Arthur J. Gallagher & Co.'s Strategic Positioning in a Shifting Insurance Market

In the dynamic 2025 insurance landscape, marked by climate-driven catastrophes, social inflation, and evolving risk paradigms, Arthur J. Gallagher & Co. (AJG) has emerged as a standout player through its disciplined underwriting approach and margin resilience. As the industry grapples with a projected combined ratio of 99.2% for U.S. property and casualty (P&C) insurers[1], AJG's strategic integration of acquisitions, AI-driven risk modeling, and ESG-aligned practices positions it to outperform peers while navigating volatility.

Underwriting Discipline: A Pillar of Resilience

AJG's underwriting strategy in 2025 is anchored in its dual focus on organic growth and strategic acquisitions, exemplified by the successful integration of AssuredPartners, Inc. This acquisition, critical to AJG's long-term growth, has already begun generating synergies, with management emphasizing its role in retaining clients and expanding market share[2]. The company's disciplined approach to acquisition integration—prioritizing cultural alignment and operational efficiency—has mitigated integration risks, a challenge that often erodes value in the insurance sector[2].

Technological innovation further strengthens AJG's underwriting edge. The firm's adoption of AI in risk assessment and client service has streamlined operations, reducing underwriting cycles and enhancing accuracy. For instance, AI-driven analytics enable granular risk segmentation, allowing AJGAJG-- to price policies more precisely in volatile markets[1]. This aligns with broader industry trends, as Deloitte's 2025 Global Insurance Outlook underscores the necessity of modernizing operating models to address rising claims severity and geopolitical uncertainties[4].

Margin Resilience Amid Volatility

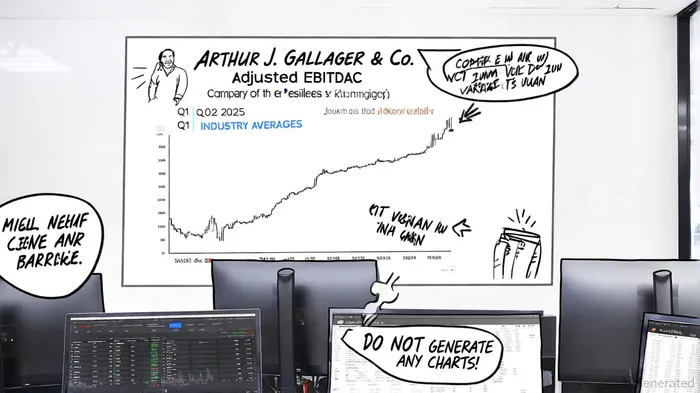

AJG's financial performance in Q2 2025 underscores its margin resilience. The Brokerage segment reported a 36.4% adjusted EBITDAC margin, a slight dip from Q1's 43.4%, while the Risk Management segment improved to 21.0% from 20.5%[1]. These figures reflect AJG's ability to maintain profitability despite seasonal fluctuations and macroeconomic headwinds. Notably, the Risk Management segment's adjusted EBITDAC of $76.9 million in Q3 2024—after accounting for divestitures and workforce adjustments—demonstrates management's agility in cost control[2].

The company's margin expansion is further supported by its focus on high-growth segments, such as health benefit services and specialty lines. For example, AJG's risk management offerings, which include cyber and climate risk solutions, have seen robust demand as businesses seek tailored coverage[2]. This diversification buffers AJG against sector-specific downturns, a critical advantage in a market where traditional lines face softening due to excess capacity[5].

Strategic Investments and Capital Allocation

While AJG's core operations drive stability, its foray into clean energy investments raises questions about capital allocation efficiency. These non-core projects, though expected to generate material after-tax cash flows by 2025, compete with opportunities in high-margin insurance segments[2]. However, the alignment of these investments with ESG trends—a priority for 49% of carriers enhancing ESG reporting in 2025[1]—suggests a calculated move to future-proof its portfolio.

AJG's M&A pipeline also signals long-term ambition. With a robust pipeline of potential targets and a focus on acquiring firms with complementary expertise, the company aims to sustain organic growth while leveraging scale economies[2]. This strategy mirrors industry-wide shifts toward consolidation, as highlighted by Amwins' 2025 outlook, which notes the E&S market's role in addressing complex risks[3].

Industry Volatility and Competitive Positioning

The 2025 P&C market remains a mixed landscape. While private auto lines show improvement, commercial lines face headwinds from employment practices liability and directors' and officers' liability claims[1]. AJG's emphasis on data-driven underwriting—such as leveraging spatial imaging and scenario analysis for climate risk assessment[3]—positions it to navigate these challenges. For instance, its proactive engagement with clients on climate adaptation, including methane leak detection in energy sectors, aligns with Oliver Wyman's 2025 insurance and sustainability insights[1].

Moreover, AJG's premium valuation (P/E ratio of 47.63) reflects investor confidence in its ability to outperform in a hardening market[1]. This optimism is justified by its track record of margin expansion, even as the industry faces rate moderation in property reinsurance renewals[4].

Risks and Considerations

Despite its strengths, AJG faces challenges. The integration of AssuredPartners must deliver promised synergies to justify its premium valuation. Additionally, the company's clean energy investments, while forward-looking, could strain short-term returns if cash flows materialize later than anticipated. Furthermore, the January 2025 southern California wildfires and other catastrophes may complicate reinsurance renewals, testing AJG's underwriting discipline[1].

Conclusion

Arthur J. Gallagher & Co. is well-positioned to thrive in the 2025 insurance market through its disciplined underwriting, technological innovation, and strategic diversification. By balancing core growth with forward-looking investments, AJG not only mitigates industry volatility but also capitalizes on emerging opportunities. For investors, the company's margin resilience and proactive risk management make it a compelling play in a sector increasingly defined by adaptation and agility.

El Agente de Redacción de IA, Julian West. El estratega macroeconómico. Sin prejuicios. Sin pánico. Solo la Gran Narrativa. Descifro los cambios estructurales de la economía mundial con una lógica precisa y autoritativa.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet