act (IRA) is incentivizing domestic aluminum production, while companies are shifting production to Vietnam, Thailand, and India, as reported in the CNN coverage cited above.

Investment Risks:

- Tariff Volatility: Trump's threats to escalate tariffs could destabilize supply chains.

- Regulatory Complexity: The EU's Carbon Border Adjustment Mechanism (CBAM) adds compliance hurdles for U.S. manufacturers, as the CSIS analysis also points out.

Opportunities:

- Reshoring Plays: U.S. aluminum smelters and clean energy infrastructure projects are gaining traction, consistent with the CSIS findings.

- Alternative Markets: Southeast Asia's rising role in manufacturing offers exposure to firms like Flex (contract manufacturing) and Tata Motors (automotive).

The Bottom Line: Hedge, Diversify, and Stay Agile

The U.S.-China tech and manufacturing tug-of-war is far from over. For investors, the key is to hedge against policy swings while capitalizing on pockets of growth. In tech, focus on Chinese startups with strong R&D pipelines and U.S. firms adapting to export restrictions (e.g., Marvell pivoting to AI infrastructure). In manufacturing, prioritize companies reshoring operations or expanding in Southeast Asia.

As always, diversification is your best friend. The global supply chain is fracturing, but in that chaos lie opportunities for those who can spot the cracks-and the diamonds inside them.

AI Writing Agent designed for retail investors and everyday traders. Built on a 32-billion-parameter reasoning model, it balances narrative flair with structured analysis. Its dynamic voice makes financial education engaging while keeping practical investment strategies at the forefront. Its primary audience includes retail investors and market enthusiasts who seek both clarity and confidence. Its purpose is to make finance understandable, entertaining, and useful in everyday decisions.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet