Dollar Stores Are Cheaper Than the Financial Crisis—Time to Buy?

U.S. low- and middle-income consumers are facing mounting inflationary pressure, forcing them to cut back on spending.

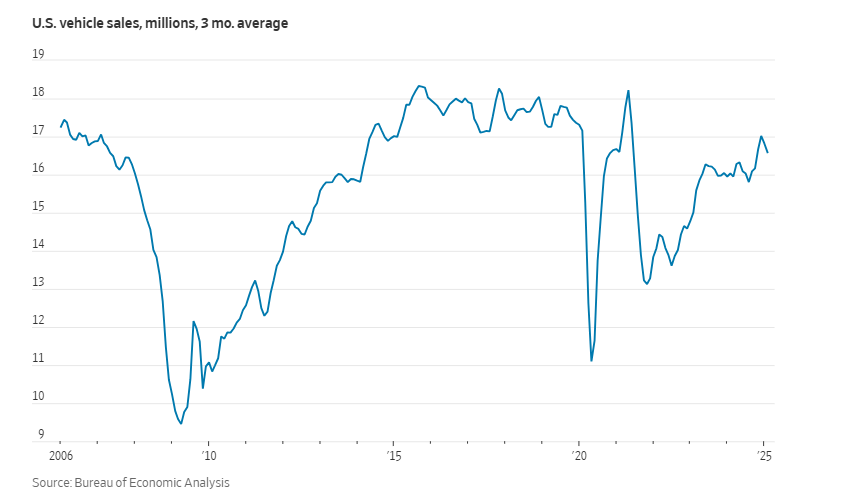

Now, consumers appear more hesitant about big-ticket purchases, such as buying a car. The Conference Board reports that consumer confidence has fallen to its lowest level in 12 years. Meanwhile, U.S. tariffs on steel, aluminum, and imported cars could push new car prices—already near record highs—even higher.

Over the years, improvements in vehicle quality and supply chain disruptions have driven the average age of U.S. light vehicles to 12.6 years, a historic high, according to S&P GlobalSPGI-- Mobility. In 2008, the average was just 10.3 years.

The trend of aging vehicles accelerated during the financial crisis when car sales plummeted, and owners opted to keep their old cars running to save money.

At the time, the stock market crashed, but auto parts retailers such as AutoZoneAZO-- and O'Reilly were unfairly punished as well—only to rebound strongly. From 2008 to 2011, they delivered total returns of 196% and 176%, respectively. Without the inefficient Cash for Clunkers program, their performance could have been even better.

In tough times, keeping a vehicle running is a priority—especially for cars aged 6 to 14 years, which receive the most maintenance. DIY repairs or buying parts and having a mechanic install them is often cheaper than purchasing parts directly from repair shops.

S&P stated last year that there are currently 110 million vehicles in this age range, a figure expected to grow by 40% by 2028.

The only problem? Wall Street has learned this lesson too well. The enterprise value-to-revenue ratios of the two major auto parts retailers are now near historical highs.

During the financial crisis, another retail segment that surprised investors was dollar storesDG--, which primarily serve low-income consumers. Over the past year, Dollar GeneralDG-- and Dollar TreeDLTR-- shares have plunged 45% and 47%, respectively. By revenue multiples, they are now even cheaper than during the 2008 financial crisis.

On Wednesday, Dollar Tree announced the sale of its budget brand Family Dollar to a private equity firm, underscoring the immense pressure the company is facing. Investors fear that welfare cuts could further squeeze consumer budgets.

The key difference between auto parts and dollar stores is competition. Essential goods have many sales channels—Walmart, after missing the opportunity 17 years ago, is now aggressively targeting low-income consumers, as is Amazon.

Even so, while Wall Street may be correct about economic trends, it may be wrong about investment opportunities. Low-income consumers have a spending floor on groceries and toiletries, just as they do on vehicle maintenance.

Buying dollar store stocks now requires a leap of faith, but the real bargain may be in dollar stores themselves—not auto parts retailers.

Fantastic stocks and where to find them

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet