Top Rated Stock | The 'Black Monday' Was Terrifying, But These Two Stocks Will Help You Survive The Upcoming Storm

In the tempestTPST-- of a market downturn, where fear becomes a more widespread sentiment, common investors usually run away from the chaos. However, those elite ones will choose to stay, because they know in every crisis always lies an opportunity, and these two companies are probably where they bet their money next - One a trailblazer in life-saving innovation, the other a fortress of timeless value.

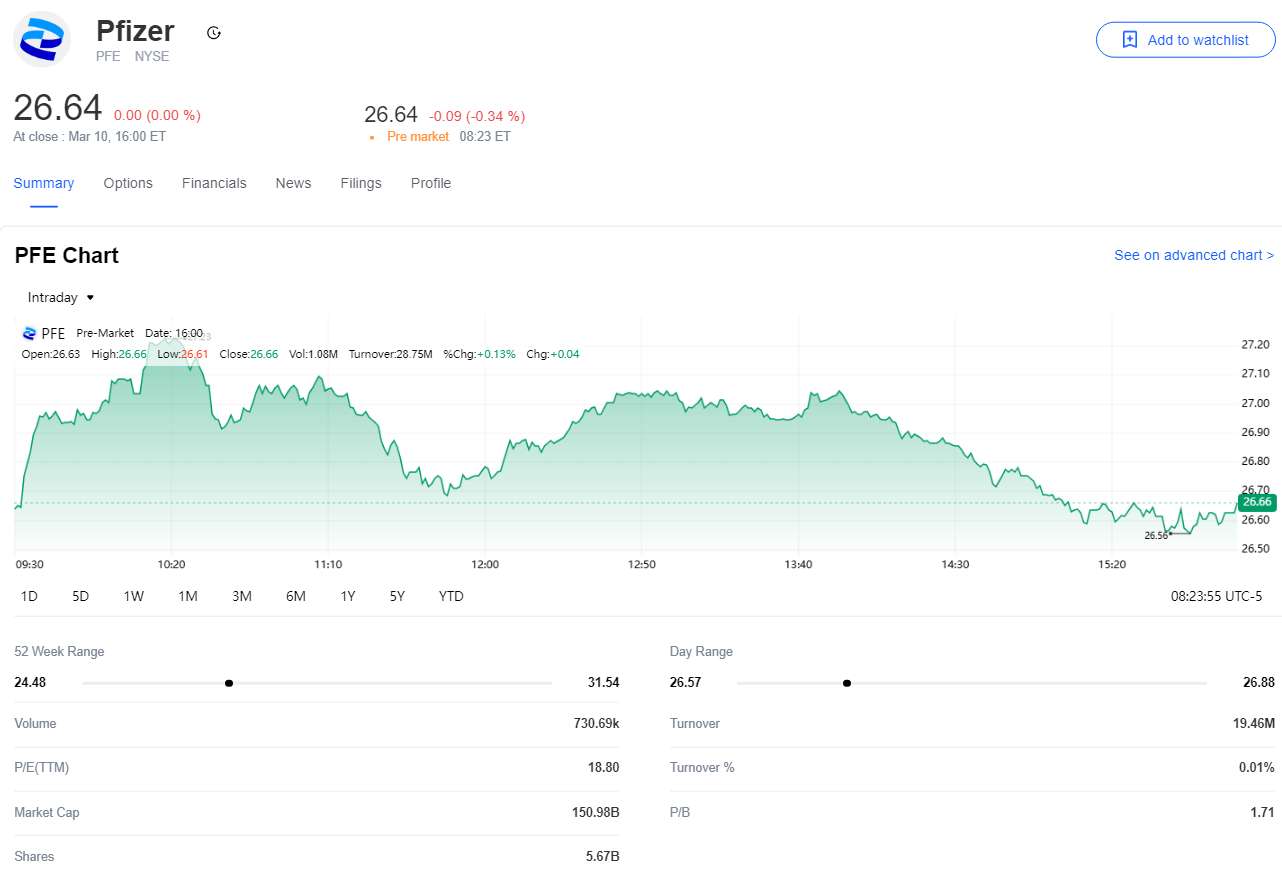

Pfizer Inc. (PFE): A Pharmaceutical Titan Poised for Growth

Current Share Price: $26.64

Market Capitalization: $150.98B

Median Target Price: $30.00

Recommendation: Buy

Pfizer Inc. (PFE) is a global leader in the pharmaceutical industry, renowned for its innovative medicines and vaccines. The company has been at the forefront of the fight against global health issues, most notably with its COVID-19 vaccine.

Financially, Pfizer demonstrates robust performance. The company's total revenue stands at an impressive $63.63 billion, reflecting revenue growth of 21.9%. This growth is underpinned by substantial gross profits amounting to $47.21 billion, with an exceptionally high gross margin of 74.19%. The company's EBITDA margins are strong at 36.65%, translating to an EBITDA of $23.32 billion, underscoring Pfizer's operational efficiency.

Pfizer's profitability metrics are noteworthy, with an operating margin of 15.90% and profit margins standing at 12.62%. These figures highlight the company's ability to convert revenue into profit effectively. The return on assets (ROA) is 4.64%, while the return on equity (ROE) is 9.06%, indicating efficient use of assets and equity to generate returns.

In terms of liquidity, Pfizer maintains substantial cash reserves of $20.48 billion ($3.61 per share) and a significant operating cash flow of $12.74 billion. The company's free cash flow is robust at $12.78 billion, ensuring ample liquidity to support ongoing operations and strategic initiatives. However, Pfizer's debt levels are considerable, with total debt amounting to $67.42 billion, resulting in a debt-to-equity ratio of 76.18%.

Analysts are optimistic about Pfizer's prospects, assigning a Buy rating with a mean score of 2.43. Price targets range from $25.00 to $42.00, with the median target set at $30.00. This positive outlook is supported by Pfizer's strong financials and market position.

In summary, Pfizer Inc.PFE-- remains a compelling investment opportunity in the pharmaceutical sector. With its strong financial performance, innovative product pipeline, and significant market presence, Pfizer is well-positioned for continued growth and success.

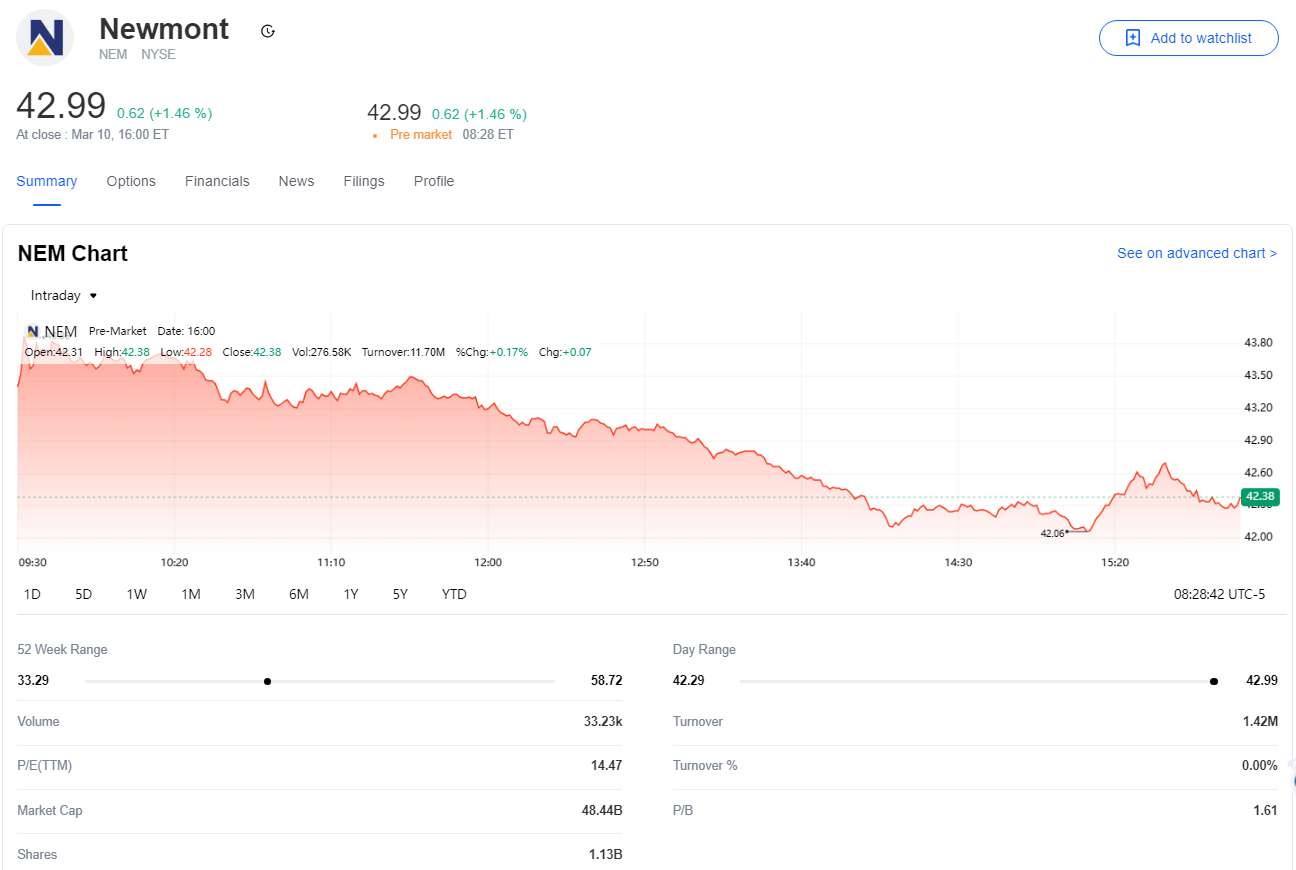

Newmont Corporation (NEM): Securing Value in Gold Mining

Current Share Price: $42.99

Market Capitalization: $48.44B

Median Target Price: $52.50

Recommendation: Buy

Newmont Corporation (NEM) stands as a powerful entity in the gold mining sector, boasting a significant global footprint that ensures it remains a key player in the supply of this precious metal.

Key financial metrics highlight Newmont's robust fiscal health. The company's revenue has surged to an impressive $18.68 billion, showcasing a robust year-on-year growth of 42.8%. This revenue growth is complemented by substantial gross profits amounting to $9.39 billion, yielding a gross margin of 50.27%. These figures are a testament to Newmont's operational efficiency and its ability to effectively manage its cost structure.

From a profitability standpoint, Newmont exhibits strong metrics, including an operating margin of 40.85% and an EBITDA margin of 46.71%. This high level of profitability underscores Newmont's operational proficiency and its ability to generate significant earnings before interest, taxes, depreciation, and amortization.

The company also demonstrates commendable liquidity, with total cash reserves of $3.64 billion ($3.21 per share) and a solid operating cash flow of $6.36 billion. However, it is noteworthy that Newmont maintains a significant debt load, with total debt standing at $8.97 billion, resulting in a debt-to-equity ratio of 29.80%. Despite this, the company's strong cash flow positions it well to manage its debt obligations effectively.

Profitability indicators are also positive, with a return on assets (ROA) of 6.61% and a return on equity (ROE) of 11.17%. These figures highlight Newmont's efficiency in utilizing its assets and equity to generate profits. Further, the profit margin of 17.92% reinforces the company's strong profitability outlook.

Analysts are optimistic about Newmont's future, assigning a Buy rating with a mean recommendation score of 1.95. Price targets for the stock range from $45.00 to $65.43, with the median target standing at $52.50. This optimistic outlook suggests that Newmont is well-positioned to continue its upward trajectory amidst market volatility.

In conclusion, Newmont Corporation presents a compelling investment opportunity in the gold mining sector, supported by its robust financial performance, efficient operations, and significant market position. For investors looking to gain exposure to precious metals, Newmont offers stability and potential for substantial returns.

Independent investment research powered by a team of market strategists with 20+ years of Wall Street and global macro experience. We uncover high-conviction opportunities across equities, metals, and options through disciplined, data-driven analysis.

Latest Articles

Unlock Market-Moving Insights.

Subscribe to PRO Articles.

Already have an account? Sign in

Unlock Market-Moving Insights.

Subscribe to PRO Articles.

Already have an account? Sign in

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.