Billionaires Lose Big, Buffett Bags $12 Billion - Oracle of Omaha's Wisdom Still at Work

In 2025, as President Donald Trump's tariff policies sent shockwaves through global markets, triggering a sell - off that erased trillions of dollars from global equities, the world's billionaires faced a brutal wealth wipeout. However, Warren Buffett, the 94 - year - old investment legendLEGN--, stands out as an exception.

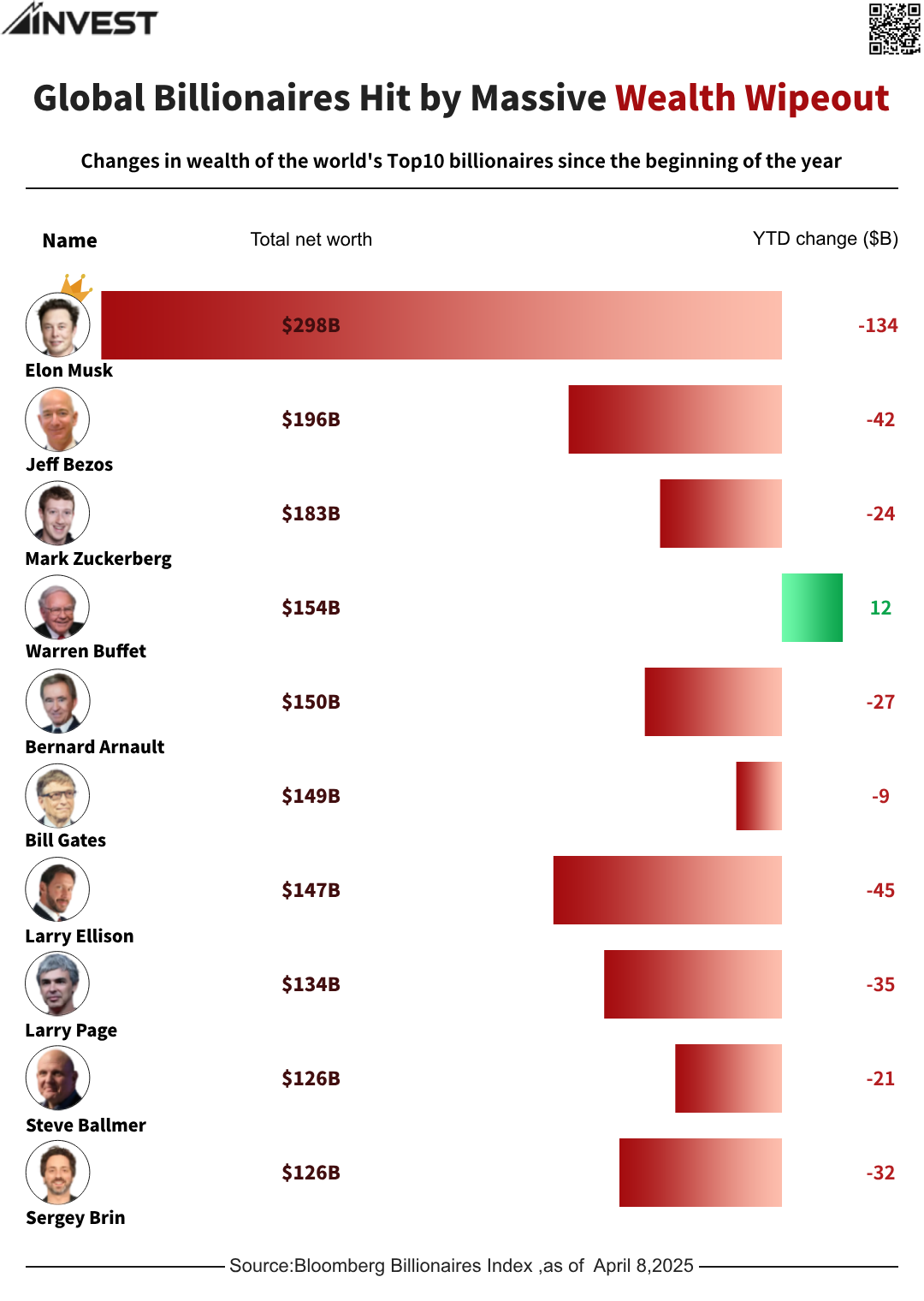

According to the Bloomberg Billionaires Index as of April 8, 2025, Buffett's net worth has increased by $12 billion this year, soaring to $154 billion. This makes him the world's fourth - richest person. He is one of only two in the top 20 of the Bloomberg ranking whose wealth has grown this year, with the other being L'Oreal SASA-- heiress Francoise Bettencourt Meyers.

In stark contrast, other billionaires have suffered significant losses. Elon Musk, despite remaining the world's richest person, has seen his fortune plummet by $134 billion to $298 billion. Jeff Bezos' wealth has declined by $42 billion to $196 billion, Mark Zuckerberg's by $24 billion to $183 billion, and Bernard Arnault's by $27 billion to $150 billion. Bill Gates, Larry Ellison, Larry Page, Steve Ballmer, and Sergey Brin have also witnessed substantial dips in their net worths.

The market turmoil has been intense. Since Trump's tariff announcement, Wall Street has shed nearly $8 trillion in market value, with around $5 trillion vanishing in just two trading sessions. The Dow Jones Industrial Average plunged 2,231 points on one particularly grim Friday, its worst single - day loss since March 2020. The S&P 500 dropped 6%, losing $5 trillion in value in 48 hours, and the Nasdaq fell 5.8%. JP Morgan downgraded U.S. GDP growth for 2025 to - 0.3% from 1.3%, and predicts a two - quarter recession starting in Q3.

Buffett's Berkshire HathawayBRK.B-- has shown relative resilience. Its shares have dropped 7.91% since April 2, compared to the 10.13% drop of the S&P 500. This is partly because the property and casualty sector, in which Berkshire has significant exposure, is relatively shielded from global trade disruptions.

Moreover, Buffett's strategic moves have paid off. He has reduced stakes in AppleAAPL-- and Bank of America, whose shares have tumbled post - tariff announcement. Instead, he doubled down on Japanese trading giants. Early in 2025, Berkshire increased its stakes in Japan's five largest trading houses: Mitsui & Co. (9.82%), Mitsubishi Corp. (9.67%), Sumitomo Corp. (9.29%), Itochu Corp. (8.53%), and Marubeni Corp. (9.30%). This has propelled Berkshire Hathaway's market cap past $1.14 trillion, overtaking companies like Tesla and bolstering Buffett's wealth.

In this landscape of widespread billionaire wealth destruction, Buffett's ability to navigate the storm and even grow his fortune showcases his unparalleled investment acumen and long - term - focused strategy.

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet