CPB Reports Earnings; Is It Time to Move into the Defensives?

Campbell Soup Company (CPB), a well-known food and beverage company with a long history dating back to 1869, released its first-quarter earnings report for fiscal year 2024. In this article, we will analyze the growth potential and investment value of CPB stock based on the provided information.

Overall, Campbell Soup has experienced decreases in dollar consumption throughout the summer in its soup portfolio. The ready-to-serve and Condensed eating businesses faced more pressure in Q1 as consumers shifted towards more flexible meal options. However, over the last four weeks, including Thanksgiving, Campbell Soup has seen improvements across all segments.

In terms of financial performance, Campbell Soup's Q1 results exceeded expectations. Adjusted earnings per share (EPS) stood at $0.91, surpassing analyst estimates of $0.88. Net sales reached $2.52 billion, meeting expectations.

Meals and beverages sales amounted to $1.40 billion (against the estimates of $1.38 billion), while snacks sales were $1.11 billion (compared to the estimates of $1.13 billion). However, it is worth noting that Campbell Soup's organic net sales saw a slight decline of 1%, although meals and beverages and snacks showed different trends.

Meals and beverages organic net sales dropped by 3% (compared to the estimates of -4.36%), while snacks organic net sales increased by 1% (against the estimates of +1.92%). The decrease in overall volumes, down by 5% in Q1, can be attributed to consumers opting for cheaper private-label brands and other alternatives. This shift in consumer behavior affected Campbell Soup's sales, reflecting the ongoing challenges in the consumer landscape.

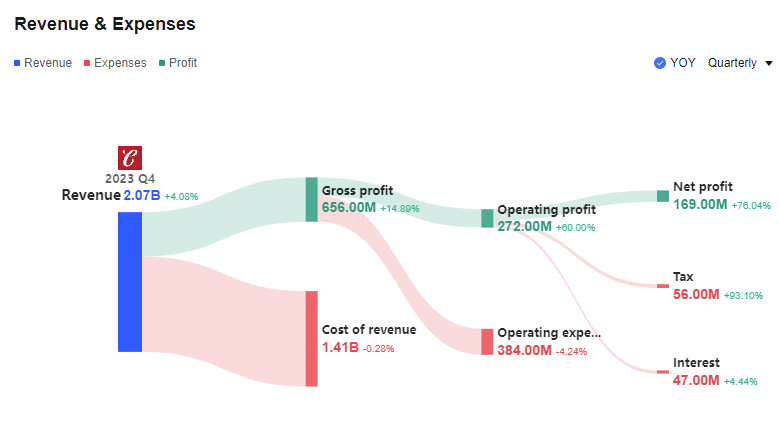

Gross profit decreased to $788 million from $834 million, with a gross profit margin of 31.3% compared to 32.4%. Adjusted gross profit decreased slightly, reaching $808 million, reflecting an adjusted gross profit margin of 32.1%. The decline in gross profit margin can be primarily attributed to unfavorable volume/mix, partially offset by net price realization, supply chain productivity improvements, and cost savings initiatives.

As reported, Campbell Soup's EPS decreased to $0.78 per share from $0.99 per share in the prior year period. Excluding items impacting comparability, adjusted EPS declined by 11% to $0.91 per share, largely due to the decrease in adjusted EBIT and slightly higher interest expense.

Despite these challenges, Campbell Soup reaffirmed its full-year fiscal 2024 guidance and expects the acquisition of Sovos Brands, Inc. to close in calendar year 2024. The company sees net sales of -0.5% to +1.5% and organic net sales growth of 0-2% for fiscal year 2024. Adjusted EBIT is expected to increase by 3-5%, and adjusted EPS is anticipated to grow by 3-5%.

Shares of CPB are seeing a muted reaction to the news. The stock fell from $56 at the beginning of the year to $40 as investors shunned staples given the better yields in money market funds and treasuries. The decline in rates could lead to a move in defensives like staples. The stock trades at 12.5x earnings compared to 17.8x for Consumer Defensives. It pays a Dividend Yield of 3.80% which is looking more attractive as the 10-year yield slides to 4.17% this morning,

Considering the provided information, investors should be aware of the challenges Campbell Soup is currently facing, including decreasing volumes and shifts in consumer preferences. However, the company's ability to meet or surpass earnings expectations, along with its reaffirmed guidance for fiscal year 2024, suggests potential opportunities.

Investors should closely monitor Campbell Soup's progress in addressing the challenges in the consumer landscape. Additionally, developments related to the acquisition of Sovos Brands, Inc. should be considered, as they may impact Campbell Soup's growth potential.

Overall, while Campbell Soup faces hurdles, the company's long-standing reputation and diverse portfolio of iconic brands provide a solid foundation. Investors should thoroughly assess the company's performance, growth strategies, and industry trends before making any investment decisions. (Note: This article is based solely on the information and statements provided in the prompt.)

Senior Analyst and trader with 20+ years experience with in-depth market coverage, economic trends, industry research, stock analysis, and investment ideas.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet