Dollar General Q3 Earnings: Navigating Through Challenges and Maintaining Growth Plans

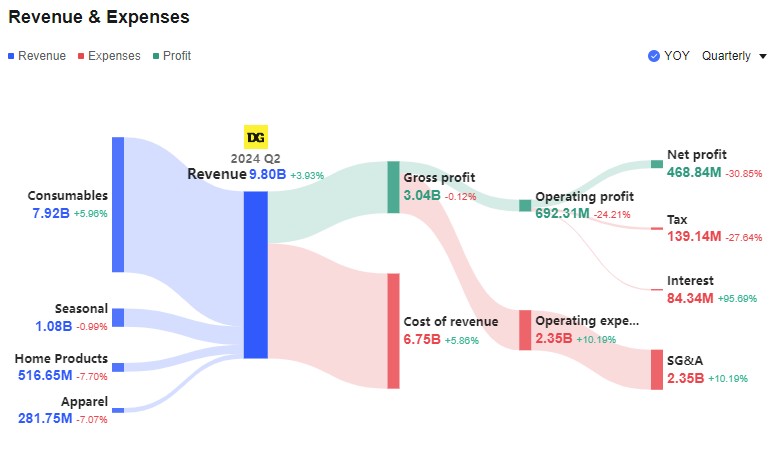

Dollar General Corp (NYSE: DG) released its Q3 fiscal year 2023 earnings report premarket, highlighting a net sales increase of 2.4% to $9.7 billion, primarily driven by new store openings. Despite this growth, the company faced significant challenges, including a 41.1% drop in operating profit and a 45.9% decline in diluted earnings per share (EPS) to $1.26. In this article, we will analyze Dollar General's financial performance, growth plans, and the potential for future investment.

Financial Performance Overview

Dollar General's gross profit rate decreased by 147 basis points to 29.0%, mainly due to increased inventory shrink, lower inventory markups, and higher markdowns. Selling, general, and administrative expenses (SG&A) rose by 183 basis points to 24.5% of net sales, with increased costs in several areas, including retail labor and depreciation. Interest expenses also surged by 53.3% to $82.3 million, largely due to higher average borrowings and interest rates.

Although the company faced significant challenges, CEO Todd Vasos remains optimistic, citing positive customer traffic and market share gains in both dollars and units. Vasos also emphasized the company's focus on operational excellence and future growth plans, including the announcement of the fiscal year 2024 real estate growth plan, which involves approximately 2,385 projects.

Balance Sheet and Cash Flow Highlights

As of November 3, 2023, Dollar General's total merchandise inventories decreased by 1.8% on a per-store basis to $7.4 billion. The company's capital expenditures for the 39-week period amounted to $1.2 billion, with significant investments in store improvements, distribution, and technology projects. Notably, the company did not repurchase any shares in the third quarter, leaving a remaining authorization of $1.4 billion for future repurchases.

The Board of Directors declared a quarterly cash dividend of $0.59 per share, reflecting the company's commitment to returning value to shareholders. However, the declaration and amount of future dividends will depend on various factors, including the company's financial condition and results of operations.

Growth Plans and Outlook

Dollar General Corp (NYSE: DG) reiterated its financial guidance for fiscal year 2023, expecting net sales growth in the range of 1.5% to 2.5% and same-store sales to be approximately flat to a 1.0% decline. The diluted EPS is projected to be in the range of approximately $7.10 to $7.60, with capital expenditures anticipated between $1.6 billion to $1.7 billion. The company also plans to execute around 3,110 real estate projects in the United States, including 990 new store openings.

For fiscal year 2024, Dollar General Corp (NYSE: DG) aims to execute approximately 2,385 real estate projects, including 800 new store openings, 1,500 remodels, and 85 relocations. This plan reflects a modest slowdown compared to recent years, which the company believes is prudent in the current environment.

Investment Potential and Conclusion

Dollar General's Q3 fiscal year 2023 earnings report showcases a mixed performance, with net sales growth and new store openings offset by a decline in operating profit and EPS. The company's focus on operational excellence and future growth plans, coupled with its commitment to returning value to shareholders through dividends and share repurchases, indicates a strong potential for long-term investment.

However, investors should closely monitor Dollar General's ability to address the challenges faced in Q3, such as inventory shrink, cost increases, and interest expenses. Additionally, the company's growth plans for fiscal years 2023 and 2024 will be crucial in determining its future success.

In conclusion, Dollar General's Q3 earnings report presents both opportunities and challenges for investors. While the company's growth plans and commitment to shareholder value are promising, investors should carefully assess the company's ability to address its financial challenges and adapt to the current retail environment.

Senior Analyst and trader with 20+ years experience with in-depth market coverage, economic trends, industry research, stock analysis, and investment ideas.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet