Broadcom: A Comprehensive Analysis of Q4 FY2023 Results and Future Prospects

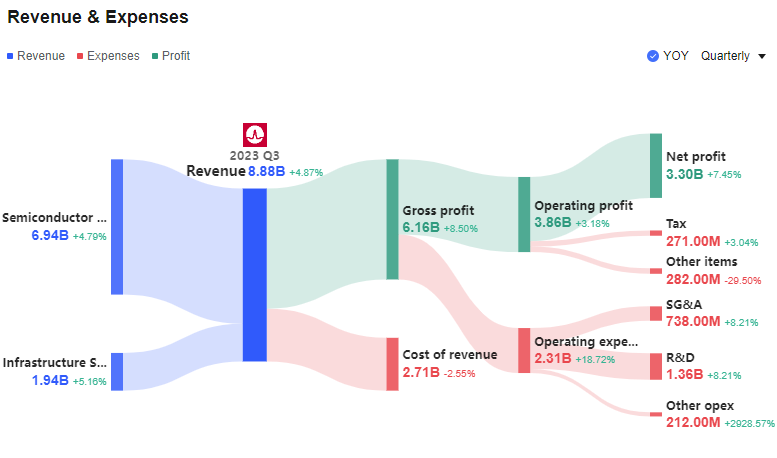

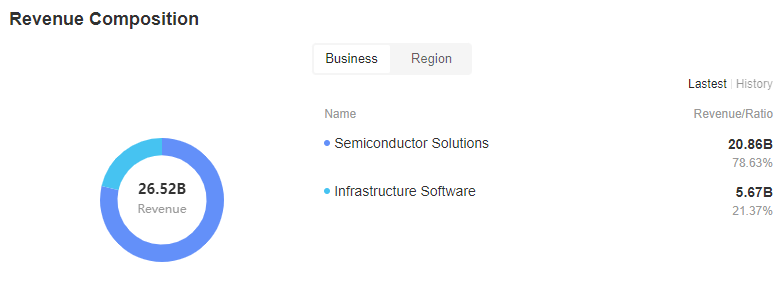

Broadcom (NASDAQ:AVGO), a leading semiconductor and software conglomerate, reported its Q4 FY2023 results, which were in line with analysts' expectations. The company's revenue grew by 4.3% year-over-year to $9.30 billion, driven by investments in accelerators and network connectivity for AI by hyperscalers. However, the company's full-year revenue guidance for FY2024 missed analyst estimates by 2.1%, implying 39.7% growth, down from 4.1% in FY2023.

Broadcom's Q4 FY2023 highlights include a GAAP profit of $8.25 per share, down from $8.80 per share in the same quarter last year. The company also reported non-GAAP EPS of $11.06, beating analyst estimates of $10.96. The free cash flow of $4.72 billion was similar to the previous quarter, while inventory days outstanding decreased from 74 to 60. Gross margin (GAAP) was 68.9%, down from 73.4% in the same quarter last year.

Broadcom's fiscal year 2023 revenue grew 8% year-over-year to a record $35.8 billion, driven by investments in accelerators and network connectivity for AI by hyperscalers. The company's semiconductor division spans wireless, networking, data storage, and industrial end markets along with an infrastructure software business focused on mainframes and cybersecurity.

The demand drivers for processors (CPUs) and graphics chips are currently secular trends related to 5G and Internet of Things, autonomous driving, and high-performance computing in the data center space, specifically around AI and machine learning. Like all semiconductor companies, digital chip makers exhibit a degree of cyclicality, driven by supply and demand imbalances and exposure to PC and Smartphone product cycles.

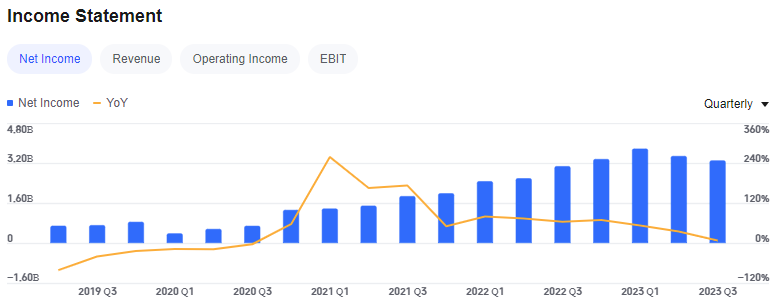

Broadcom's revenue growth over the last three years has been mediocre, averaging 13.5% annually. This was a sluggish quarter for the company, with revenue growing from $8.92 billion in the same quarter last year to $9.30 billion, a 4.3% year-on-year increase. However, the company's growth flipped from negative to positive this quarter, an encouraging sign for shareholders.

The pandemic has fundamentally changed several consumer habits, benefiting a founder-led company that has grown astonishingly fast with 40%+ free cash flow margins. With a market capitalization of $373 billion, a $14.19 billion cash balance, and positive free cash flow over the last 12 months, some investors are confident that Broadcom has the resources needed to pursue a high-growth business strategy.

Broadcom's strong improvement in inventory levels, adjusted EBITDA, and EPS, which outperformed Wall Street's estimates, stand out. On the other hand, its full-year FY24 revenue guidance underwhelmed, but it expects higher adjusted FY24 EBITDA profitability, partly thanks to its acquisition of software company VMware, which closed in November.

Overall, Broadcom's Q4 FY2023 results were mixed, with revenue growth in line with expectations but revenue guidance for FY2024 missing analyst estimates. The company's future prospects hinge on its ability to capitalize on secular trends related to 5G, IoT, and AI, as well as its successful integration of VMware. Long-term investors should be prepared for periods of high growth followed by periods of revenue contractions, which can sometimes offer opportune times to buy.

Senior Analyst and trader with 20+ years experience with in-depth market coverage, economic trends, industry research, stock analysis, and investment ideas.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet