Canadian Dollar Turbulence: What Takes the Maple Currency on the Wild Ride?

The Canadian Dollar experienced a dramatic swing yesterday, leaving investors and market watchers scrambling to decipher its sudden volatility.

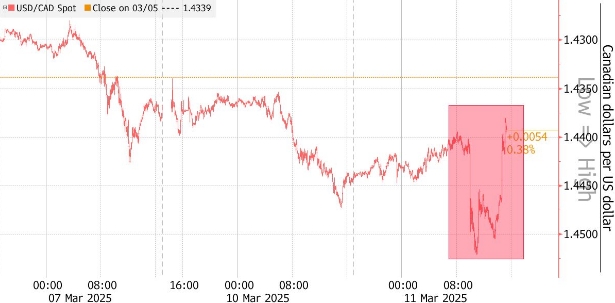

Initially, the CAD weakened against the U.S. dollar (USD), trading at near 1.451, a 0.3% decline from the previous session. However, it later rebounded by 0.4% to 1.438, recovering from a one-week low.

In this in-depth analysis, we explore the multiple forces at play—from tariff shock wave and domestic economic signals to global commodity trends and geopolitical shifts. We also bring you insights from top market analysts and offer a forecast on where this situation might lead.

The Tariff Shock wave: Trade Takes a Hit

The headline driver of today's CAD turbulence was Trump's threat to imposing a 50% tariff on Canadian steel and aluminum, which are vital Canadian exports to the U.S., as retaliation to the Canadian electricity charges to the U.S. These sectors fuel Canada's economy, with exports, mostly US-bound, comprising about 33.7% of its GDP. Higher tariffs threaten to choke export revenues, raise production costs, and erode Canada's trade surplus, all of which weigh heavily on the CAD.

The market's swift reaction, a flash crash to 1.4521, reflects fears of a looming trade war and further unsettling the currency. However, the decision by Trump to suspend the doubling tariffs on Canadian steel and aluminum, back to 25% from 50%, provided a lift to the currency, rose as much as 0.4% to 1.4380. Such drastic change laid bare its nature, vulnerability to trade turbulence and codependency to the U.S. Market and policies.

Monetary Policy Pressure: Interest Rate Gaps Widen

The CAD has been under strain since October 2024, partly due to diverging monetary policies. The U.S. Federal Reserve's higher interest rates contrast with the Bank of Canada's (BOC) dovish stance, making USD assets more attractive and draining capital from Canada. Today's turmoil intensified this dynamic, with whispers of a BOC rate cut, possibly 25 basis points on March 12, adding downward pressure. A wider rate differential could keep the CAD weak, even as the BOC aims to soften the tariff's economic sting.

Global Economic Tremors: The U.S. Crash Ripple Effect

The CAD's woes didn't unfold in isolation. A U.S. stock market crash today signaled broader distress, possibly tied to trade fears or recession signals. For Canada, a commodity-reliant economy, this raises red flags about oil prices, a key CAD anchor. As of March 12th, the Brent Crude is around $69 per barrel with a monthly decrease around 7%, signaling a global slowdown that depress demand, dragging the loonie lower. This external shock amplified the tariff's domestic impact especially since Canada's status as an oil exporter ties the CAD closely to crude prices. Historical patterns show the loonie often tracks oil price swings, and this linkage likely contributed to today's volatility.

Market Sentiment: Fear Fuels the Fall

Beyond the tariff news, investor psychology played a starring role. The announcement, coupled with the recent U.S. stock market crash, sparked a risk-off stampede. Social media lit up with reports of the CAD's plunge, amplifying panic. In times of uncertainty, the USD often emerges as a safe haven, siphoning demand away from riskier currencies like the CAD. This sentiment-driven sell-off likely exaggerated the tariff's immediate impact, driving the loonie's sharp decline.

Top Analysts' Commentary: Expert Voices Weigh In

Here's what leading analysts are saying about today's CAD chaos:

Monex Canada: If these tariffs persist, the CAD could sink below 1.50 by late 2025. The economic damage would be profound, and markets are bracing for it.

Goldman Sachs: Analysts link significant CAD losses to Trump's trade agenda, warning of sustained weakness unless trade tensions ease.

Bank of Canada: Official statements note trade policy uncertainty as a key CAD depressant since late 2024, with rate gaps adding strain.

Vanguard Canada:The Fed-BOC policy split is a structural drag on the loonie—tariffs just pour gas on the fire.

RBC Analysts: Offering optimism, they suggest a CAD recovery in 2025 is possible if trade disputes resolve or global growth steadies.

The prevailing view leans bearish, with recovery hinging on diplomatic breakthroughs or economic stabilization. For now, the CAD faces headwinds, with volatility likely to linger as tariff details and BOC actions unfold. Long-term prospects hinge on Canada's ability to weather this storm and seize any global upswing.

Conclusion: A Currency in the Cross-hairs

The Canadian Dollar's wild fluctuations today laid bare its vulnerability to trade shocks, magnified by a U.S. stock crash and structural pressures. Trump's tariffs ignited the chaos, but market fear, rate disparities, and global tremors fanned the flames. Data confirms a dramatic dip and fragile recovery, while analysts sound a cautious note. The loonie's future hangs in the balance—poised for further turbulence unless trade tensions cool or external conditions brighten. For now, Canada's currency remains on a knife-edge, its wild ride far from over.

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet