Cracks Behind Google's Earnings: What to Worry About for Meta and Apple This Week

Alphabet (Google) posted better-than-expected earnings last week, but the stock failed to capitalize on the initial 4% surge, closing only 1.7% higher. While the tech giant reported impressive figures, its advertising business showed signs of fragility, with increased tariffs set to take effect in Q2 and massive investments in AI despite a slowing ads and cloud business amid uncertainty. Investors should be cautious as Meta and Apple report their earnings this week, as further cracks may surface. Here's why.

Google's Earnings: Not Perfect After All

Despite beating expectations for Q1, Google's earnings were far from perfect. Revenue surged 12% to $90 billion, and EPS jumped 48% to $2.81. On the surface, these numbers look stellar, but a deeper look reveals some concerning trends.

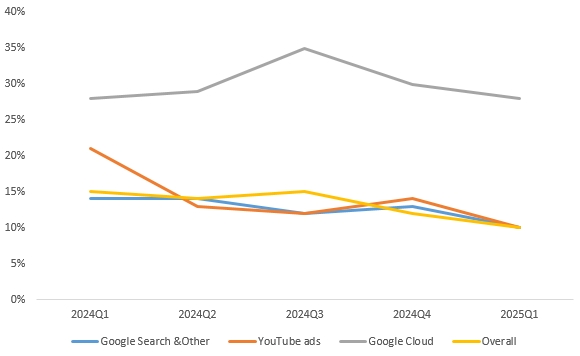

Google Search & Other, the main ads business, generated $50.7 billion in Q1, up 10% YoY—down from 12.5% YoY growth in the previous quarter. The most-anticipated video platform, YouTube, saw ad revenue grow 10% YoY, down from 14% in the prior quarter. In Q4, these two businesses had outperformed, contributing to overall 12% YoY growth. However, now Google's search and YouTube just keep pace, signaling that the entire business is decelerating.

Alphabet's Revenue Segment Y/Y vs Overall Growth

The outlook for ads remains gloomy. As Philipp Schindler, Chief Business Officer, noted: We're not immune to the macro environment, but we wouldn't want to speculate about potential impacts beyond noting that the changes to the de minimis exemption will obviously cause slight headwinds to our ads business in 2025, primarily from APAC-based retailers.

For context, Google generated $14.8 billion in APAC revenue, accounting for 16% of its Q1 sales, with a 12% YoY growth.

The management's optimistic but ambiguous response has been a big negative for earnings, as it failed to fully convince investors that the company is prepared for the challenges ahead. The market remains skeptical about the potential impacts on Google's ad business, especially in the unpredictable global environment.

Moreover, Google is facing a decrease in its cloud business backlog, with Q1's remaining revenue backlog at $92.4 billion, slightly down from $93.2 billion in Q4. Since most of this backlog is tied to Google Cloud, the business may face more challenges ahead as the growth engine has decelerated for last 2 quarters.

Despite these concerns, Google has confirmed an increase in capital expenditure to around $75 billion—up 43% YoY—despite slower cloud monetization and ongoing challenges in the ad sector. This move may not be the smartest, given the current market conditions.

Meta: Strong Earnings, But Guidance Raises Concerns

Meta is expected to post solid earnings post-market on Wednesday, but its guidance could be a major point of concern. Unlike Google, Meta will offer concrete guidance, which will be crucial in showing how tariffs could affect its AI-powered social platform—something the market is keenly watching. If they don't offer guidance this time, it could create even more trouble.

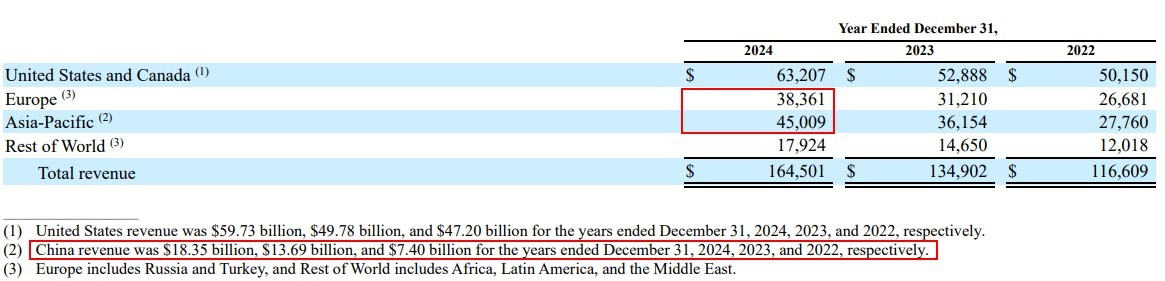

Meta has significant exposure to Europe and Asia Pacific (including China). The company posted $38 billion in Europe and $45 billion in Asia Pacific, together making up 52% of its overall sales last year. The potential for retaliatory tariffs between the US and the EU (as seen with Tesla in Europe), and escalating US-China tensions, could have a greater impact on Meta. While Meta doesn't operate directly in China, Chinese e-commerce companies leverage its platform to expand their overseas presence. Companies like Temu and Shein are major sponsors of Meta, and China contributed $18.35 billion to Meta's revenue—up 34% YoY, compared to 22% YoY growth for the company overall. If Chinese companies scale back their spending, Meta could face some trouble.

Additionally, Meta's efforts in AI might be more controversial than expected. The release of LLaMA 4 has stirred up debate, with some experts claiming its capabilities, particularly in coding, are similar to Alibaba's Qwen-QwQ-32B, despite LLaMA 4 having a significantly larger model size. Some Reddit users have also pointed out that LLaMA 4's performance benchmarks were artificially inflated. Furthermore, Meta's Head of AI Research, Joelle Pineau, is stepping down, indicating that Meta's AI division may be facing challenges.

Despite these concerns, Meta has confirmed it will continue its massive AI push, allocating $65 billion this year—an increase of 71% YoY. However, with the macro slowdown in ads, the company's heavy cash burn may not be sustainable. Even with potential spending cuts, investors are unlikely to be satisfied, and their worries could be justified.

Apple: More Concerns as US-China Tensions Escalate and Production Shifts to India

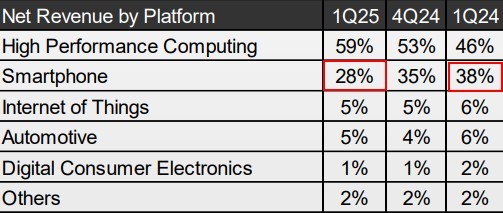

Apple faces a more complex set of challenges than Meta and Google. The AI-powered iPhone cycle isn't living up to expectations, and growing tensions between the US and China could further hurt margins. While TSMC, Apple's core chip foundry, reported solid earnings driven by robust AI chip demand, Apple's own smartphone-related revenue shows signs of strain.

In Q1, TSMC's 3nm wafer revenue, primarily driven by iPhone models, dropped 22%, a 4 percentage point decrease from the previous year. Smartphone revenue overall shrank to 28%, marking a 10 percentage point decline compared to Q1 2024.

TSMC Latest Earnings

Let's do some simple math: Q1 smartphone revenue divided by Q1 2024's, which is (25.5B * 28%) / (18.9B * 38%) - 1 = -0.6%. So, TSMC's smartphone revenue actually declined on a year-over-year basis, as demand remains a concern. Wall Street had been bullish on Apple's potential to spark a new supercycle with AI, but this is far from clear at the moment. Meanwhile, Apple's AI initiatives in China are still not launched, supposedly in April, dampening the potential boost from iPhone subsidies in the region. Competition from Huawei, China's leading domestic smartphone maker, is intensifying, which could further slow iPhone sales.

The bigger concern, however, is the outlook. Although Apple no longer offers detailed guidance, CFO Luca Maestri typically provides some color on estimates. This time, however, the outlook is highly uncertain. China remains the primary hub for Apple's product assembly, and any escalation in the tariff war could push margins even lower, with the current 20% tariff already taking a toll.

Apple has reportedly been planning to shift some iPhone assembly to India by 2026. However, this move seems unlikely in the short term, as it would require significant investment in new factories and skilled labor, with a slow ramp-up in production. If Apple does make this shift, could hint US-China trade war could escalate further, and Apple could become a major casualty.

Trump's tariffs have yet to impact the tech giants' earnings, but the uncertainty surrounding global trade, combined with slowing macro conditions, could disrupt their business models and hinder AI development. These challenges should be closely monitored, as they could lead to a major reevaluation of how these companies navigate the difficult environment ahead.

Independent investment research powered by a team of market strategists with 20+ years of Wall Street and global macro experience. We uncover high-conviction opportunities across equities, metals, and options through disciplined, data-driven analysis.

Latest Articles

Unlock Market-Moving Insights.

Subscribe to PRO Articles.

Already have an account? Sign in

Unlock Market-Moving Insights.

Subscribe to PRO Articles.

Already have an account? Sign in

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.