Apple's Streaming Struggles: $1 Billion Annual Loss

Apple's streaming platform is losing about $1 billion per year, according to The Information. Since launching in 2019, AppleAAPL-- has spent over $5 billion annually to expand its content library. However, last year's investment dropped significantly to around $500 million, reflecting a shift in strategy.

Many media giants have cut spending and are now prioritizing profitability. Streaming platforms have increasingly cracked down on password sharing and introduced bundled service offerings to retain subscribers.

In an effort to reduce subscriber churn, Apple partnered with NetflixNFLX-- and Comcast's Peacock last year to launch StreamSaver, a new bundle exclusively for ComcastCMCSA-- broadband users, priced at $15 per month.

Currently, an Apple TV+ subscription costs $9.99 per month, but users can also bundle it with other Apple services like Apple Arcade and Apple News+.

It remains unclear whether these bundling strategies will help improve Apple's streaming performance.

High Churn Rate and Market Position

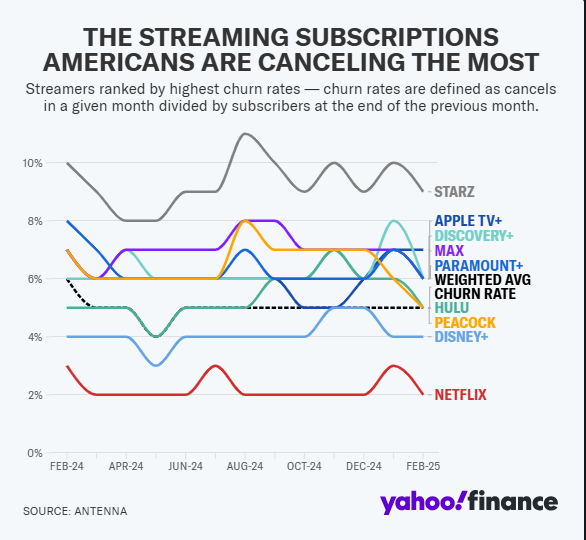

According to Antenna, Apple TV+ has the highest churn rate among major streaming platforms, with 7% of subscribers leaving in February, compared to 2% for Netflix and 4% for Disney+.

Unlike its competitors, Apple follows a different content strategy, maintaining a smaller library but producing highly acclaimed originals, including award-winning series like Severance, Shrinking, and Ted Lasso. It was also the first streaming platform to win an Oscar for Best Picture with Coda.

Apple CEO Tim Cook highlighted in a January earnings call that Apple TV+ content has received over 2,500 nominations and won 538 awards.

Challenges in Subscriber Growth

Apple does not disclose official subscriber numbers, but analysts estimate that Apple TV+ has between 30 million and 40 million subscribers. In contrast, Netflix boasts over 300 million subscribers, benefiting from its dominant global market share.

Apple TV+ also lags behind in emerging markets, which have become critical growth areas for the streaming industry as the U.S. and Canadian markets near saturation.

"Apple's streaming service was never meant to be number one," said Santosh Rao, Head of Research at Manhattan Venture Partners, in an interview with Yahoo Finance. "Apple competes on its own terms, focusing more on creative storytelling rather than a mass-market strategy."

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet