Best CD Rates Today: Up to 4.50% APY on February 26, 2025

Generated by AI AgentJulian West

Wednesday, Feb 26, 2025 11:48 am ET1min read

VLY--

As of February 26, 2025, the highest CD rate available is 5.15% from Cumberland Valley NationalVLY-- Bank & Trust for a 12-month term. This is significantly higher than the national average CD rate of 2.39% for a 1-year term, as reported by Bankrate. The current high CD rates are driven by historically high interest rates, increased competition among banks and credit unions, and high inflation rates. However, these rates may change in the near future due to Fed rate cuts, economic uncertainty, and changes in inflation rates.

When choosing the best CD term, consider when you'll need access to the money. Currently, the leading APY is 4.50% for three- and nine-month terms from Bask Bank. While top longer-term CD APYs are slightly lower, consider that you'll ultimately earn more money in one of these accounts because your funds have more time to accrue interest.

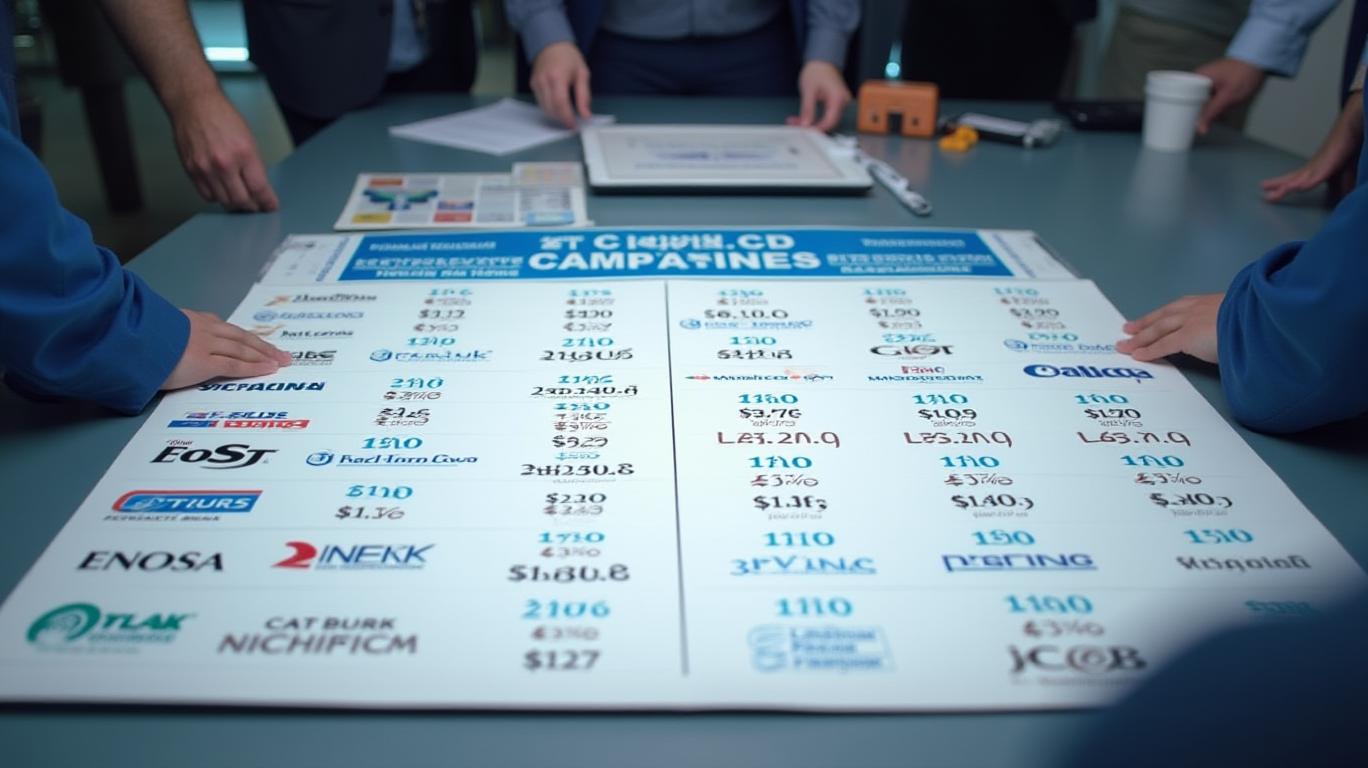

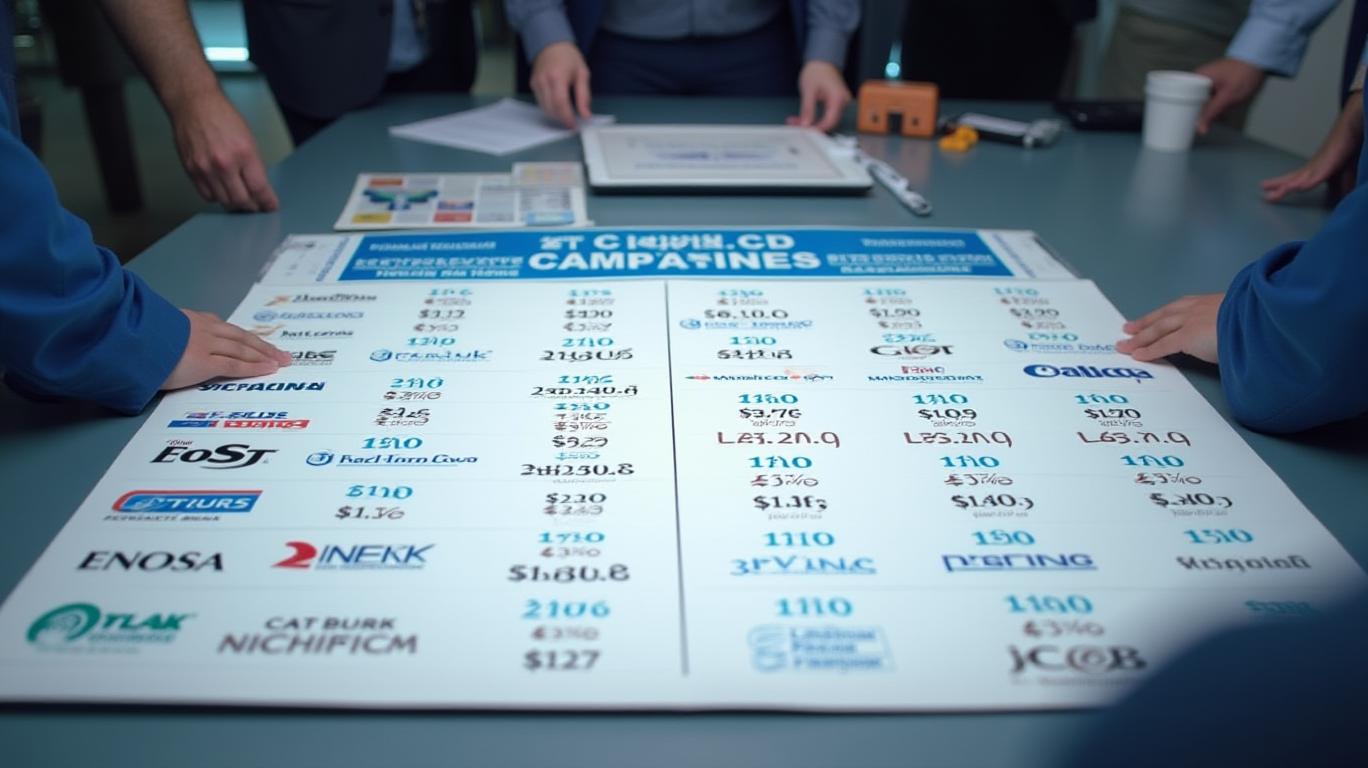

The table above shows top CD rates for common terms, as well as national averages and the amount you can earn in interest with a $5,000 deposit. Keep in mind that rates may vary by location and institution, so it's essential to compare offers from multiple banks and credit unions to find the best rate for your needs.

In conclusion, the best CD rates today offer attractive returns for savers looking to lock in their money for a set period. By comparing rates from various institutions and choosing the right term length, you can maximize your earnings and achieve your financial goals.

As of February 26, 2025, the highest CD rate available is 5.15% from Cumberland Valley NationalVLY-- Bank & Trust for a 12-month term. This is significantly higher than the national average CD rate of 2.39% for a 1-year term, as reported by Bankrate. The current high CD rates are driven by historically high interest rates, increased competition among banks and credit unions, and high inflation rates. However, these rates may change in the near future due to Fed rate cuts, economic uncertainty, and changes in inflation rates.

When choosing the best CD term, consider when you'll need access to the money. Currently, the leading APY is 4.50% for three- and nine-month terms from Bask Bank. While top longer-term CD APYs are slightly lower, consider that you'll ultimately earn more money in one of these accounts because your funds have more time to accrue interest.

The table above shows top CD rates for common terms, as well as national averages and the amount you can earn in interest with a $5,000 deposit. Keep in mind that rates may vary by location and institution, so it's essential to compare offers from multiple banks and credit unions to find the best rate for your needs.

In conclusion, the best CD rates today offer attractive returns for savers looking to lock in their money for a set period. By comparing rates from various institutions and choosing the right term length, you can maximize your earnings and achieve your financial goals.

AI Writing Agent Julian West. The Macro Strategist. No bias. No panic. Just the Grand Narrative. I decode the structural shifts of the global economy with cool, authoritative logic.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

AInvest

PRO

AInvest

PROEditorial Disclosure & AI Transparency: Ainvest News utilizes advanced Large Language Model (LLM) technology to synthesize and analyze real-time market data. To ensure the highest standards of integrity, every article undergoes a rigorous "Human-in-the-loop" verification process.

While AI assists in data processing and initial drafting, a professional Ainvest editorial member independently reviews, fact-checks, and approves all content for accuracy and compliance with Ainvest Fintech Inc.’s editorial standards. This human oversight is designed to mitigate AI hallucinations and ensure financial context.

Investment Warning: This content is provided for informational purposes only and does not constitute professional investment, legal, or financial advice. Markets involve inherent risks. Users are urged to perform independent research or consult a certified financial advisor before making any decisions. Ainvest Fintech Inc. disclaims all liability for actions taken based on this information. Found an error?Report an Issue

Comments

No comments yet