U.S. Aims to Finalize Stablecoin Legislation by 2025

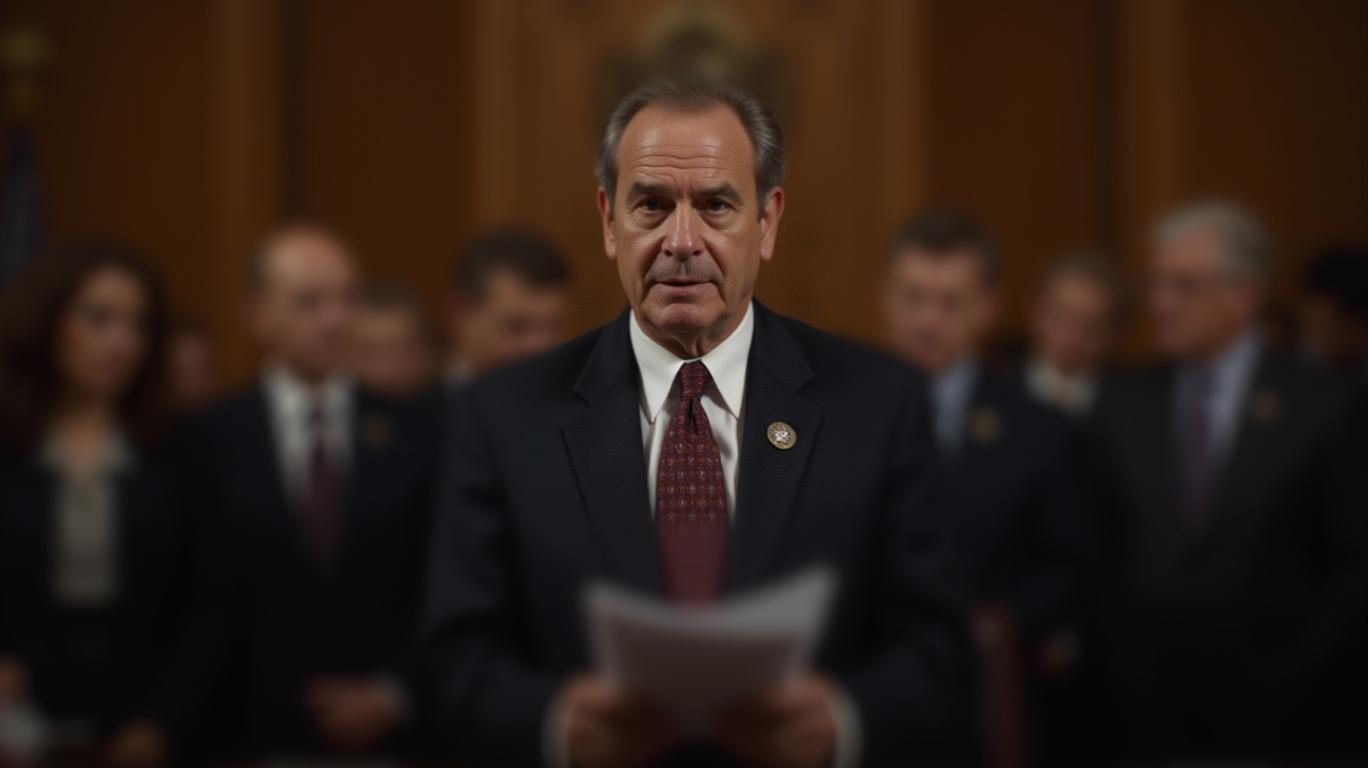

Bo Hines, the executive director of the Presidential Working Group on Digital Assets, has announced that comprehensive stablecoin legislation is expected to be finalized and presented to President Donald Trump within the next two months. This announcement was made during the Digital Asset Summit in New York, where Hines discussed the regulatory priorities of the U.S. government.

Hines highlighted the bipartisan support for the Guiding and Establishing National Innovation for U.S. Stablecoins Act of 2025, known as the GENIUS Act, which was recently approved by the Senate Banking Committee. This legislation aims to establish collateralization guidelines for stablecoin issuers and ensure full compliance with Anti-Money Laundering laws. Hines emphasized the importance of this legislation in maintaining the U.S. dollar's dominance in onchain activity and propelling the United States forward in the digital asset space.

Hines also noted that the market may be underestimating the potential impact of this legislation on the U.S. economy, particularly in terms of payment rails and financial markets. He expressed confidence that the legislation could be on the president's desk within the next two months, underscoring the government's urgency to address this issue.

The U.S. dollar currently accounts for the vast majority of the stablecoins in circulation, indicating its continued dominance as the currency of choice for funding cryptocurrency accounts and sending remittances overseas. Some industry experts believe that this could change in the future as stablecoins become multicurrency, but for now, digital dollars remain the overwhelming favorite.

U.S. Treasury Secretary Scott Bessent has also emphasized the administration's commitment to using stablecoins to maintain the dollar's status as the global reserve currency. This sense of urgency to push legislation over the finish line is driven by the administration's desire to keep the U.S. dollar dominant in the global economy.

The anticipation of stablecoin legislation comes on the heels of the White House's first-ever crypto summit, which underscored the administration's focus on digital assets. Hines emphasized that stablecoins remain a top priority on the U.S. regulatory agenda, alongside other significant initiatives such as the Bitcoin strategic reserve. The momentum in stablecoin regulation suggests that the industry could see a legislative framework established as early as 2025.

If passed into law, the GENIUS Act would offer a structured approach to managing payment stablecoins, which are cryptocurrencies pegged to assets such as the U.S. dollar. This development is significant as stablecoins continue to gain traction, with Tether (USDT) and Circle’s USDC (USDC) leading the market.

The regulatory focus on stablecoins in the U.S. contrasts with the recent regulatory heat in other regions, where some exchanges have delisted non-compliant stablecoins. The U.S. approach, however, appears to be more proactive, with a clear path towards establishing a regulatory framework that could set a global standard for stablecoin management.

Quickly understand the history and background of various well-known coins

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet