Diving into 13Fs: Hedge Funds Embrace AI Enthusiasm While Burry Goes Full Bear

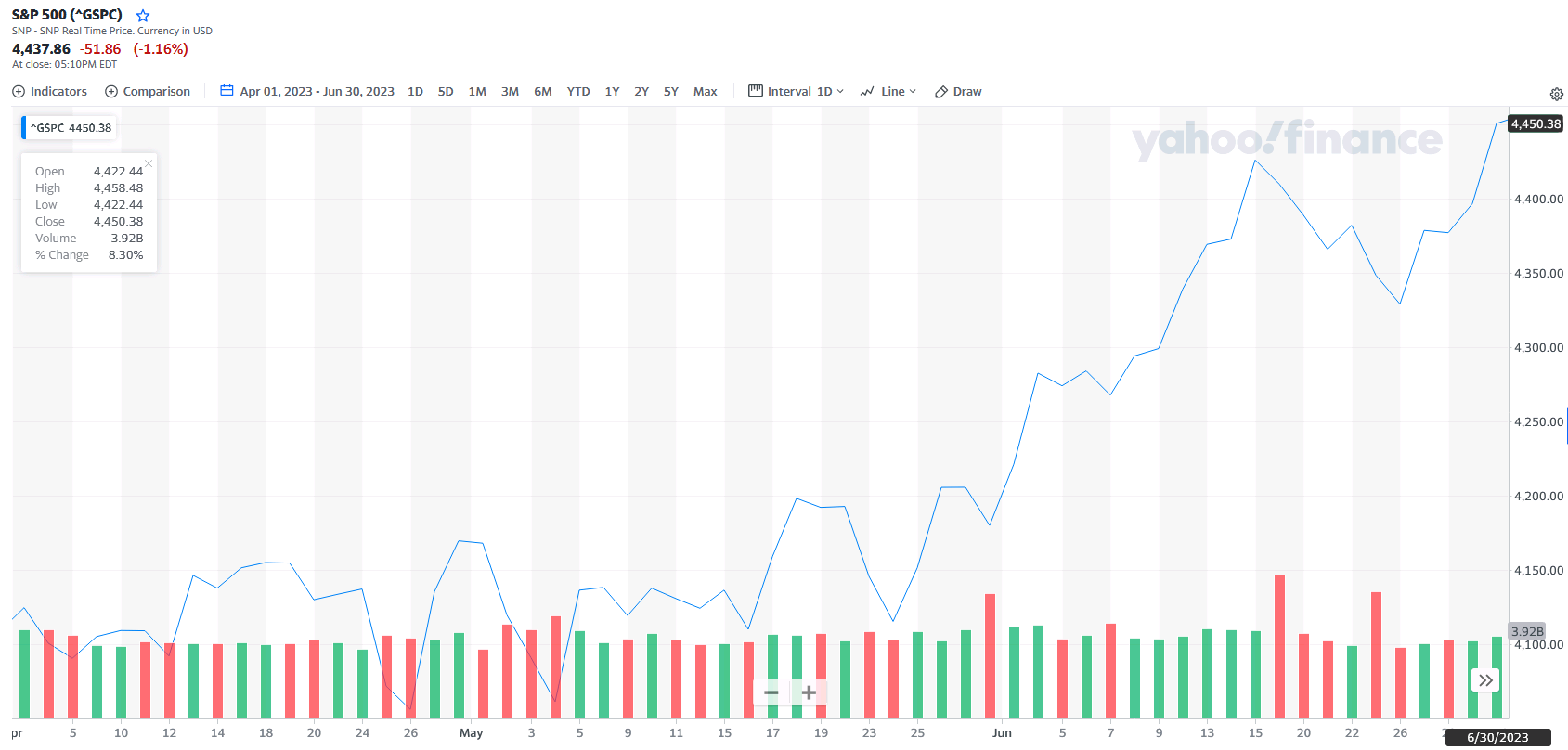

The Q2 13F reports have been released, shedding light on the activities of major funds and investment firms in the market during the three-month span from April to June. This period saw a significant 8.3% uptick in the S&P 500.

For individual investors, the 13F reports provide valuable insights into fund managers' strategies and their market perspectives during the reporting period.

In Q1, investors capitalized on the banking crisis and China's prolonged economic slowdown by adding stocks related to these topics to their portfolios.

However, Q2 marked the ascent of a bullish market, challenging investors to reposition their portfolios. Let's explore some of the notable occurrences of the quarter.

Burry Dumps China, Turns Fully Bearish on S&P 500

Burry's Scion Capital hedge fund adopted a bearish outlook encompassing both the broader market and the tech sector. The fund purchased 20,000 put options on the SPDR S&P 500, costing about $2.25 per contract, and an equivalent number of put options against the Nasdaq via the Invesco QQQ Trust, at around $2.70 per contract.

This bearish stance on QQQ reflects Burry's expectation that the prevailing AI-driven enthusiasm might wane, potentially causing the momentum behind SPY gains during the same period to diminish.

These actions underscore Burry's contrarian approach during a time when many were buying into the tech frenzy. Additionally, considering Burry's Q1 acquisitions, these moves could be seen as hedging strategies.

Regarding stock holdings, Burry exited several prominent positions. Notably, he divested his entire 250,000-share stake in JD.com, a stock that previously accounted for 10.26% of his portfolio.

Similarly, Burry liquidated his 100,000-share position in Alibaba, which had formerly constituted 9.56% of his portfolio, with an average quarterly trading price of $87.76.

In completing these strategic maneuvers, Burry also exited his 100,000-share investment in Zoom Video Communications. This stock, previously comprising 6.91% of his portfolio, had an average quarterly trading price of $66.97.

Hedge Funds Ride the AI Wave, Avoid Energy

Contrary to Burry, hedge funds snapped up shares of prominent technology giants during the quarter, aiming to benefit from the sector's robust rally and the widespread AI buzz.

According to Bloomberg, institutional investors boosted their holdings in Meta Platforms by 5.7 million shares during the quarter, amounting to a significant market value of $6.7 billion. This made it the most acquired stock by hedge funds during this period.

Additionally, in contrast to Michael Burry's moves, institutional investors reinforced their positions in Microsoft and Apple, adding fuel to the rally that surged through the market during the reported period.

In terms of sectors, technology held the most substantial weight in institutional investors' portfolios, comprising 28%, closely followed by healthcare at 16%.

Notably, investments in the energy sector saw the most significant decline across all industries, indicating that hedge fund managers did not anticipate the subsequent rise in oil prices.

Buffett Ventures into Real Estate, Parts Ways with Activision Blizzard

Distinguished investor Warren Buffett saw the Q2 bull market as an opportunity to recalibrate his market strategy. First, Berkshire Hathaway took positions in the oversold homebuilders sector, which surged by 18% during the period via the SPDR® S&P Homebuilders ETF.

Despite the industry's positive quarter, Buffett's strategic move runs counter to the backdrop of high interest rates, which act as a headwind for housing market activity. This suggests that Berkshire Hathaway's strategic positions might signal an anticipatory approach towards a potential future shift by the Fed.

Buffett's largest acquisition was DR Horton stock, with an impressive 5,969,714 shares acquired. Alongside this, BRK purchased 152,572 shares in Lennar and 11,112 shares in NVR to complete this strategic trio.

Buffett's company also boosted its position in Capital One Financial and Occidental Petroleum, a prescient move that seemingly paid off quickly due to rising oil prices in Q3.

This calculated move elevated COF holdings from 9,922,000 shares to 12,471,030, while the OXY position expanded from 211,707,119 shares to a confident 224,129,192 shares.

On the flip side, Buffett took advantage of the broader bull market to divest from several positions.

The company sold off Activision Blizzard, Celanese, Chevron, General Motors, and Globe Life.

Furthermore, the conglomerate completely exited Marsh & McLennan Companies, McKesson Corp., and Vitesse Energy, showcasing a resolute path towards recalibration.

While BRK's meticulously orchestrated moves did not drastically alter its portfolio landscape, it retained 915,560,382 shares in Apple by the end of Q2, reflecting Buffett's unwavering commitment to the tech giant, which plays a pivotal role in its broader investment strategy.

As of Q2 2023's conclusion, Buffett's holdings encompassed 49 distinct stocks, collectively valued at $348.19 billion. Prominently leading this portfolio was Apple, commanding a share of 51.00%, followed by Bank of America Corp at 8.51%, and American Express at 7.59%.

Fantastic stocks and where to find them

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet