Anticipated Interest Rate Cut Boosts Long-Term Treasury Bond Investments

Bond investors are anticipating that the Federal Reserve will abandon its inclination to raise interest rates at the upcoming FOMC meeting and some hints for possible multiple rate cuts this year, which would be the first cuts since the outbreak of the COVID-19 pandemic in 2020.

To be more specific, portfolio managers have increased their bets on long-term U.S. government bonds ahead of the interest rate meeting, reflecting their expectation that the yields on these bonds will decline as the Federal Reserve moves towards easing interest rates.

Kathy Jones, head of fixed income strategy at Schwab Financial Research Center in New York, says: We have throughout the past year suggested extending duration in anticipation of the cycle turning.

Generally speaking, the market widely expects the Federal Reserve to keep interest rates unchanged at this week's policy meeting, and some investors believe that following last month's policy meeting, the Federal Reserve's tone was seen as deviating from a tight policy outlook, hence the Federal Reserve may reinforce its dovish stance.

Previously, at the meeting on December 12th-13th, 17 of the 19 Federal Reserve officials predicted that the policy rate would be below last month's level by the end of this year. The Federal Reserve's median forecast indicates that the rate will drop by 74 basis points from the current range of 5.25% to 5.50%.

In reaction, Guneet Dhingra, head of U.S. interest rate strategy at Morgan Stanley in New York, said the Federal Reserve this week may talk more about easing bias. The only question is how quickly it starts and how fast the easing is.

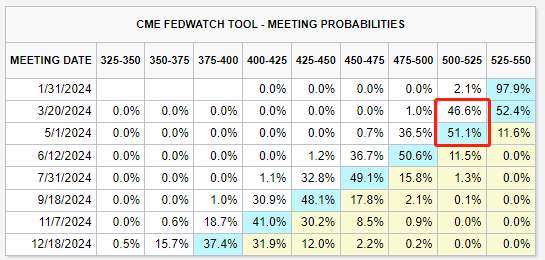

The market expects the Federal Reserve to make its first rate cut at the meeting on April 30th-May 1st, with a probability of 91%. Meanwhile, futures show that the probability of a rate cut at the meeting on March 19-20 is less than 50%. Three weeks ago, the probability of a rate cut in March was as high as 80%.

Therefore, investors move to long-term government bonds to cope with potential rate cut expectations.

Jeff Klingelhofer, co-director of investment at Thornburg Investment Management, says: We have moved to longer duration for all the portfolios we manage. He adds: The bar for reverting back to higher rates is quite high and we're unlikely to go there.

The director also pointed out that given the strength of the Federal Reserve's interest rate increases over the past two years, it is more likely that the U.S. economy will enter a recession.

However, since the last meeting, U.S. non-farm employment data for December and the GDP growth for the fourth quarter of 2023 were unexpectedly strong.

Ryan Swift, a bond strategist at BCA Research in Montreal, wrote that although U.S. economic data as a whole is solid, the federal funds futures market's expectations lean to the dovish side, and investors are more likely to reduce the part of their expected rate cuts in futures contracts in their near-term trading behavior.

He suggests that this indicates investors should keep the duration of their bond holdings close to the market benchmark, or maintain a steady investment tendency.

According to a survey of economists, the Federal Reserve is likely to wait until the second quarter of 2024 to start lowering interest rates. These economists believe that it would be a good time for the central bank to lower borrowing costs at the meeting on June 11th-12th.

I think it's unlikely that we see 5% again, Jeff Klingelhofer added. In order to see above 5% in the 10-year, you have to believe that either we don't get a recession or the Fed doesn't cut over the next 10 years. But he noted neither of these scenarios is likely to happen.

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet