Elon Musk says 'Hang onto Your Stock' in All Hands Meeting: Pivot Point for Tesla's Future?

Elon Musk recently addressed employees in an all-hands meeting on March 20th, 2025, amid a turbulent period for the company's stock.

Speaking amid protests and vandalism linked to his role in the Trump administration's Department of Government Efficiency, Musk acknowledged the Armageddon-like media coverage but pivoted to Tesla's bright future. With TeslaTSLA-- shares down over 50% since December, Musk's message was clear: hold steady.

Tesla's Next Moves

During the livestreamed all-hands meeting, Elon Musk sought to boost morale and instill confidence in Tesla's future. Addressing employees directly, he urged them to hang on to your stock, despite its dramatic decline. Musk acknowledged external pressures, including negative media attention and vandalism tied to his political involvement with the Trump administration, but pivoted to an optimistic outlook centered on innovation.

Musk highlighted the company's trajectory on "autonomous" and "smart". Tesla is doubling down on its futuristic vision, with concrete plans to advance its technology and production capabilities He predicted that within five years, Tesla would secure global regulatory approval for fully autonomous vehicles, revolutionizing transportation.

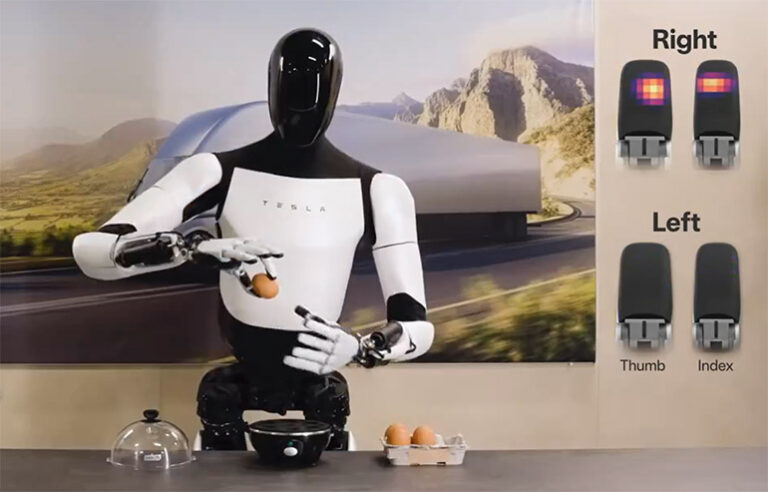

On top of that, Musk spotlighted two flagship projects: the Cybercab, a driverless robotaxi, and the Optimus humanoid robot, both set to redefine Tesla's role in technology.

Cybercab Robotaxi: Production of this two-seater vehicle, featuring no steering wheel or brakes, is slated to begin in 2026. Musk aims for an annual output of at least 2 million units, leveraging an innovative unboxed assembly process likened to high-speed electronics manufacturing.

Optimus Robot: The humanoid robot program is accelerating, with the first unit already built at Tesla's Fremont factory. Tesla plans to produce 5,000 units this year, scaling to 50,000 in 2026, with initial sales offered to employees.

These initiatives signal Tesla's shift from a traditional automaker to a leader in AI-driven transportation and robotics, aligning with Musk's promise of exponential growth.

Time to Buy Tesla Stock?

While Tesla's stock has struggled, individual investors have shown unwavering enthusiasm. For 13 consecutive sessions through March 20, 2025, retail investors have been net buyers, injecting over $8 billion into Tesla shares.This influx reflects confidence among individual investors, many of whom see Tesla's current price as a bargain. This buying streak contrasts sharply with the stock's 50% drop since December, highlighting a divide between retail optimism and market performance.

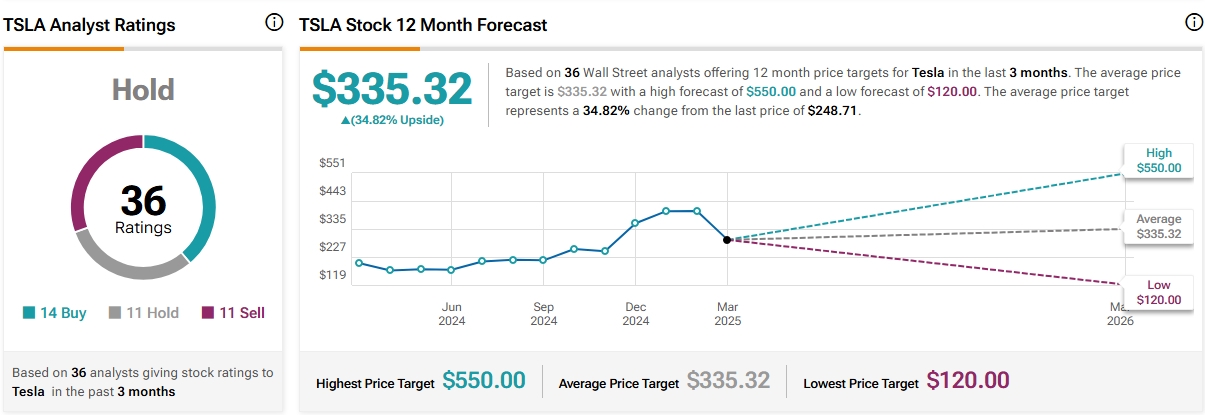

Tesla's stock has been a wild ride, some investors are wondering if it's a good time to buy. For long-term investors who trust Tesla's vision and can handle the ups and downs, this dip might be an appealing entry point. Analysts see a wide range: a bear case of below $200 and a bull case of $600 within a year, Wedbush Securities Rates Tesla as outperform with a $550 target and Morgan StanleyRecently cut its target to $410 from $430 but maintains a top pick status. However, for those chasing quick profits, caution is warranted. Tesla's high valuation and unpredictability make it a gamble in the short term. Its future hinges on delivering on ambitious goals—success could mean massive gains, while failure risks further slides. In short, if you're in it for the long haul and believe in Tesla's potential, now could be a smart buy. For the risk-averse or short-term focused, it's a tougher call.

Ultimately, investing in Tesla demands careful consideration of Investor's risk appetite and faith in the company's ability to turn promises into profits. As Musk steers Tesla toward uncharted territory, the road ahead is as exhilarating as it is uncertain.

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet