AMD's AI Push: Can the New MI300 Series Compete with Nvidia in the Booming AI Chip Market?

Advanced Micro Devices (NASDAQ: AMD) has made significant strides in recent years, positioning itself as a strong competitor in the computing industry. With the unveiling of its new MI300 Series data center AI accelerators, ROCm 6 open software stack, and Ryzen 8040 Series processors with Ryzen AI, AMD is aggressively targeting the rapidly growing artificial intelligence (AI) market. This article will examine the growth potential and investment value of AMD stock by analyzing relevant news, fundamental factors, technical specifics, and current market data.

At the Advancing AI event, AMD showcased its collaboration with industry leaders to deliver advanced AI solutions across various platforms. The company launched its new products, including the AMD Instinct MI300 Series data center AI accelerators, ROCm 6 open software stack, and Ryzen 8040 Series processors with Ryzen AI. The launch has received positive feedback from analysts and industry giants such as Microsoft, Meta, Oracle, and Cisco.

AMD's CEO, Dr. Lisa Su, expressed her confidence in the company's ability to power the end-to-end AI infrastructure, stating that they are seeing strong demand for their new Instinct MI300 GPUs. AMD is also building significant momentum for its data center AI solutions with the largest cloud companies, server providers, and innovative AI startups.

Following the MI300 launch event, several analysts have revised their price targets and maintained a bullish outlook on AMD stock. TD Cowen raised their price target from $125 to $140, maintaining a Strong Buy rating, while RAJA bumped their price target from $125 to $140, also maintaining a Strong Buy rating.

Key takeaways from the event include the official announcement of Oracle and Meta as MI300X customers, as well as a wide variety of OEM and ODM partners. TD Cowen's belief in AMD's ability to meaningfully participate in the large AI accelerator growth TAM has been reinforced.

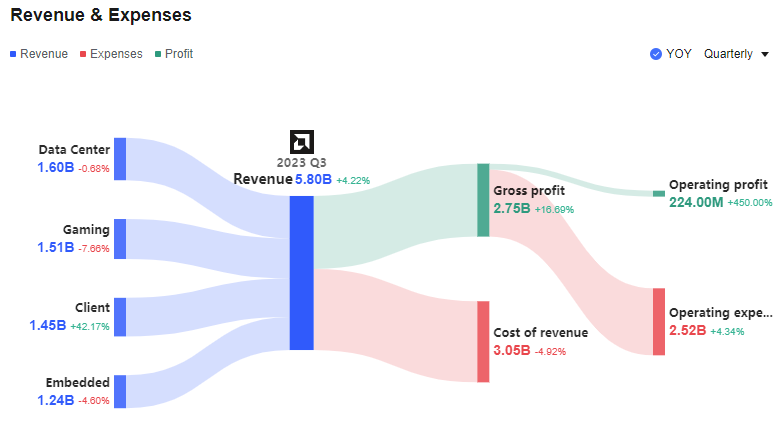

AMD has traditionally competed with Intel in the personal computer and server markets. However, with the emergence of Nvidia as a dominant player in the AI chip market, AMD is under pressure to prove its worth. The company has set ambitious revenue targets for its new MI300 products, projecting $2 billion in revenue for the chip family's first full year on the market.

AMD's strong performance in recent years has been driven by smart design decisions and technological stumbles by its rival, Intel. The company has experienced significant revenue growth, while Intel's business has shrunk. However, the emergence of Nvidia as a dominant player in the AI chip market presents a new challenge for AMD.

AMD's new AI chips are designed to compete with Nvidia's H100 family, and the company has been open about its intentions to challenge its rival. Analysts expect Nvidia's annual revenue to surpass $108 billion by the end of 2025, highlighting the enormous growth potential in the AI chip market.

The company's focus on developing advanced AI solutions, as evidenced by the launch of the MI300 Series, demonstrates its commitment to staying competitive in the rapidly growing AI industry. The positive analyst feedback and collaborations with industry leaders suggest that AMD is well-positioned to capitalize on the substantial potential of the AI chip market.

Shares of AMD fell -1.7% on the day of the event. The weakness could be chalked up to broader market weakness as equities, and semiconductors in particular, were under selling pressure. The stock slipped to $116 in late afternoon trade and closed below its 20-sma. Shares have rebounded today, rallying 9% on the session as the stock blasts back above the 20-sma ($120.25). The stock has rallied to $127, setting up a potential test of the 2023 high of $132.83 set back in June.

AMD's recent launch of the MI300 Series data center AI accelerators, ROCm 6 open software stack, and Ryzen 8040 Series processors with Ryzen AI demonstrates the company's commitment to competing in the booming AI chip market. With strong collaborations with industry leaders, positive analyst feedback, and a bullish technical outlook, AMD appears well-positioned for growth in the AI industry.

However, investors should carefully consider the potential risks, such as increased competition from Nvidia and the challenges of maintaining momentum in the fast-paced AI sector. As always, it is crucial to conduct thorough research and consult with financial advisors before making any investment decisions.

Senior Analyst and trader with 20+ years experience with in-depth market coverage, economic trends, industry research, stock analysis, and investment ideas.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet